- United States

- /

- Professional Services

- /

- NYSE:TIC

Will TIC Solutions’ (TIC) Conference Appearance Reveal Strategic Priorities for Future Growth?

Reviewed by Sasha Jovanovic

- TIC Solutions, Inc. recently presented at the UBS Global Industrials and Transportation Conference, held at Eau Palm Beach Resort and Spa in Manalapan, Florida, United States on December 2, 2025.

- Investor interest is focused on potential updates or announcements arising from TIC Solutions' participation at this prominent industry event.

- We'll assess how the anticipation surrounding TIC Solutions' conference presentation may influence the company's investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

TIC Solutions Investment Narrative Recap

To be a shareholder in TIC Solutions, Inc., an investor must be confident in the company’s ability to deliver recurring revenue from critical asset integrity services and execute effectively on large-scale integrations, particularly after the recent NV5 merger. The company’s presentation at the UBS Global Industrials and Transportation Conference is unlikely to change the most important short-term catalyst, the realization of operating synergies from the NV5 acquisition, nor does it materially affect the immediate risk, which remains execution and financial integration challenges.

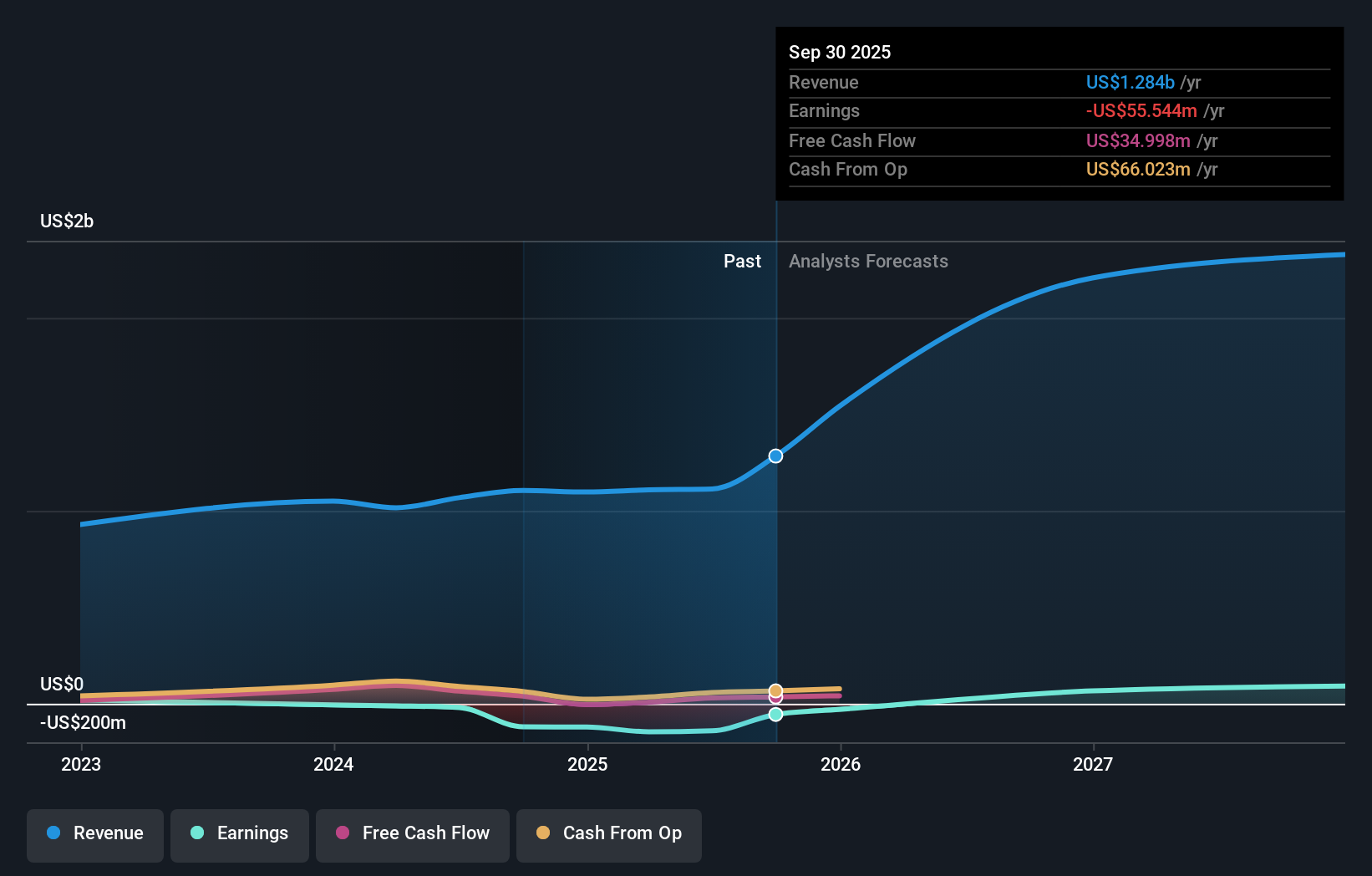

Among recent announcements, TIC Solutions reaffirmed its 2025 earnings guidance, projecting revenue between US$1,530,000,000 and US$1,565,000,000. This guidance is especially relevant as it sets stakeholder expectations regarding short-term performance and supports investor focus on whether integration milestones and margin improvements from recent acquisitions can be delivered as promised.

In contrast, investors should pay close attention to how execution risk from the NV5 integration could affect future margins if synergy targets are not reached...

Read the full narrative on TIC Solutions (it's free!)

Acuren's narrative projects $3.0 billion in revenue and $141.5 million in earnings by 2028. This requires 39.0% yearly revenue growth and a $282 million earnings increase from current earnings of -$140.5 million.

Uncover how TIC Solutions' forecasts yield a $13.90 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for TIC Solutions, ranging from US$2.76 to US$13.90 per share. Despite this spectrum of opinion, recent focus on successful acquisition integration remains central to the company’s future, reminding you that market participants view potential outcomes quite differently.

Explore 2 other fair value estimates on TIC Solutions - why the stock might be worth less than half the current price!

Build Your Own TIC Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TIC Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TIC Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TIC Solutions' overall financial health at a glance.

No Opportunity In TIC Solutions?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIC Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIC

TIC Solutions

Provides critical asset integrity services in North America.

High growth potential and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026