- United States

- /

- Commercial Services

- /

- NYSE:RBA

A Look at RB Global (NYSE:RBA) Valuation Ahead of Earnings and Analyst Growth Forecasts

Reviewed by Simply Wall St

RB Global (NYSE:RBA) is set to announce earnings this week. Investors are watching for the company’s expected year-on-year revenue growth and technical signals that are influencing its recent trading momentum.

See our latest analysis for RB Global.

RB Global's share price has cooled off in the past month with a 9.2% drop; however, it remains up 8.1% year-to-date. Investors looking at the bigger picture will notice a hefty 10.5% total shareholder return over the past 12 months and a remarkable 105% gain on a three-year basis. This points to durable long-term momentum and positive sentiment tied to the company's future growth story.

If you’re interested in what else is attracting strong hands right now, it could be an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With earnings on deck and shares trading at a discount to price targets, the key question is whether RB Global is trading below its true value, or if the market has already priced in all its future growth potential.

Most Popular Narrative: 20.4% Undervalued

RB Global's last close at $97.63 stands well below the fair value set by the most popular narrative, signaling significant upside based on future growth potential. As analysts weigh in on ambitious international expansion and digital transformation, the price appears to reflect only part of the company's projected momentum.

Expansion of the international buyer base and new alliance partnerships, along with ongoing growth in e-commerce marketplace activities, are expected to drive higher transaction volumes and revenue as more asset sales and auctions move online. Joint ventures and acquisitions, such as LKQ in the U.K., J.M. Wood in the U.S., and new operations in Australia, are building a larger global footprint and improving cross-selling opportunities. These activities are supporting long-term revenue and margin growth.

Want to peek inside the narrative behind this valuation? The secret formula is aggressive profit expansion, surging global sales, and a future multiple outpacing the industry. Wondering if these bold projections really support such a premium? Only the complete breakdown reveals the full answers driving this eye-catching target.

Result: Fair Value of $122.7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting economic conditions or challenges with integrating recent acquisitions could quickly alter the growth outlook that analysts are banking on for RB Global.

Find out about the key risks to this RB Global narrative.

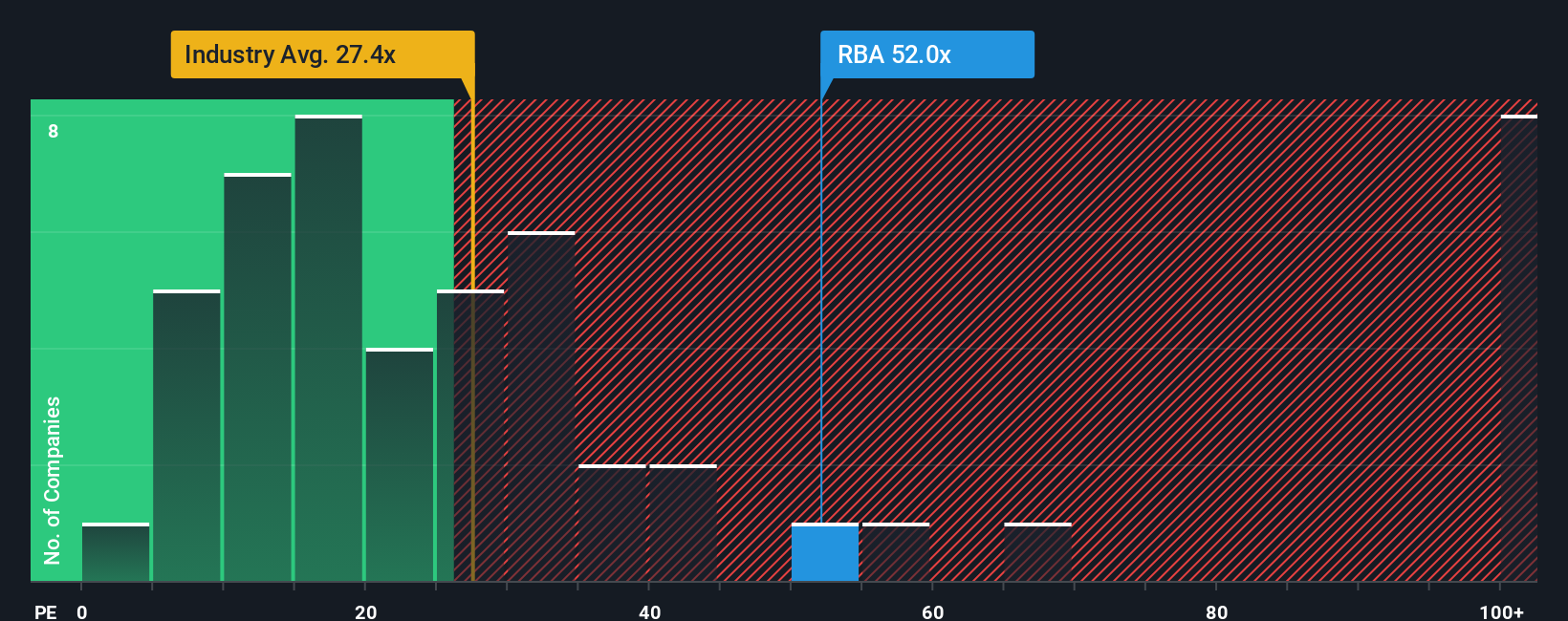

Another View: Testing the Multiple

Looking at RB Global through the lens of its price-to-earnings ratio, things appear stretched. Shares trade at 48x earnings, far above the industry average of 22.4x, its peer group’s 29.9x, and even the fair ratio of 32.1x. That gap could be a red flag or a sign the market expects outperformance. Does this multiple justify the optimism, or could it set up volatility if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RB Global Narrative

If you have a different perspective, or want to dig into the numbers on your own terms, you can craft your own analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding RB Global.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your portfolio and stay ahead of the curve with ideas that others may overlook. Your next big winner could be just a click away.

- Capture tomorrow’s innovation by checking out these 26 AI penny stocks, which are shaping artificial intelligence breakthroughs and setting the pace in this transformative sector.

- Tap into income potential with these 20 dividend stocks with yields > 3%, offering substantial yields and a track record of rewarding shareholders.

- Seize value opportunities by investigating these 844 undervalued stocks based on cash flows, which are trading below their intrinsic worth. Don’t let market inefficiencies pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBA

RB Global

Operates a marketplace that provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives