- United States

- /

- Commercial Services

- /

- NYSE:SCS

Steelcase (SCS): Is the Recent Rally Reflected in Its Current Valuation?

Reviewed by Simply Wall St

See our latest analysis for Steelcase.

Steelcase’s momentum has really picked up, not just in the last quarter, but across the past year as a whole. With a 90-day share price return of nearly 55% and a robust total shareholder return of 39% over the past year, confidence in the company’s growth prospects is clearly on the rise among investors.

If you’re interested in finding other companies that combine sustained growth with insider conviction, now is the perfect time to discover fast growing stocks with high insider ownership

With shares trading just shy of their analyst price target and healthy financial growth on record, investors are left to ask: Is Steelcase still undervalued, or is the current stock price already factoring in all future gains?

Most Popular Narrative: 7.6% Overvalued

According to codabat, Steelcase’s intrinsic value per share stands slightly below the current market price, suggesting that recent share gains may have outpaced underlying fundamentals. The narrative points to a business with appealing valuation signals, yet not without significant caveats regarding sustainability and future growth.

Based on sector-relative P/E analysis, Steelcase appears moderately undervalued. Using TTM EPS of $1.04 and applying the furniture industry average P/E multiple of 15x, the intrinsic fair value equals $15.60 per share. Key assumptions include a normalized P/E of 15x, reflecting the furniture industry median. The maintainability of current TTM earnings of $1.04 is also assumed. Additionally, it is expected that the SCS multiple will align with furniture peers, and that office furniture demand will stabilize as part of a cyclical recovery.

Ready for the full story? Codabat’s valuation depends on a handful of critical accounting decisions and industry comparisons that could shift the narrative considerably. What subtle forecast changes are behind this number? Don’t miss the eye-opening details fueling this controversial call.

Result: Fair Value of $15.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure or a slower office real estate recovery could quickly undermine this outlook. This highlights real risks behind the current optimism.

Find out about the key risks to this Steelcase narrative.

Another View: Discounted Cash Flow Tells a Different Story

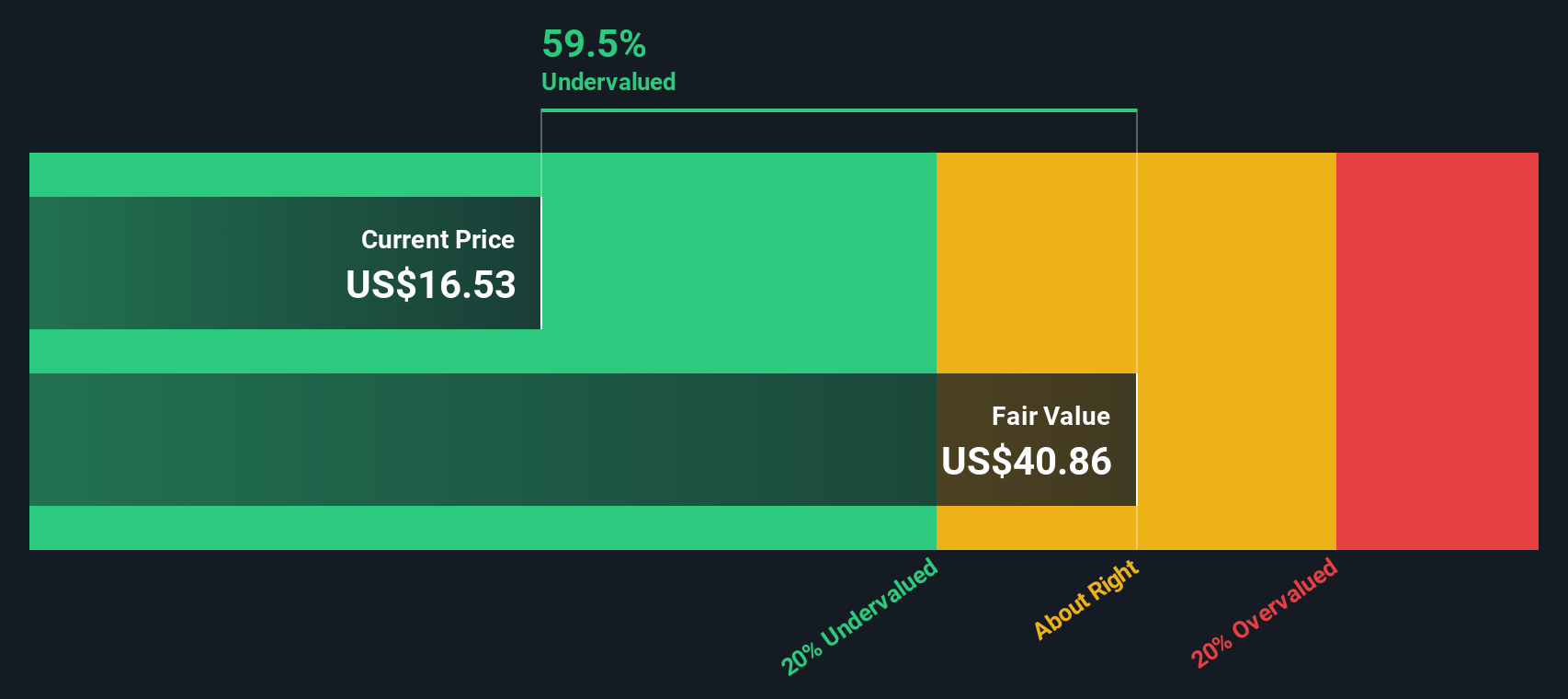

While the narrative above leans on a price-to-earnings approach, the SWS DCF model points in a different direction. This model suggests Steelcase is trading at nearly 60% below its fair value, which indicates far more upside than a multiples analysis implies. So, can you trust the DCF outlook, or is this a classic value trap?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Steelcase Narrative

If you have your own perspective or favor hands-on research, you can dive into the numbers and build your own view in just a few minutes, or simply Do it your way.

A great starting point for your Steelcase research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

The smartest investors never stop at just one opportunity. Don’t sit on the sidelines while market leaders shape tomorrow’s financial landscape. These handpicked screeners can help you seize your advantage right now:

- Uncover early-stage businesses set for big breakthroughs and get ahead by reviewing these 3559 penny stocks with strong financials before they hit everyone’s radar.

- Capitalize on the hottest trends in healthcare innovation as you tap into tomorrow’s potential with these 33 healthcare AI stocks.

- Grab your chance for long-term returns with these 17 dividend stocks with yields > 3%, offering stocks that reward you with stable and attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCS

Steelcase

Provides a portfolio of furniture and architectural products and services in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives