- United States

- /

- Commercial Services

- /

- NYSE:RSG

How a Lowered 2025 Outlook and One-Time Gains Could Influence the Republic Services (RSG) Narrative

Reviewed by Sasha Jovanovic

- Republic Services announced third-quarter 2025 results with US$4.21 billion in sales and lowered its full-year 2025 revenue guidance, expecting revenue to come in near the low end of its prior range.

- While the company delivered growth in adjusted EBITDA margin and maintained dividend and buyback activity, management cautioned that a US$100 million event-driven landfill revenue boost in 2025 will not recur in the following year, impacting growth comparisons.

- We'll explore how Republic Services' lowered 2025 revenue outlook and non-recurring landfill revenue shape its future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Republic Services Investment Narrative Recap

To be a Republic Services shareholder, you need to believe in the company’s ability to deliver sustainable growth through operational excellence, digital transformation, and expanding into recycling and renewable energy. The recent guidance cut, which places 2025 revenue at the lower end of its range, may slow momentum temporarily, but does not fundamentally alter the biggest near-term catalyst: further margin expansion driven by innovation and efficiency. The main risk remains persistent weakness in key end markets like construction and manufacturing, which could limit earnings growth if conditions do not improve.

Among recent announcements, management’s affirmation of the quarterly dividend at US$0.625 per share underlines their ongoing commitment to shareholder returns despite guiding for lower revenues. This consistency in returning capital is particularly relevant as it maintains investor confidence, even as short-term catalysts such as margin gains or new sustainability projects may take time to translate into higher earnings. However, this stability is also dependent on the broader business environment.

In contrast, one key risk that investors should be aware of is the possibility of continued softness in construction and manufacturing volumes if demand does not recover...

Read the full narrative on Republic Services (it's free!)

Republic Services' outlook anticipates $19.3 billion in revenue and $2.7 billion in earnings by 2028. This represents a 5.6% annual revenue growth rate and a $0.6 billion increase in earnings from the current $2.1 billion.

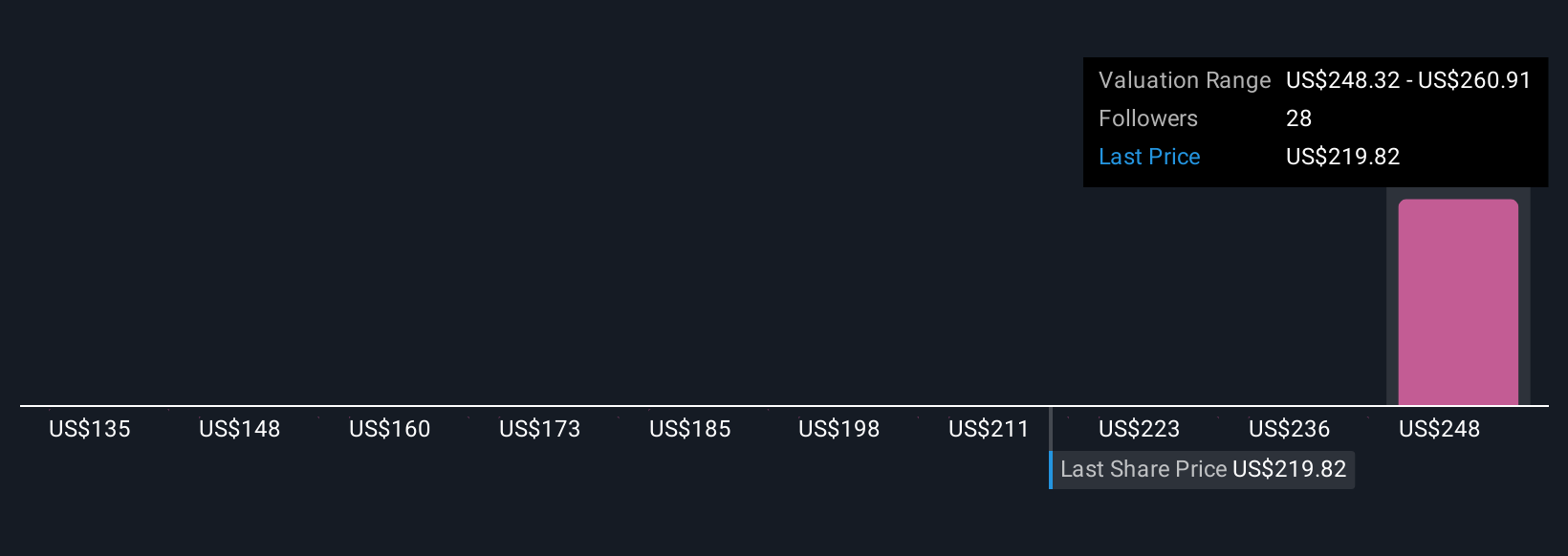

Uncover how Republic Services' forecasts yield a $256.68 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Four distinct fair value estimates from the Simply Wall St Community range from US$248.86 to US$266.63 per share. As caution grows over cyclical end markets, these diverse viewpoints show just how differently individual market participants assess Republic Services’ outlook and potential.

Explore 4 other fair value estimates on Republic Services - why the stock might be worth just $248.86!

Build Your Own Republic Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Republic Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Republic Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Republic Services' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSG

Republic Services

Offers environmental services in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives