- United States

- /

- Professional Services

- /

- NYSE:TIC

TIC Solutions (TIC): Assessing Valuation After $256 Million Shelf Registration and Share Offering

Reviewed by Simply Wall St

TIC Solutions (TIC) has wrapped up a shelf registration worth $256 million, issuing over 20 million new common shares. Investors are watching to see how this expanded capital base could influence the company’s next moves and existing shareholder value.

See our latest analysis for TIC Solutions.

Following the share sale, TIC Solutions saw its share price slide 11.5% over the past month. However, the 90-day share price return is still up nearly 10%. This momentum shift suggests investors are reassessing prospects as fresh capital reshapes the company’s growth narrative and risk profile.

If you’re interested in what else might be gaining traction beyond headline deals, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a 30 percent discount to analyst targets, but recent declines raising questions, is TIC Solutions an undervalued opportunity or is the market already pricing in its future growth prospects?

Most Popular Narrative: 23.2% Undervalued

At $12.13, TIC Solutions trades well below the most-followed narrative’s fair value of $15.80. Those following the consensus are watching to see if bold growth assumptions play out, while recent price moves test market conviction.

The combination with NV5 significantly broadens Acuren's end-market exposure, including faster-growth verticals such as data centers and infrastructure, and enhances cross-selling potential for turnkey, integrated inspection and engineering solutions. This is likely to drive higher future revenue and margin expansion. Heightened global emphasis on critical infrastructure resilience, aging asset maintenance, and intensifying regulatory scrutiny creates durable, non-discretionary demand for Acuren's TICC and engineering services, supporting more stable, recurring revenues and improved earnings visibility.

What’s the pivot point in this valuation? The entire case turns on assumptions of aggressive growth, accelerating margins, and a revenue surge that rivals top disruptors. Want a closer look at the ambitious projections setting today’s price target? Find out how this scenario stacks the odds in favor of a much higher valuation.

Result: Fair Value of $15.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated debt from acquisitions and challenges integrating NV5 could restrain earnings if synergies fall short or cost pressures persist.

Find out about the key risks to this TIC Solutions narrative.

Another View: What Do the Numbers Really Say?

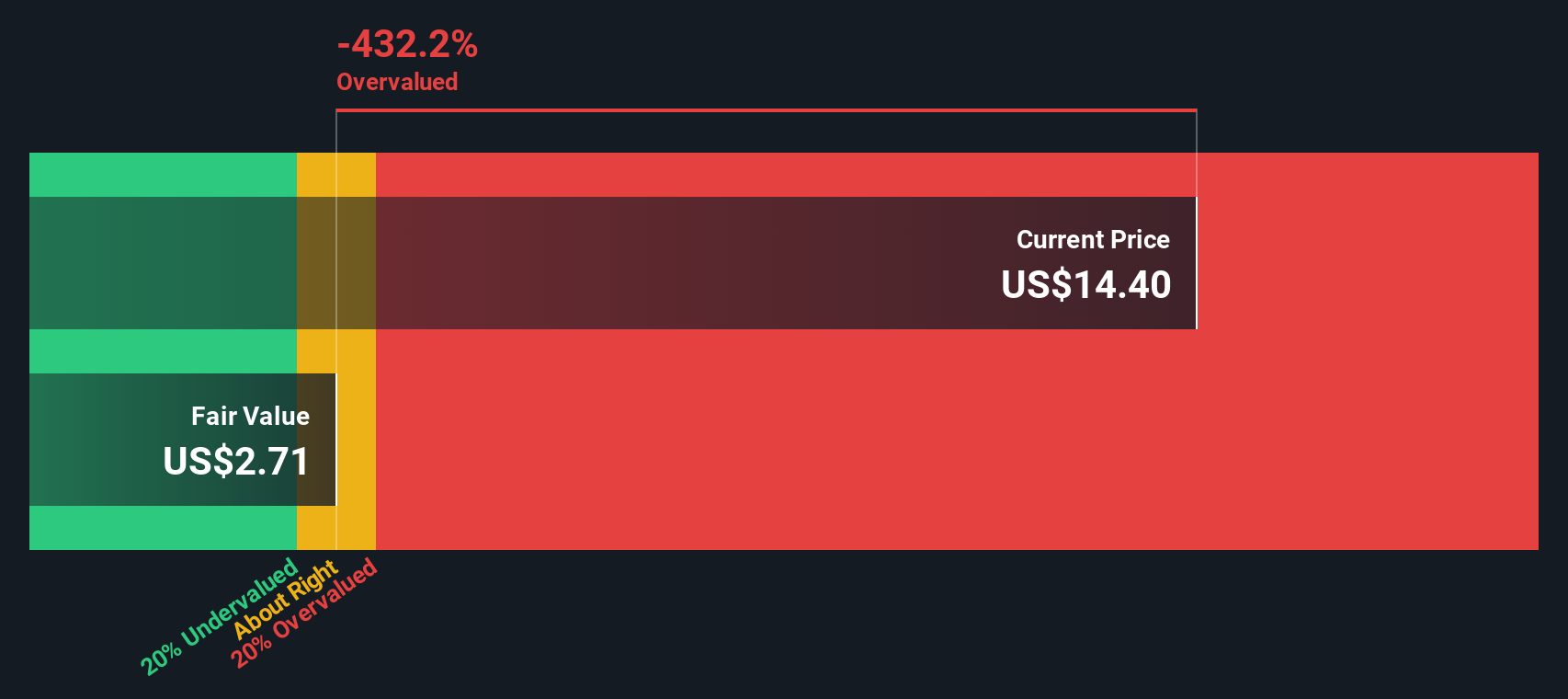

While analysts see TIC Solutions as undervalued based on future earnings and ambitious growth projections, our SWS DCF model paints a less optimistic picture. This model suggests TIC might actually be trading above its fair value. Which outlook do you trust, and what does it mean for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TIC Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TIC Solutions Narrative

If you see things differently or want to dig into the data on your own terms, it’s quick and easy to craft your own perspective. Do it your way

A great starting point for your TIC Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stick to just one opportunity when the market is full of unique potential? Stay ahead by checking out these curated stock ideas tailored for smart investors:

- Tap into tomorrow’s tech and uncover exciting prospects by checking out these 26 AI penny stocks that are setting the pace in artificial intelligence innovation.

- Target dependable returns by browsing these 22 dividend stocks with yields > 3% which consistently provide yields above 3 percent and put cash back in your pocket.

- Seize emerging opportunities and review these 81 cryptocurrency and blockchain stocks for companies powering advances in blockchain, digital payments, and crypto assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIC Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIC

TIC Solutions

Provides critical asset integrity services in North America.

High growth potential and fair value.

Market Insights

Community Narratives