- United States

- /

- Professional Services

- /

- NYSE:SKIL

Why Investors Shouldn't Be Surprised By Skillsoft Corp.'s (NYSE:SKIL) 28% Share Price Plunge

To the annoyance of some shareholders, Skillsoft Corp. (NYSE:SKIL) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

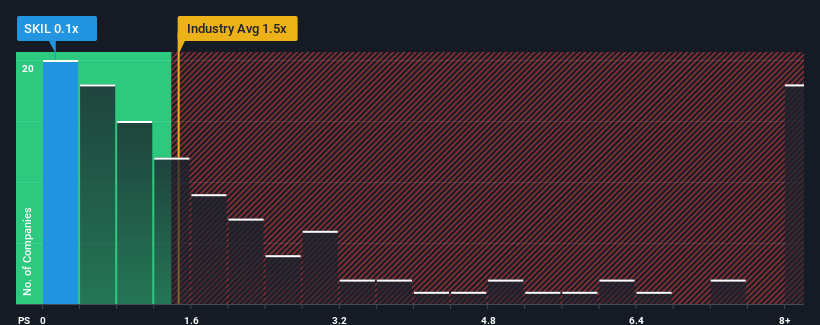

Since its price has dipped substantially, Skillsoft's price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Professional Services industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Skillsoft

How Has Skillsoft Performed Recently?

Skillsoft could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Skillsoft.How Is Skillsoft's Revenue Growth Trending?

In order to justify its P/S ratio, Skillsoft would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 3.1% over the next year. That's shaping up to be materially lower than the 6.5% growth forecast for the broader industry.

With this information, we can see why Skillsoft is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Skillsoft's P/S

Skillsoft's recently weak share price has pulled its P/S back below other Professional Services companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Skillsoft maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Skillsoft has 3 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SKIL

Skillsoft

Provides personalized, interactive learning experiences, and enterprise-ready solutions in the United States, Other Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives