- United States

- /

- Professional Services

- /

- NYSE:TIC

TIC Solutions: Exploring Valuation After Reaffirmed Earnings Guidance and Sharply Reduced Losses

Reviewed by Simply Wall St

TIC Solutions, Inc. (TIC) reaffirmed its full-year earnings guidance and reported a sharp reduction in net losses for the recent quarter and year to date. This signals improving performance and steady operational momentum for investors.

See our latest analysis for TIC Solutions.

While TIC Solutions’ recent 1-day and 7-day share price returns have been positive, the stock is still working its way back from a rough patch. Over the past 30 days, the share price return is -20.6% and the year-to-date return is -22.6%. The company’s improving fundamentals and upbeat outlook appear to be supporting a recovery in sentiment. This suggests that investor confidence could continue to build if progress continues from here.

If you’re interested in finding other stocks with strong growth and insider confidence, now’s a great chance to discover fast growing stocks with high insider ownership

With the stock still trading well below analyst targets, even as it reports solid revenue growth and sharply narrowing losses, the key question for investors is whether TIC Solutions remains undervalued or if the market is already factoring in its turnaround potential.

Most Popular Narrative: 30.8% Undervalued

With TIC Solutions’ narrative fair value at $13.90, well above the last close of $9.62, there is a notable gap between where the analyst consensus thinks the stock could be headed and its recent market price. This difference sets the stage for an in-depth look at what is fueling analyst optimism.

The combination with NV5 significantly broadens Acuren's end-market exposure (including faster-growth verticals such as data centers and infrastructure) and enhances cross-selling potential for turnkey, integrated inspection and engineering solutions. This is likely to drive higher future revenue and margin expansion. Heightened global emphasis on critical infrastructure resilience, aging asset maintenance, and intensifying regulatory scrutiny creates durable, non-discretionary demand for Acuren's TICC and engineering services, supporting more stable, recurring revenues and improved earnings visibility.

Curious what ambitious growth forecasts and bold margin targets are built into that fair value? There is a surprising set of financial assumptions behind the scenes that could change how you see TIC’s future. See which details are moving the needle and why analysts are backing such a strong potential upside.

Result: Fair Value of $13.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure or challenges in integrating recent acquisitions could quickly undermine the confidence supporting TIC Solutions’ turnaround story.

Find out about the key risks to this TIC Solutions narrative.

Another View: Market Ratios Tell a Mixed Story

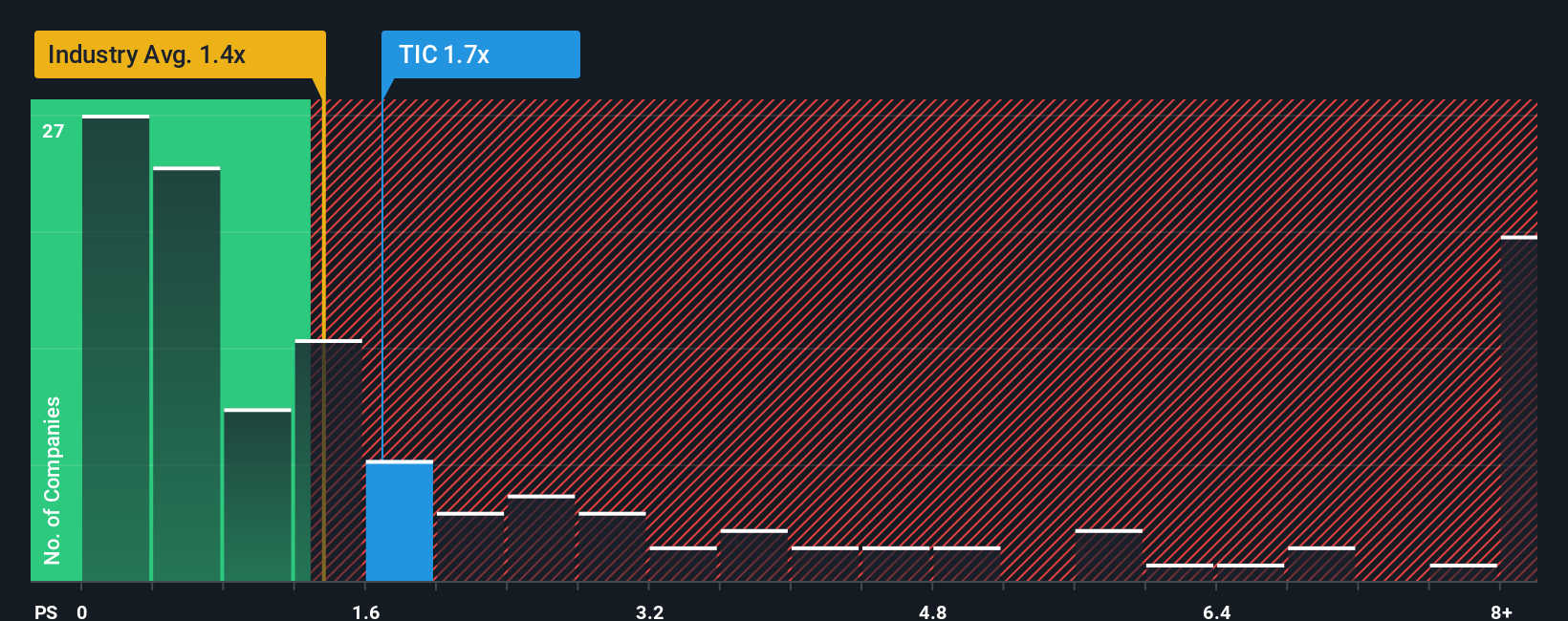

Stepping away from fair value estimates, the stock’s price-to-sales ratio sits at 1.7x. That is higher than the industry’s average of 1.3x, yet below peers at 2.1x. Notably, the fair ratio, which is the level the market might eventually price toward, is 2.2x. This split suggests both caution and opportunity for investors. Could the market be missing something, or is it overreaching?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TIC Solutions Narrative

If you have your own perspective or want to dive deeper into the numbers, building your personal investment case takes just a few minutes. Do it your way

A great starting point for your TIC Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that real opportunities rarely wait around. Take the next step and uncover high-potential stocks that could reshape your portfolio. These fast-moving possibilities are just a click away.

- Capture steady income potential when you check out these 14 dividend stocks with yields > 3% offering yields above 3% and robust financial strength.

- Fuel your curiosity in artificial intelligence by scanning these 26 AI penny stocks poised for rapid adoption and innovation across industries.

- Capitalize on today’s market mispricings by searching through these 924 undervalued stocks based on cash flows rooted in solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIC Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIC

TIC Solutions

Provides critical asset integrity services in North America.

High growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success