- United States

- /

- Commercial Services

- /

- NYSE:SCS

Assessing Steelcase (SCS) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Steelcase.

Steelcase’s share price has gained serious momentum this year, with a year-to-date price return of nearly 39% reflecting renewed optimism around its growth trajectory. After steady advances and a robust 24% total shareholder return over the past year, the stock’s recent uptick seems to mirror improving sentiment rather than just short-term volatility.

If you’re interested in tracking other companies with similar potential, consider uncovering new opportunities in the market with fast growing stocks with high insider ownership.

Yet with shares up nearly 39 percent so far this year, investors are left wondering whether Steelcase remains undervalued or if today's price already reflects all its future growth potential. Could there still be a buying opportunity?

Most Popular Narrative: 3.8% Overvalued

Steelcase is trading at $16.20, just above the narrative fair value of $15.60 according to codabat. This small premium suggests that the market may be incorporating optimistic expectations or that current price momentum exceeds fundamental estimates.

This appears to be a value trap rather than a value opportunity. The low multiple reflects justified skepticism about business quality.

Want to know why the narrative signals more risk than reward? Hint: it comes down to persistent margin issues and unexpected earnings patterns that shape this price target. The fair value depends on assumptions most investors may overlook. Discover what’s behind the market's cautious stance by reading the full narrative.

Result: Fair Value of $15.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, successful cost-cutting or a stronger office market rebound could quickly shift sentiment and challenge the current outlook for Steelcase.

Find out about the key risks to this Steelcase narrative.

Another View: Multiple-Based Risks to Watch

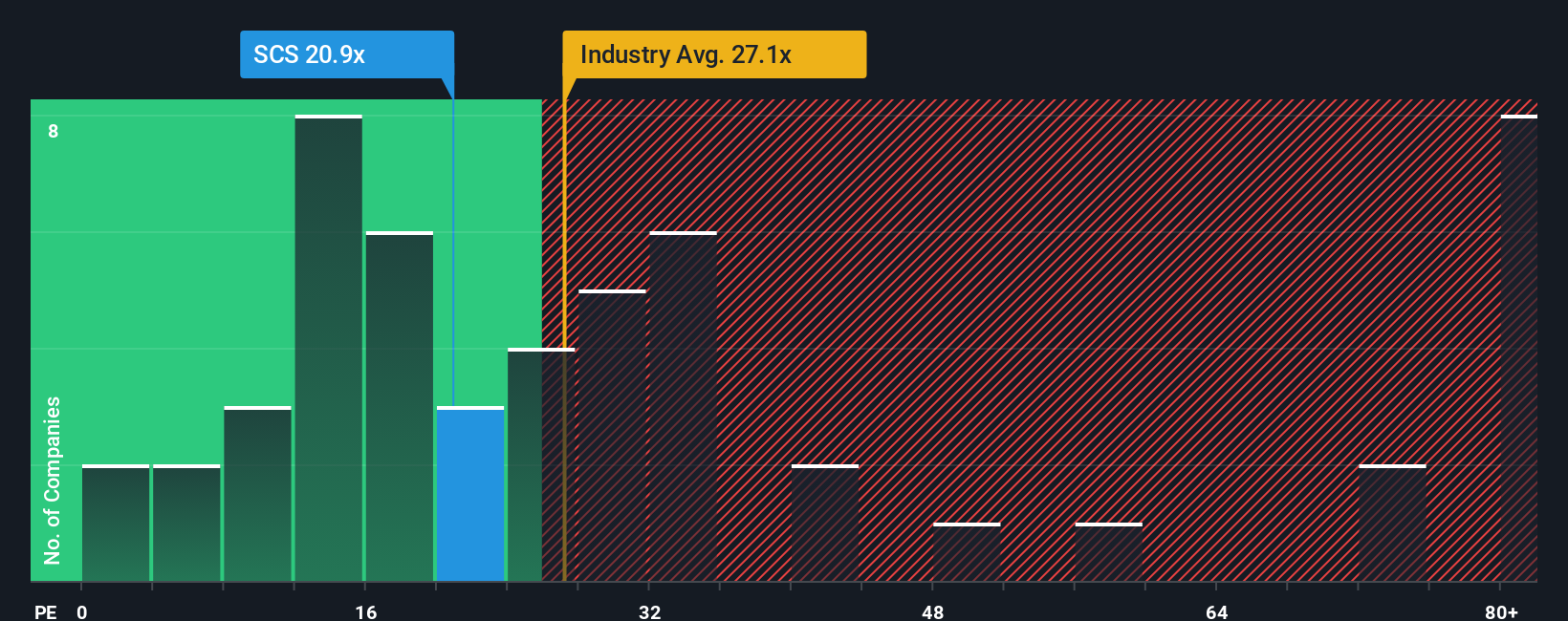

Looking at a different lens, Steelcase's price-to-earnings ratio stands at 20.2x. While this is lower than the US commercial services industry average of 22.6x, it is more expensive than its peer group average of 17.8x. The fair ratio, which is a level the market could move towards, is 29.9x.

That gap offers both promise and warning. Could the current valuation signal hidden risk, or does it highlight a missed chance for upside? Investors will want to watch for any shifts in these key multiples.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Steelcase Narrative

If you would rather dig into the numbers firsthand or prefer your own analysis, you can quickly build your personal narrative in just a few minutes. Do it your way.

A great starting point for your Steelcase research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Uncover your next advantage by researching companies in sectors positioned for growth, high-yield returns, or future-defining technologies. If you want smart opportunities, use these powerful tools to guide your next move. Don’t let others take the lead before you.

- Benefit from high potential by reviewing these 3579 penny stocks with strong financials making a splash with strong financials and momentum others may be overlooking.

- Earn passive income by checking out these 15 dividend stocks with yields > 3% offering attractive yields above 3 percent for stable, long-term returns.

- Seize gains from fast-moving tech by targeting these 25 AI penny stocks pioneering breakthroughs in artificial intelligence and data-driven innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCS

Steelcase

Provides a portfolio of furniture and architectural products and services in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success