- United States

- /

- Commercial Services

- /

- NYSE:ROL

Assessing Rollins (ROL) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Rollins.

The momentum behind Rollins is not just a short-term story. The share price has climbed steadily this year, building on recent gains and resulting in a robust year-to-date share price return of 27.3 percent. Looking further out, total shareholder return over the past three and five years stands at 46.1 percent and 58.6 percent respectively. This illustrates that investors who remained with Rollins have seen rewards for their patience, even through periods of short-term volatility.

If you're interested in broadening your search beyond Rollins, now is the perfect moment to discover fast growing stocks with high insider ownership

With such impressive momentum, the key question becomes whether Rollins’s current price still reflects a potential bargain, or if the market has already factored in every bit of expected future growth. Could there be more upside for new investors?

Most Popular Narrative: 3% Undervalued

With Rollins' fair value estimated at $60.42, slightly above its last close of $58.61, the narrative points to a modest upside. Investors are watching closely to see if the company can live up to these expectations.

The acquisition of Saela Pest Control is expected to add between $45 million to $50 million in revenue in 2025 and is anticipated to be accretive to earnings, signaling potential revenue growth and earnings enhancement. Continued strategic investments in sales staffing and marketing are expected to drive organic growth, particularly as the pest control season ramps up, which could lead to increased revenue.

Curious how Rollins’s growth story stacks up? The narrative behind this fair value hinges on aggressive top-line expansion, margin improvement, and a future profit multiple that sets a high bar. Want to see what assumptions underpin these bold projections? Unlock the full narrative to dig into the surprising drivers fueling this price target.

Result: Fair Value of $60.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including increased competition and the potential for market volatility, which could challenge Rollins's growth momentum in the months ahead.

Find out about the key risks to this Rollins narrative.

Another View: Are Valuation Multiples Sound?

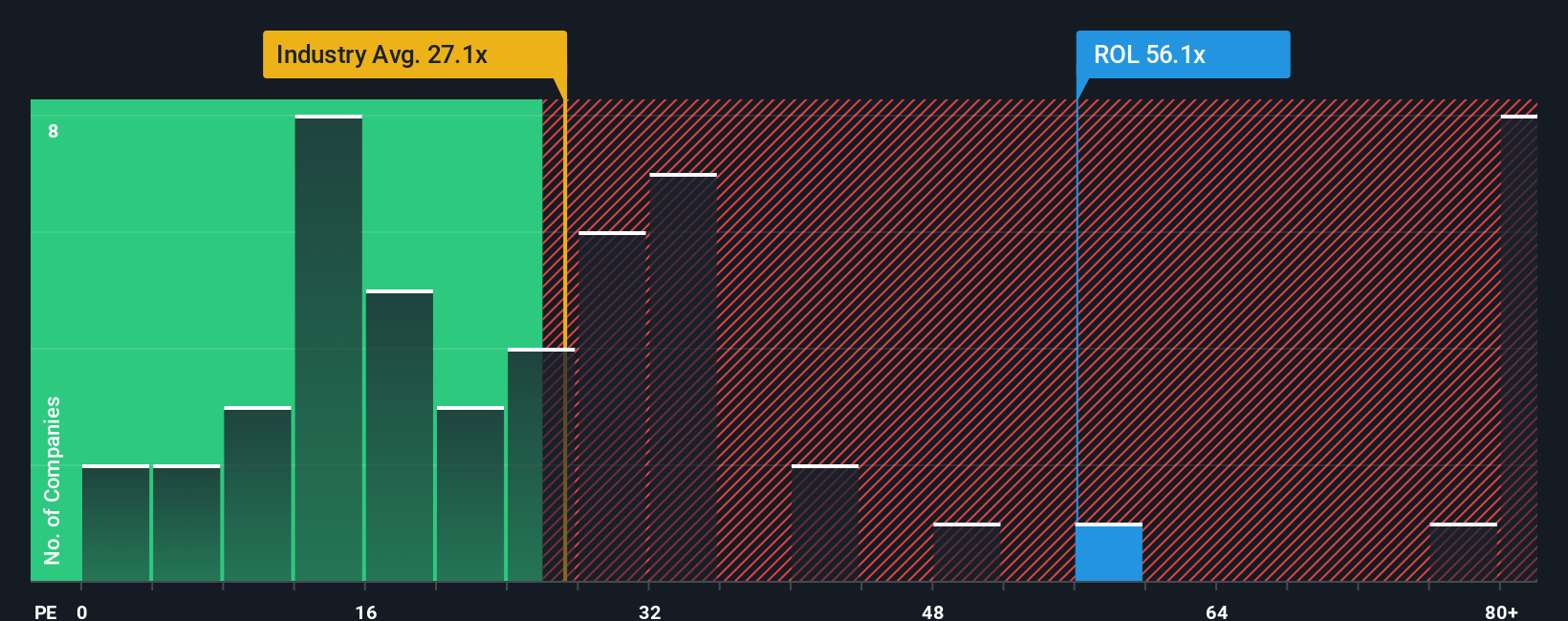

Looking at Rollins through the lens of valuation multiples reveals a different perspective. Its price-to-earnings ratio stands at 55.1x, which is notably higher than the US Commercial Services industry average of 22.2x and the peer average of 38.5x. Even compared to its fair ratio of 27.5x, Rollins trades at a significant premium. This elevated multiple suggests the market expects exceptional growth, but it also exposes investors to more downside risk if those expectations fall short. Does this premium truly reflect Rollins’ future potential, or is the bar set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rollins Narrative

If you would like to chart your own course or dig deeper into the numbers, you can develop your own view on Rollins in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rollins.

Ready for More Investment Opportunities?

Smart investors always keep their options open. Don’t let the next breakout stock or sector trend slip past you. Find your edge with these powerful tools from Simply Wall Street:

- Capture steady returns and boost your income by targeting these 16 dividend stocks with yields > 3% offering yields above 3%.

- Capitalize on rapid technological change by targeting tomorrow’s disruptors through these 25 AI penny stocks, unlocking access to companies at the forefront of artificial intelligence.

- Pick up strong value opportunities by targeting these 876 undervalued stocks based on cash flows powered by healthy cash flows and favorable valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives