- United States

- /

- Professional Services

- /

- NYSE:PL

AI-Driven Demand For Satellite Data Might Change The Case For Investing In Planet Labs (PL)

Reviewed by Sasha Jovanovic

- Planet Labs has recently experienced increased demand for its advanced satellite imagery and analytics, fueled by global conflicts and the rising integration of AI solutions.

- The company's recurring subscription model and expansion into AI-powered, user-friendly analytics have positioned it as a leader in the evolving satellite imagery market.

- We'll explore how surging demand for AI-enabled satellite data could influence Planet Labs' outlook and reshape its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Planet Labs PBC Investment Narrative Recap

To own shares of Planet Labs, investors need to believe in a world where high-frequency, AI-enhanced satellite imagery is indispensable for government and commercial decision-making. The recent uptick in demand, partly fueled by global conflicts and AI adoption, may amplify the positive catalyst of expanding high-value contracts in the near term. However, the most significant risk remains the strain from heavy capital expenditures on new satellite fleets, potentially pressuring cash flow, not fundamentally altered by recent news. Of the latest announcements, Planet’s $12.8 million contract with the National Geospatial-Intelligence Agency for AI-powered maritime analytics stands out, directly linking AI integration to revenue growth. This aligns closely with the trend highlighted in the recent news, supporting the current narrative that scaling AI-powered solutions and winning high-value contracts could be key drivers for short-term momentum. By contrast, investors should be aware that growing demand can also expose Planet Labs to ...

Read the full narrative on Planet Labs PBC (it's free!)

Planet Labs PBC is projected to achieve $409.3 million in revenue and $29.2 million in earnings by 2028. This assumes an annual revenue growth rate of 17.8% and an increase in earnings of $135.7 million from the current -$106.5 million.

Uncover how Planet Labs PBC's forecasts yield a $14.55 fair value, a 8% upside to its current price.

Exploring Other Perspectives

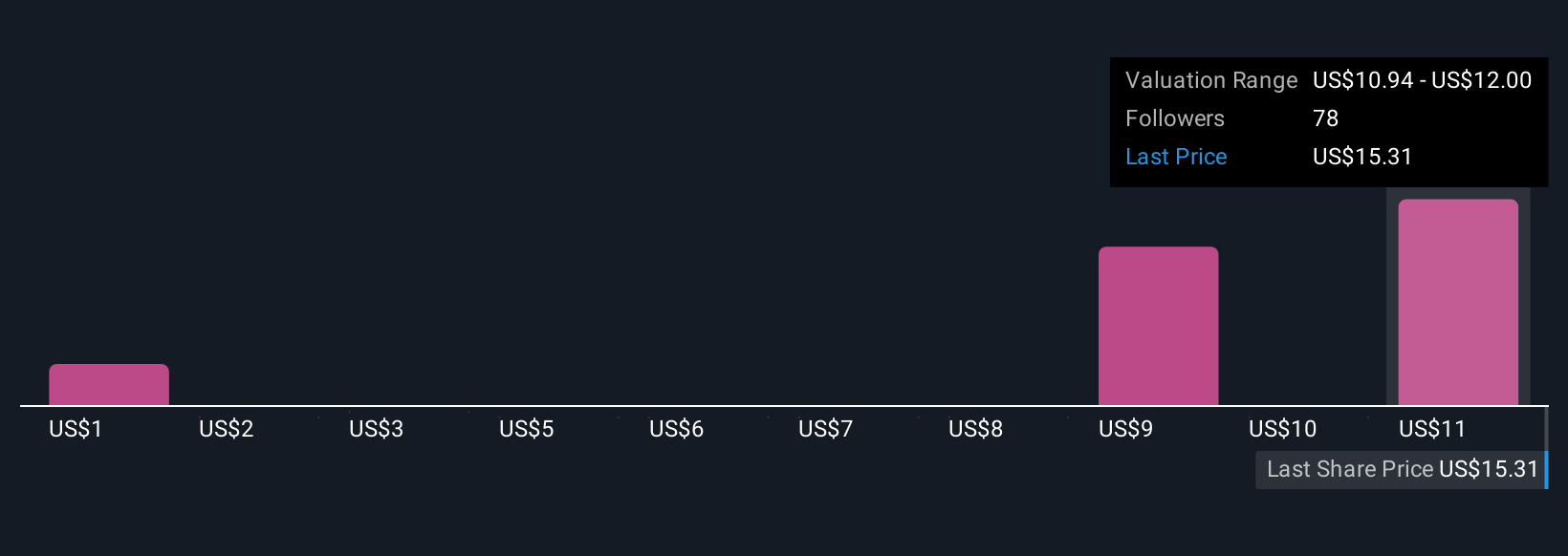

Fair value estimates from 11 Simply Wall St Community members range widely, from as low as US$0.27 to US$14.55 per share. While the market weighs these views, many are also focused on whether Planet Labs’ aggressive investment in expanding its satellite fleet will convert demand into lasting financial health, explore more perspectives to see the full picture.

Explore 11 other fair value estimates on Planet Labs PBC - why the stock might be worth as much as 8% more than the current price!

Build Your Own Planet Labs PBC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Labs PBC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Labs PBC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Labs PBC's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives