- United States

- /

- Commercial Services

- /

- NYSE:RSG

Republic Services (RSG) Margin Improvement Reinforces Bullish Narratives Despite Slower Revenue Growth

Reviewed by Simply Wall St

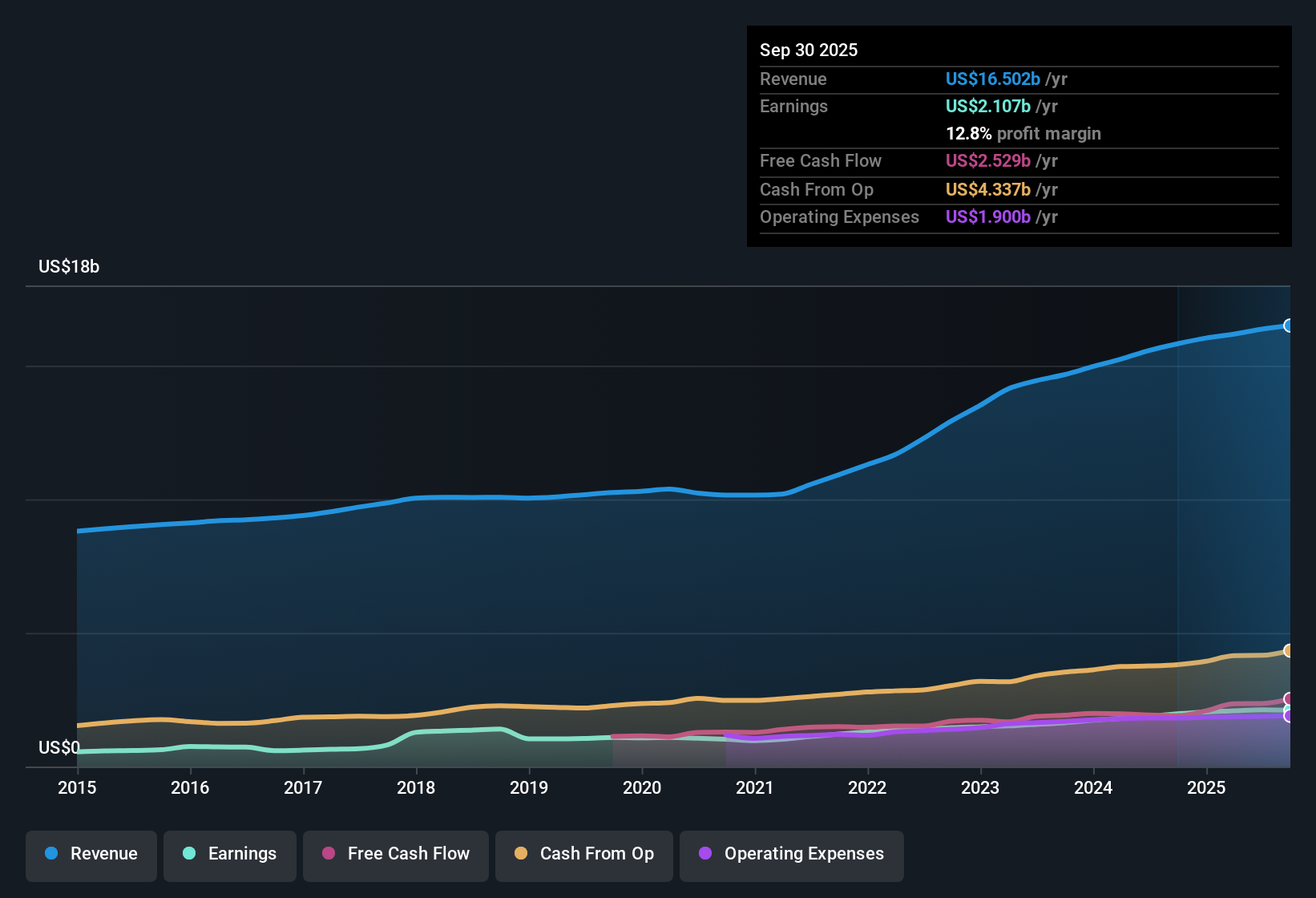

Republic Services (RSG) posted earnings growth of 6.9% over the most recent year, with an average annual earnings growth rate of 15.7% over the past five years. Net profit margin improved slightly to 12.8%, up from last year’s 12.5%. Analysts expect forward earnings to grow at 8.09% yearly, trailing the broader US market forecast of 15.9%. Investors are likely to weigh the company’s consistent earnings history and steady margin gains against a revenue growth outlook of 5.2% per year, which is slower than the 10.3% industry average.

See our full analysis for Republic Services.Next up, we will see how these fresh figures stack up against the analyst and community narratives, highlighting where consensus might get challenged and where the story holds firm.

See what the community is saying about Republic Services

Margin Expansion Edges Up to 12.8%

- Net profit margin landed at 12.8%, edging up from 12.5% in the previous year, as Republic Services focused on cost management and operational efficiency during a period of moderate revenue growth.

- Analysts’ consensus narrative notes that margin performance has been underpinned by digital initiatives, such as the rollout of M-Power and steps toward fleet electrification. Both are believed to lift technician productivity and reduce costs.

- Sustainability and recycling investments are expected to contribute to earnings starting in the second half of 2025, supporting the margin profile through new revenue channels.

- However, weak volumes in certain sectors raised concern among analysts about whether margin improvements can be sustained if cyclical end markets remain soft.

- Analysts are closely watching whether these margin gains can withstand continued pressure on volumes in construction and manufacturing, as persistent softness in those markets could threaten profitability even amid operations-driven efficiencies. 📊 Read the full Republic Services Consensus Narrative.

Strategic Acquisitions in Play for 2025

- The company is planning over $1 billion in acquisitions to expand recycling and environmental solutions. This move is expected to bolster future revenue growth beyond what is achievable through organic channels alone.

- Consensus narrative emphasizes that acquisitions, including joint ventures in plastics and investment in renewable natural gas (RNG), could unlock new earnings streams and position Republic Services for sustainable, long-term growth.

- Yet, analysts flag the risk that aggressive capital outlays and fast-paced integration of acquired businesses could strain cash flow or dilute returns if execution falls short.

- Overall, the consensus perspective rests on the belief that the company’s deal pipeline, combined with ongoing digital and sustainability efforts, establishes a base for growth even as headline growth rates trail the broader market.

Valuation Sits Below Analyst Targets but Market Growth Lags

- With a current share price of $208.24 and an analyst price target of $250.18, Republic Services trades at a discount relative to consensus expectations. Its forward earnings growth is pegged at 8.09% yearly, which falls short of the US market’s 15.9% forecast.

- Consensus narrative highlights the valuation tension: Bulls might argue the lower Price-to-Earnings ratio versus select peers makes shares appealing, but others question paying a premium relative to the overall industry, given the company’s slower top-line expansion.

- For valuation to converge with the analyst target, investors would have to accept a future PE ratio of 37.0x, above the current US Commercial Services industry average of 25.7x. This could be hard to justify if growth does not accelerate.

- The spread between the share price and DCF fair value of $260.67 also creates room for disagreement about whether the stock is fundamentally undervalued or fairly priced given its growth profile.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Republic Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the data that tells a different story? Put your perspective to work and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Republic Services research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Republic Services faces valuation pressure because its slower growth limits potential upside, making it hard to justify its premium relative to industry peers.

If you want to avoid overpaying for companies with limited growth, discover better-priced opportunities with these 832 undervalued stocks based on cash flows that may offer stronger value for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSG

Republic Services

Offers environmental services in the United States and Canada.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives