- United States

- /

- Professional Services

- /

- NYSE:RHI

Does the Recent 8.6% Rebound Signal Opportunity in Robert Half Stock for 2025?

Reviewed by Bailey Pemberton

- Wondering if Robert Half is trading at a bargain or if there is more value to be uncovered? You are not alone. Investors are always looking for the next opportunity, and the current pricing brings up some interesting questions.

- The stock has seen some rapid moves lately, bouncing up 8.6% in the past week, even after dropping 11.7% over the last month, and it is still down a sharp 59.6% year-to-date.

- Market reactions have been sparked by several notable developments, including shifts in the staffing industry landscape and renewed debate over the impact of tight labor markets and technology-driven disruption. These headlines have created room for both optimism and caution, which is why Robert Half’s price action has caught the spotlight.

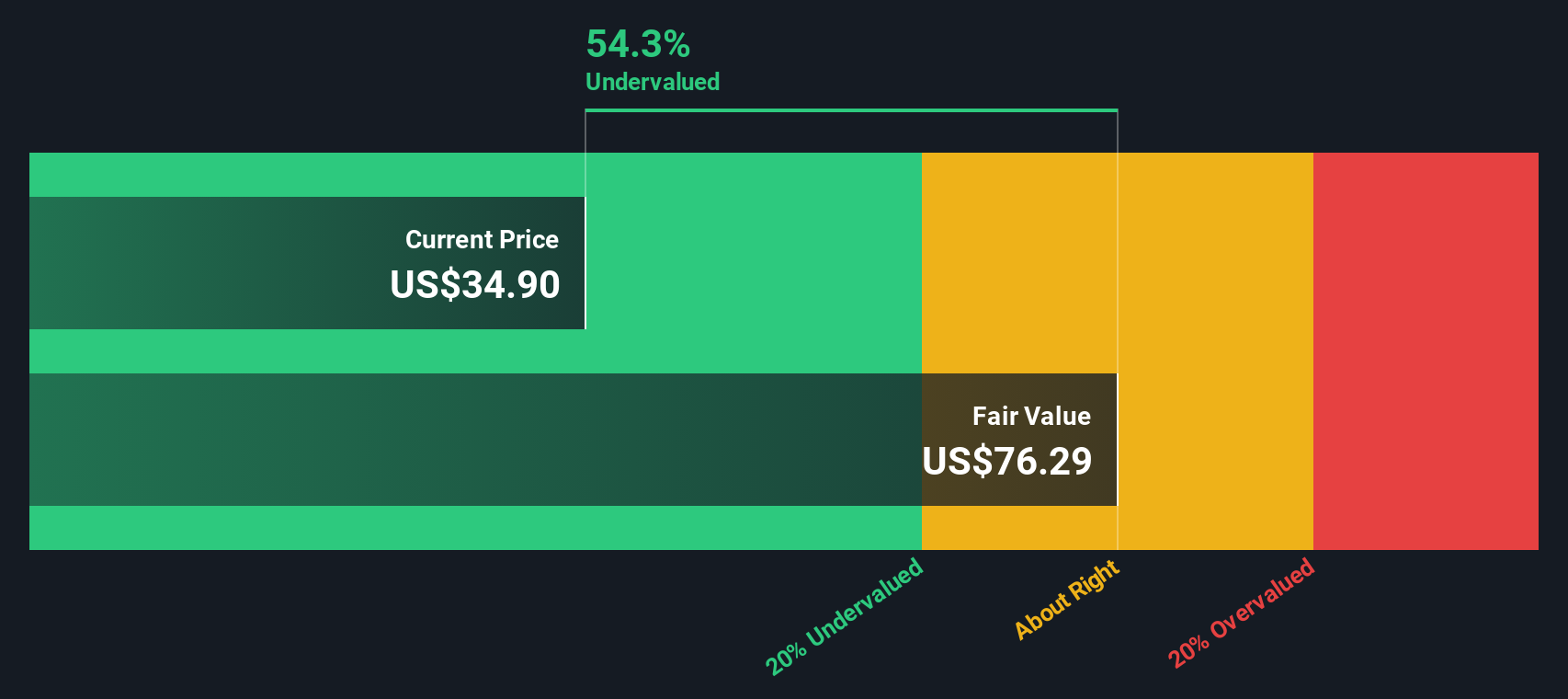

- When it comes to valuation, Robert Half currently scores a solid 5 out of 6 on our value checks, meaning it appears undervalued in most key respects. We will dive into the standard valuation approaches next. Stick around, as we will also highlight a smarter way to spot valuation signals that could give you an edge.

Find out why Robert Half's -62.1% return over the last year is lagging behind its peers.

Approach 1: Robert Half Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model calculates a company's intrinsic value by forecasting its future cash flows and then discounting them back to today's value. This approach aims to estimate what Robert Half is truly worth based on the cash it is expected to generate for shareholders over time.

For Robert Half, the DCF analysis uses a 2 Stage Free Cash Flow to Equity model. In the most recent twelve months, the company reported $244.9 million in Free Cash Flow. Analysts forecast growth in FCF, projecting $312 million by 2027. Beyond the analyst forecast period, Simply Wall St further extrapolates free cash flow out to 2035, indicating a steady upward trajectory each year.

All of these cash flows are brought back to their present value using an appropriate discount rate, yielding an estimated intrinsic value of $84.58 per share. Compared with the current share price, this suggests Robert Half is trading at a notable 67.3% discount, implying the stock is significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Robert Half is undervalued by 67.3%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Robert Half Price vs Earnings (PE)

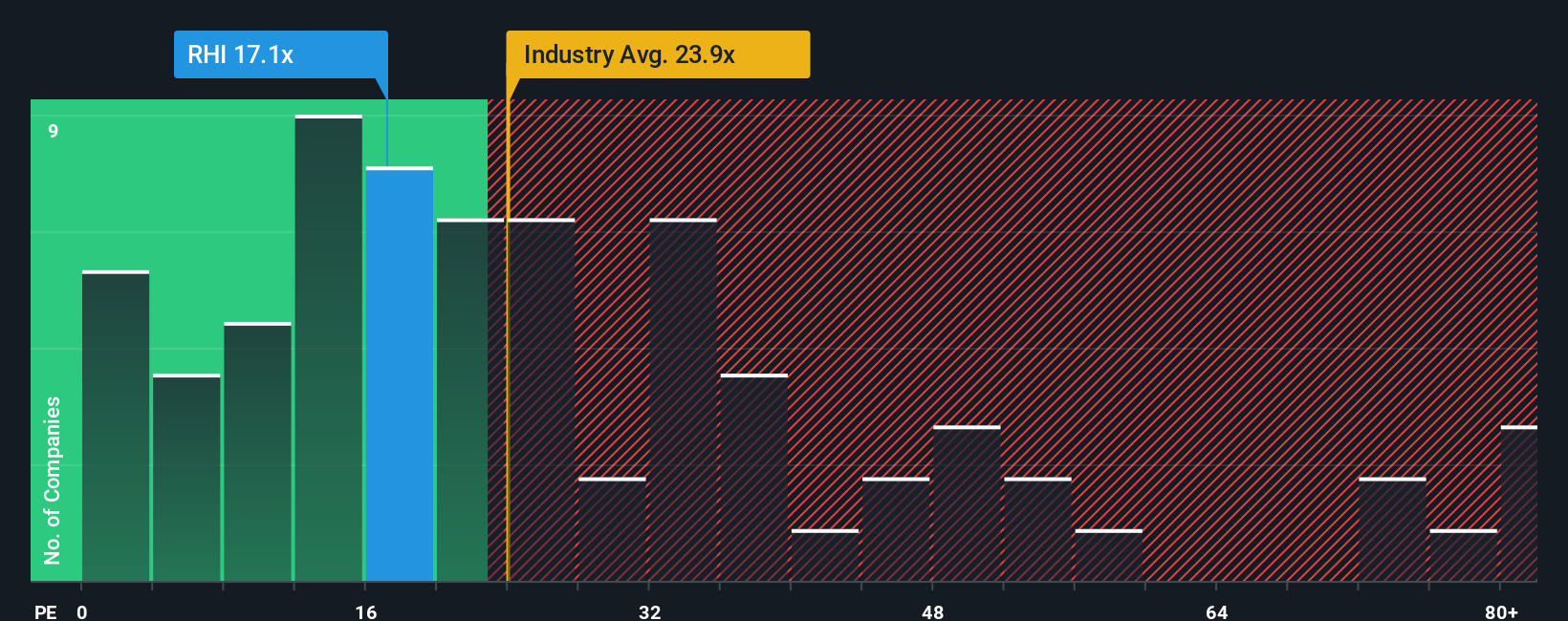

The Price-to-Earnings (PE) ratio is a key valuation tool for profitable companies like Robert Half because it directly reflects how much investors are willing to pay for each dollar of earnings. It is a straightforward way to compare one company's valuation to others and to see if the market is expecting future growth or pricing in higher risk.

Growth prospects and perceived risks play a big role in determining what a “normal” or “fair” PE ratio should be. Companies that are expected to grow faster or operate more reliably often command higher PE ratios. Those facing headwinds or uncertainty may trade at a discount.

Robert Half currently trades at a PE ratio of 17.8x. For context, the average PE among Professional Services industry peers is 29.9x, while the broader industry average sits at 24.7x. This means Robert Half is priced significantly below both its direct competitors and the wider sector.

Simply Wall St’s proprietary “Fair Ratio” considers factors like the company’s earnings growth, market risks, profit margin, industry trends, and market capitalization. Unlike a simple industry average or peer comparison, the Fair Ratio adjusts for what truly matters to the specific company and its context, offering a more complete picture of value.

Robert Half’s Fair Ratio is calculated at 27.2x, notably above its current 17.8x PE. This indicates the stock may be undervalued based on the fundamentals and outlook that investors should weigh most heavily.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Robert Half Narrative

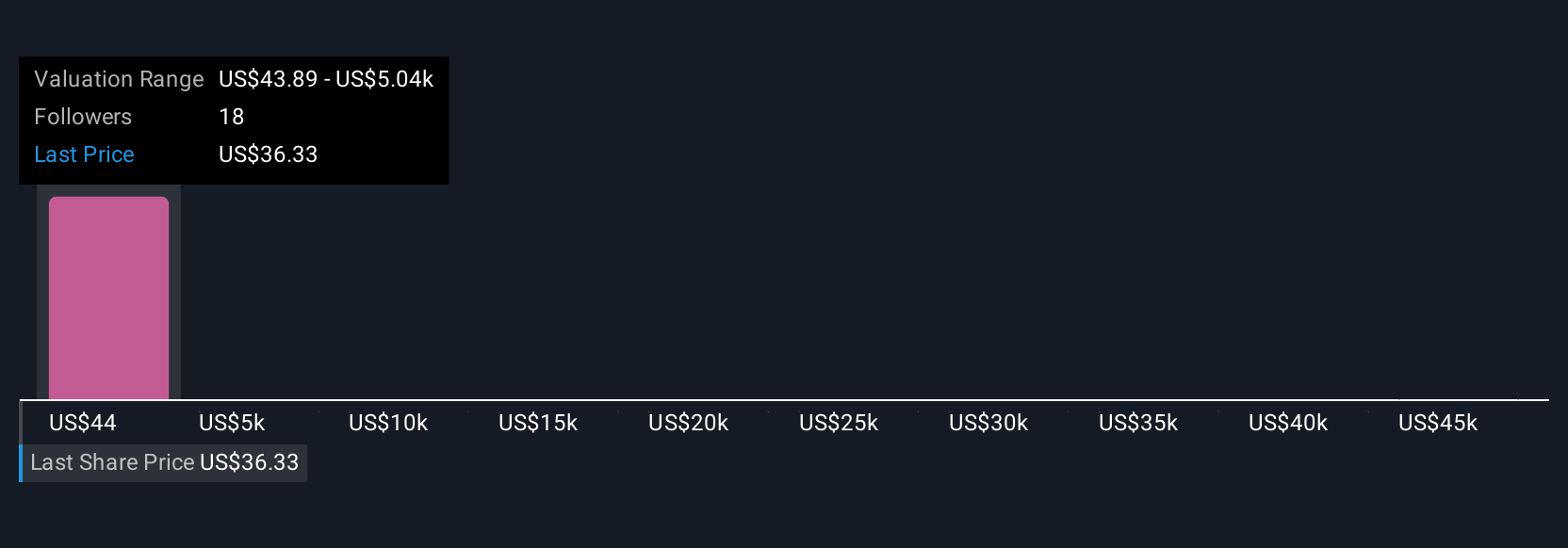

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, where you connect your own perspective on its opportunities or risks with the numbers that drive its financial future, such as estimated revenue, earnings, margins, and your view on what the business is really worth.

Narratives let you link the company’s story and key business drivers directly to a financial forecast and fair value estimate. On Simply Wall St’s platform, millions of investors use Narratives within the Community page to quickly and easily build their investment thesis and see how different assumptions or views shift the potential outcomes.

This tool empowers investors to make smarter buy or sell decisions by automatically comparing their Fair Value to the current share price. Plus, as new earnings, news, or market data are released, Narratives update dynamically, keeping your analysis fresh without extra effort.

For example, two investors analyzing Robert Half might interpret recent revenue trends in completely different ways. One may focus on the company’s investments in AI and forecast a fair value of $55.00, while another, concerned about persistent declines in legacy segments, might estimate just $33.00. Narratives let every investor see this full range of potential and choose the view that fits their own convictions.

Do you think there's more to the story for Robert Half? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RHI

Robert Half

Provides talent solutions and business consulting services in the United States and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives