- United States

- /

- Professional Services

- /

- NYSE:TNET

TriNet Group (TNET): Margin Decline Reinforces Bearish Narratives on Profitability

Reviewed by Simply Wall St

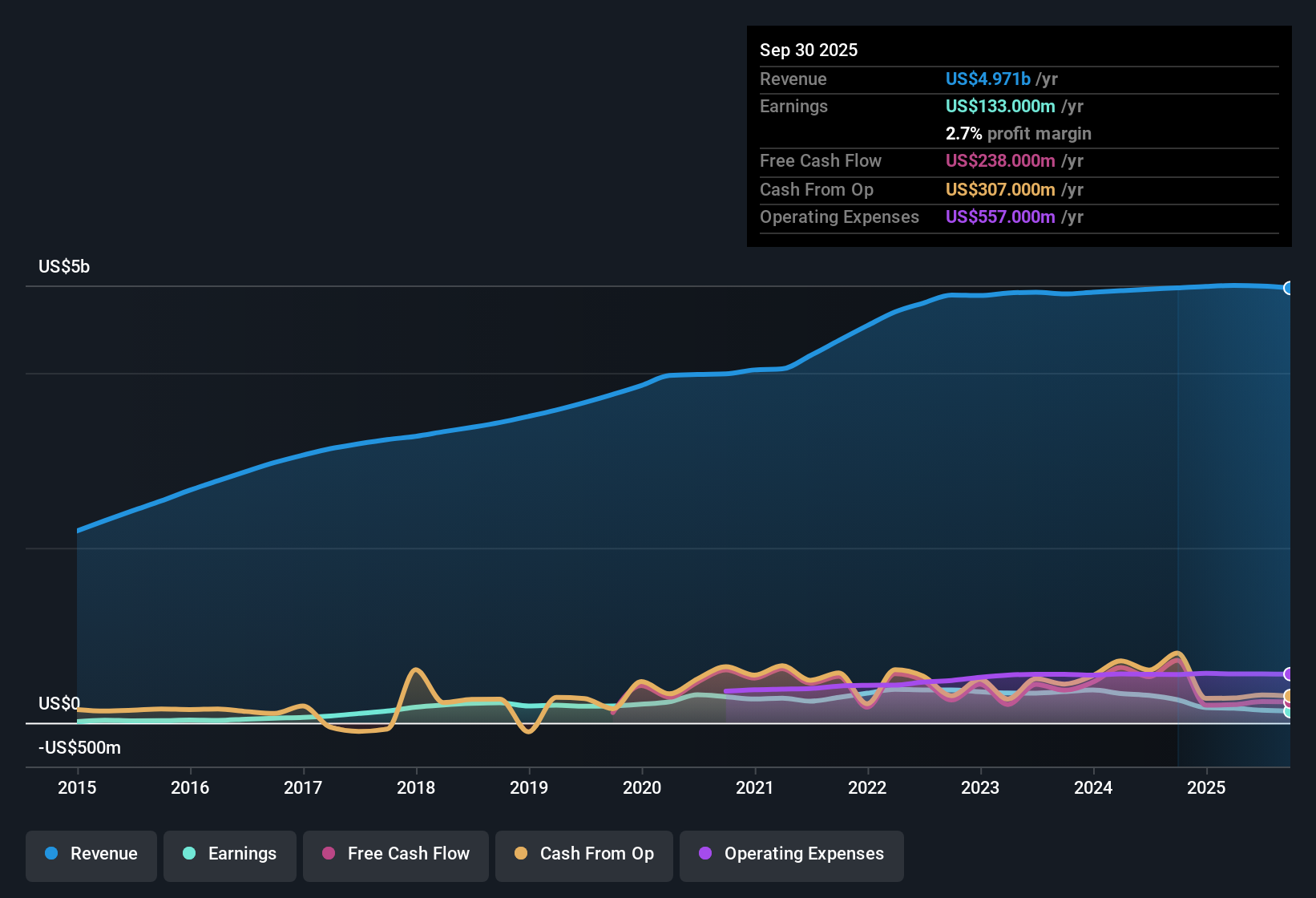

TriNet Group (TNET) reported net profit margins of 2.6%, down from 5.3% the previous year, as the company continued to see earnings decline by 8.5% per year over the last five years. The share price trades at $61.23, modestly below the estimated fair value of $63.55, while the company’s Price-to-Earnings Ratio stands at 22.5x, which is lower than the US Professional Services industry average but above its peer average. Despite pressure on margins and trailing profits, earnings are forecast to grow at 16.68% per year, outpacing the broader US market rate of 15.7%.

See our full analysis for TriNet Group.Next, we’ll see how these earnings stack up against the stories investors follow, where TriNet’s numbers support consensus views, and where they might surprise.

See what the community is saying about TriNet Group

Margin Expansion: Analyst Forecast vs Recent Decline

- Analysts expect profit margins to rise sharply from 2.9% today to 54.0% three years from now, even though actual net margins have dropped to 2.6% (down from 5.3% last year) and trailed recent standards.

- According to analysts’ consensus view, strategic investments in technology, cost controls, and insurance repricing are set to drive margin growth and help TriNet outperform rivals.

- Consensus narrative notes that automation and AI-enabled sales tools should lift operating leverage and support higher long-term net earnings.

- Still, the backdrop of falling client workforce growth and competitive pricing may challenge the scale of this expected margin rebound over the next few years.

- The striking gap between recent margin compression and ambitious long-term recovery prospects drives debate over just how quickly TriNet can reverse profitability trends. Analysts remain optimistic, but execution risk is high.

Bulls say a step change in margins and profit is coming. Get the full consensus narrative for context. 📊 Read the full TriNet Group Consensus Narrative.

Revenue Contraction Forecasted Despite Industry Growth

- Analysts are projecting revenue to decrease by 56.6% annually for the next three years, even as the broader trend for outsourced HR services points to market growth opportunities.

- The analysts’ consensus view highlights how TriNet’s position in a growing industry is offset by limitations such as modest workforce expansion among clients and revenue pressure from insurance and SaaS transition challenges.

- Consensus narrative points to intensifying competition and dependency on interest income, which could hinder revenue stability despite ongoing demand.

- This outlook stands in contrast to bullish expectations for increased client acquisition stemming from remote/hybrid work trends.

Valuation Leans Favorable but Trails Analyst Target

- TriNet’s share price of $61.23 trades slightly below its DCF fair value of $63.55, and its Price-to-Earnings Ratio of 22.5x is lower than the industry average of 25.3x, though still above the peer average of 20.1x.

- The analysts’ consensus view frames TriNet as potentially undervalued relative to peer benchmarks, yet the current price remains about 16% below the analyst price target of $73.00, suggesting room for appreciation if forecast improvements materialize.

- Consensus narrative stresses that believing in this upside requires confidence in a rebound in profit margins, sustained earnings growth, and successful navigation of competitive threats.

- Investors are cautioned to sense check these projections against their own views of TriNet’s long-term prospects, as execution risks remain.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TriNet Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the numbers? Share your insights and build your own narrative in just a few minutes. Do it your way.

A great starting point for your TriNet Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

TriNet’s shrinking profit margins and forecasted revenue decline indicate that consistent growth may be difficult to achieve, and downside risk could continue.

If you’re seeking steadier performers, check out stable growth stocks screener (2112 results) to discover companies that consistently deliver reliable revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriNet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNET

TriNet Group

Provides comprehensive and flexible human capital management services for small and medium size businesses in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives