- United States

- /

- Professional Services

- /

- NYSE:TNET

Is TriNet’s (TNET) CEO Presentation a Signal of New Priorities for the Company’s Future?

Reviewed by Sasha Jovanovic

- TriNet Group's President and CEO, Mike Simonds, recently presented at the J.P. Morgan 2025 Ultimate Services Investor Conference in New York, with a live webcast and replay available for investors on the company's website.

- This event allowed investors to gain direct insights into TriNet's business and future plans, following third quarter financial results that surpassed analyst expectations for both earnings per share and revenue.

- We'll explore how TriNet's strong quarterly earnings performance informs the company's future prospects and overall investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

TriNet Group Investment Narrative Recap

To be a TriNet shareholder, you need confidence in the company’s ability to grow by serving the HR needs of small and midsize businesses as they face increasingly complex workforce and regulatory challenges. The recent CEO presentation at a high-profile investor conference provided clarity on TriNet’s vision but does not materially change the biggest current catalyst, ongoing demand for outsourced HR solutions, or the key risk, which remains client workforce softness and modest client hiring trends.

The most relevant announcement alongside the conference is TriNet’s rollout of new AI-powered HR tools, such as virtual health assistants and dynamic dashboards. These enhancements directly support the company's main catalyst, as new technology capabilities aim to offer more value to clients and address evolving workplace requirements, potentially helping offset some competitive and economic pressures.

Yet, despite the enhanced product offerings, investors should also be mindful that ongoing cost pressures in healthcare and muted workforce growth among existing clients could still…

Read the full narrative on TriNet Group (it's free!)

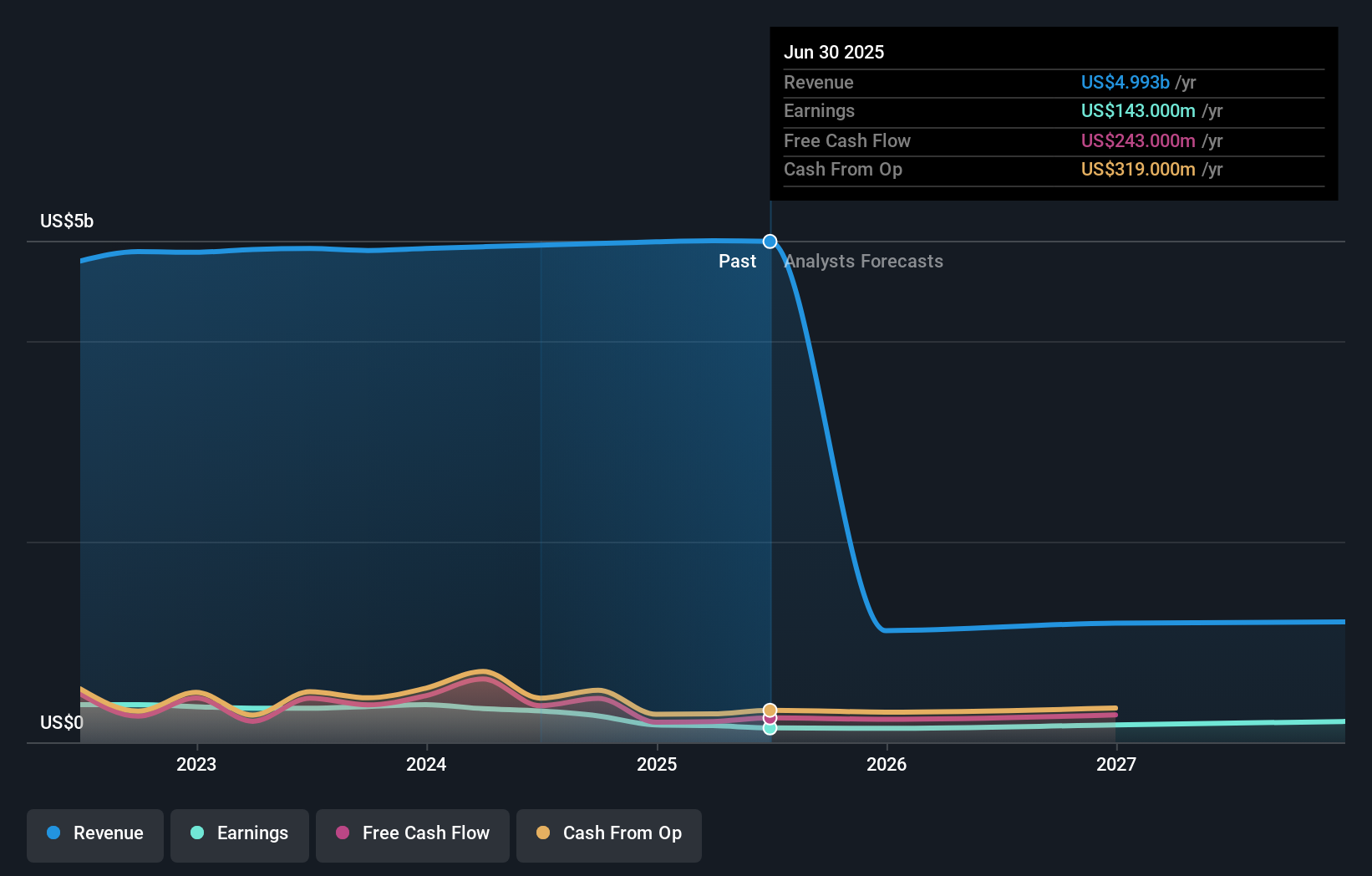

TriNet Group's narrative projects $408.0 million revenue and $220.2 million earnings by 2028. This requires a 56.6% annual revenue decline and a $77.2 million earnings increase from $143.0 million today.

Uncover how TriNet Group's forecasts yield a $72.50 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for TriNet, from US$72.50 to US$95.06 per share. While investors see upside, ongoing weak workforce growth among TriNet’s clients could impact the company’s overall momentum, consider each outlook carefully.

Explore 2 other fair value estimates on TriNet Group - why the stock might be worth just $72.50!

Build Your Own TriNet Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriNet Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TriNet Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriNet Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriNet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNET

TriNet Group

Provides comprehensive and flexible human capital management services for small and medium size businesses in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives