- United States

- /

- Professional Services

- /

- NYSE:PSN

Parsons (PSN) Profit Margin Rises, Reinforcing Stable-Growth Narrative in Investor Community

Reviewed by Simply Wall St

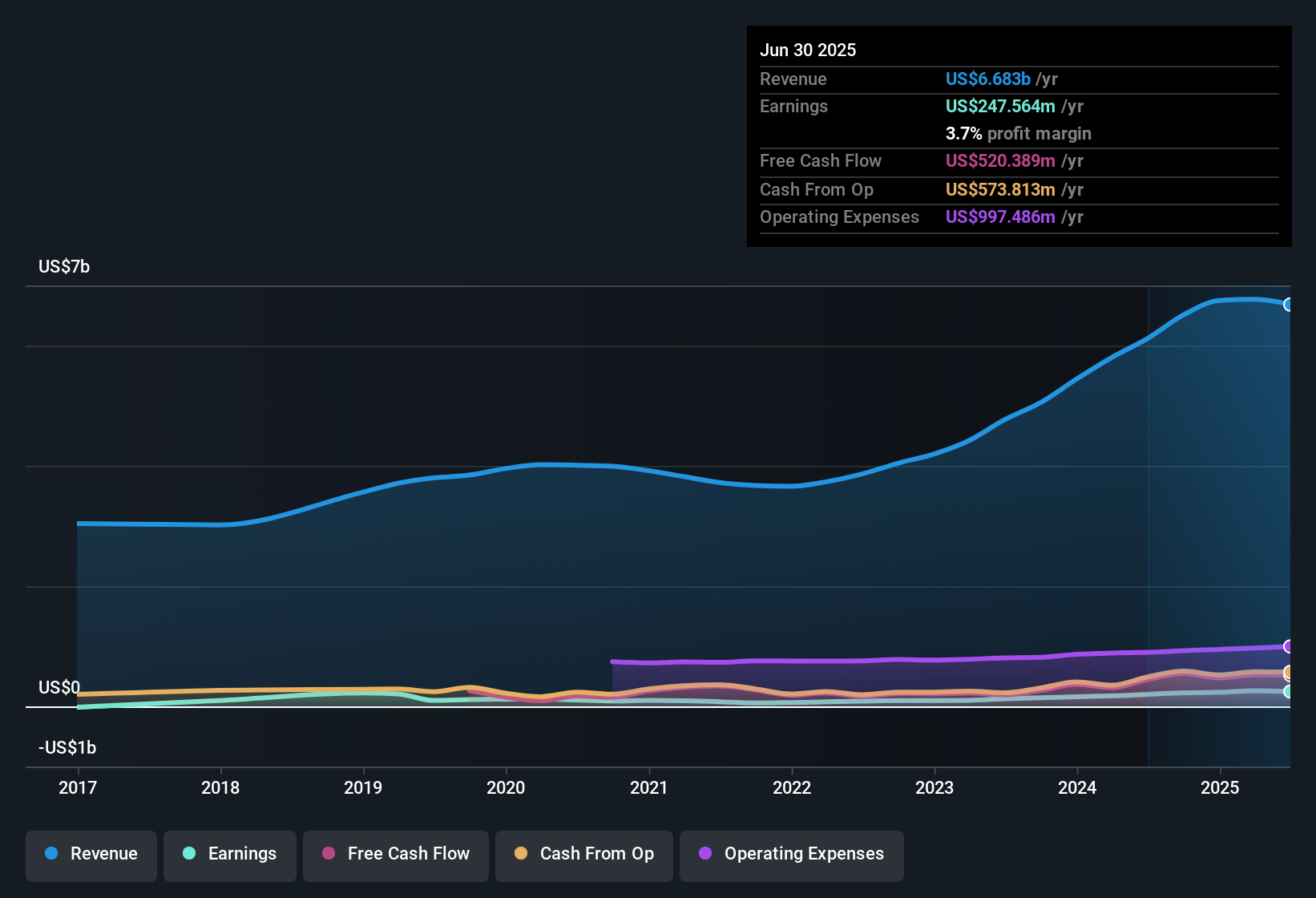

Parsons (PSN) posted a robust year, with profits climbing at an annual rate of 29.5% over the last five years and net profit margin reaching 3.7%, up from 3.3% a year prior. While the latest year’s earnings grew by 23%, this pace trails the five-year average. Future growth is forecast to moderate to 11.15% per year for earnings and 6.3% per year for revenue. With a share price of $82.91 trading below the estimated fair value of $117.28, investors are left weighing the company’s solid profit and revenue trajectory against its current valuation premium compared to the broader industry.

See our full analysis for Parsons.Next up, we will see how the latest results measure up to the dominant narratives in the market. Some will stand, while others could be put to the test.

See what the community is saying about Parsons

Margins Edge Up as Profitability Steadies

- Parsons’ net profit margin increased to 3.7%, up from 3.3% the previous year, signaling steady efficiency gains even as growth rates moderated.

- According to the analysts' consensus view, the focus on tech-enabled solutions, strategic M&A, and a robust project backlog are credited with supporting both margin expansion and revenue stability.

- The continued migration towards higher-margin segments like cybersecurity, digital engineering, and analytics is expected to help sustain these improvements and buffer against short-term volatility.

- Management highlights a record funded backlog and high contract win rates as reinforcing the company’s resilience, particularly as demand for infrastructure and security services continues to rise.

Consensus narrative notes that steady margin improvements and backlog growth are helping Parsons pivot toward tech-driven business lines, supporting a more resilient, diversified outlook. 📊 Read the full Parsons Consensus Narrative.

Peer Valuation Gap Narrows, Sector Premium Persists

- Parsons trades at a P/E of 35.8x versus a peer average of 38.9x. Its valuation remains above the US Professional Services industry average of 25.1x, reflecting continued investor willingness to pay a premium for its growth prospects.

- From the analysts' consensus perspective, this valuation is justified when factoring in strong infrastructure tailwinds and reliable multi-year revenue visibility.

- Bulls point to over $8.9 billion in project backlog, enhanced by U.S. infrastructure legislation, as key reasons the market is paying up.

- Still, consensus notes that to reach analyst target levels, Parsons’ earnings growth will need to outpace both its five-year historical average and the current sector rate, which could be challenging if competition for federal contracts heats up.

DCF Implies Deep Discount to Fair Value

- With shares trading at $82.91, Parsons sits well below the DCF fair value estimate of $117.28. This presents a potential discount of more than 29% based on long-term earnings assumptions.

- From the consensus narrative, analysts attribute this fair value gap to forecasted gains in both revenue and profit margins by 2028, though some remain cautious given the company’s dependence on government contracts and the risks posed by rising competition.

- Consensus points out that while projected earnings of $350.2 million could justify higher valuations, even minor disruptions in federal funding or increased integration costs from acquisitions could delay the expected upside.

- This tension between upside potential and execution risk is seen as a key driver of the current discount relative to modeled intrinsic value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Parsons on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you spot something others missed? Use your insight to craft your own narrative. It takes just a few minutes to share your perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Parsons.

See What Else Is Out There

Parsons' growth outlook has cooled compared to prior years, and its ability to sustain premium valuations depends on consistently exceeding already strong sector averages.

If you're looking for steadier performance and clearer earnings momentum, check out stable growth stocks screener (2074 results) to find companies delivering reliable results through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSN

Parsons

Provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives