- United States

- /

- Commercial Services

- /

- NYSE:RSG

Republic Services (RSG): Assessing Valuation After Quarterly Miss and Surprising Share Price Rally

Reviewed by Simply Wall St

Republic Services (RSG) caught investors’ attention when its latest quarterly results missed estimates for both sales volume and revenue. Surprisingly, shares have since climbed. This suggests ongoing optimism about management’s broader growth strategy.

See our latest analysis for Republic Services.

Even with shares dipping earlier in the quarter, Republic Services’ stock has regained momentum recently and now trades at $218.43, reflecting a 9.2% share price gain since the start of the year. Looking longer term, total shareholder returns have been even more robust, with a climb of over 66% over three years and an impressive 140% over five years. This highlights steady value creation for patient investors.

If the recent rebound has you reassessing your watchlist, you might find it rewarding to check out fast growing stocks with high insider ownership.

With recent results falling short of estimates, but the stock up year to date, is there real value left in Republic Services? Or is the market already reflecting the company’s future growth prospects in its current price?

Most Popular Narrative: 12.2% Undervalued

Republic Services’ last closing price of $218.43 sits noticeably below the narrative’s projected fair value of $248.86. This disconnect raises the question: what is driving the higher valuation estimate from the most widely followed narrative?

Sustainability efforts such as the development of Polymer Centers and the Blue Polymers joint venture could drive future revenue growth by enhancing plastic circularity and decarbonization. These operations are expected to contribute to earnings starting in the second half of 2025.

What numbers are fueling this bullish narrative? Underneath it all are growth assumptions that could prove transformative. If you want to uncover the bold projections hidden inside this fair value calculation, now is your chance.

Result: Fair Value of $248.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining volumes in construction and manufacturing, or challenges integrating recent acquisitions, could undermine Republic Services' ability to deliver the anticipated growth.

Find out about the key risks to this Republic Services narrative.

Another View: What Do Market Comparisons Say?

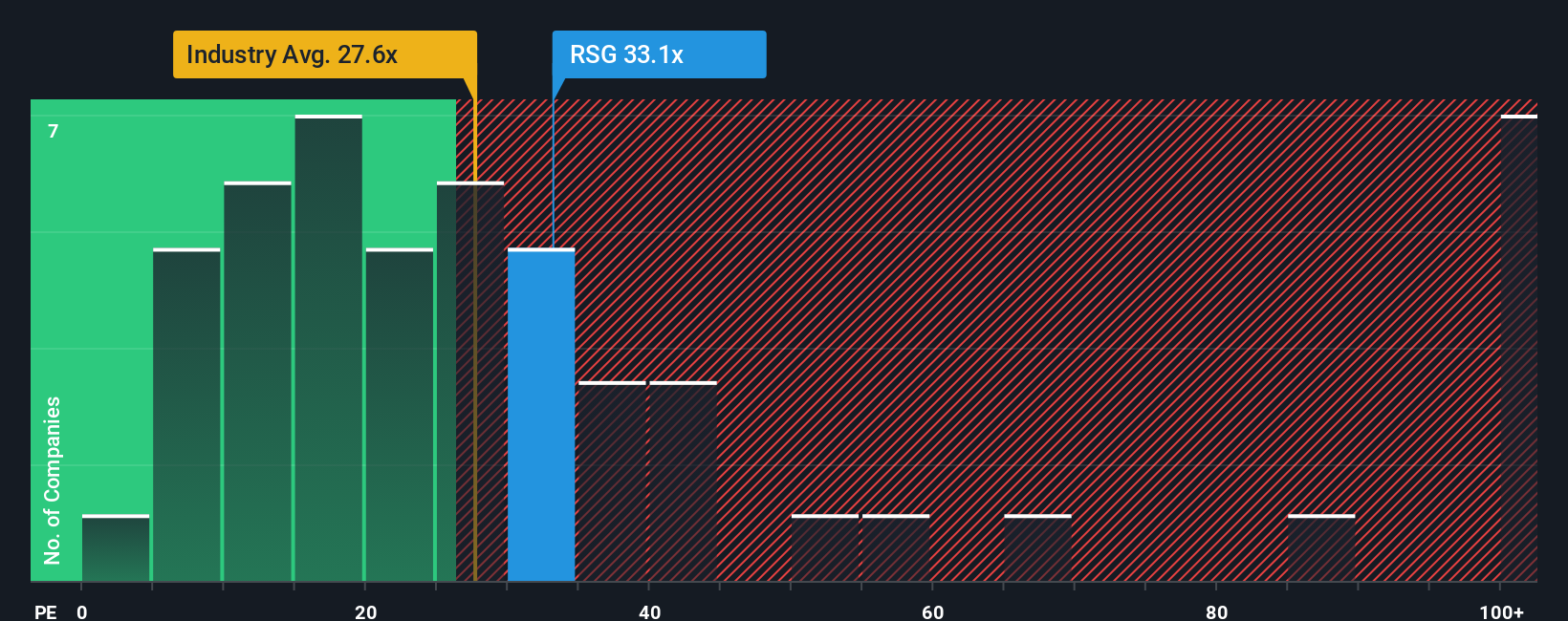

Looking from another angle, Republic Services trades at a price-to-earnings ratio of 32.1x, which is richer than both the industry average of 21.8x and its fair ratio of 28.9x. However, it is actually cheaper than the peer average of 46.9x. This higher multiple signals that investors are willing to pay up for perceived stability or growth, but it also raises the bar for future performance. Will optimism keep up, or does this expose investors to risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Republic Services Narrative

If you're keen to dig into the numbers and shape your own perspective, exploring the full data set allows you to build a custom thesis within minutes. Do it your way

A great starting point for your Republic Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Every investor stays ahead by spotting the next opportunity before the crowd. The Simply Wall Street Screener helps you target sectors poised for real growth. Why settle for average when you can aim higher? Miss these now and tomorrow’s best moves could pass you by.

- Capture returns while tech shifts the market by reviewing these 25 AI penny stocks at the forefront of AI-driven innovations and emerging business models.

- Capitalize on compelling valuations by targeting these 919 undervalued stocks based on cash flows with strong fundamentals and the potential for long-term upside.

- Unlock competitive yield and stability from these 16 dividend stocks with yields > 3% offering reliable payouts above 3% to help weather market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSG

Republic Services

Offers environmental services in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives