- United States

- /

- Professional Services

- /

- NYSE:PAYC

How Paycom Software's (PAYC) Leadership Expansion in Technology May Influence Its Investment Narrative

Reviewed by Simply Wall St

- On August 18, 2025, Paycom Software announced expanded leadership changes, including Shane Hadlock becoming both chief client officer and chief technology officer, and the promotion of Rachael Gannon to chief automation officer, while Brad Smith was named senior technical strategist.

- These shifts place seasoned veterans at the helm of technology, automation, and strategy as Paycom prepares for a high-profile presentation at Citi’s 2025 Global TMT Conference.

- We'll now examine how Paycom's leadership expansion in technology and automation could reshape its investment outlook and growth drivers.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Paycom Software Investment Narrative Recap

Paycom Software investors are generally betting on the company’s ability to leverage product innovation and automation to drive recurring revenue and client retention. While the latest leadership changes signal a focus on technology and automation, these executive moves are unlikely to have a material impact on Paycom’s immediate revenue growth catalyst or the key risk of industry-wide commoditization of AI-enabled HR tools in the short-term.

The recent appointment of Shane Hadlock as both Chief Client Officer and Chief Technology Officer is especially relevant; his long history with Paycom places experienced leadership over technology and client-facing operations just ahead of Paycom’s upcoming presentation at Citi’s 2025 Global TMT Conference, a forum often watched for new product momentum or strategy updates that could influence near-term investor sentiment. Still, investors should remain mindful of the risk that accelerated AI adoption across the sector could impact pricing and margin stability over time, especially as...

Read the full narrative on Paycom Software (it's free!)

Paycom Software's narrative projects $2.5 billion revenue and $586.5 million earnings by 2028. This requires 8.1% yearly revenue growth and a $170.8 million earnings increase from $415.7 million.

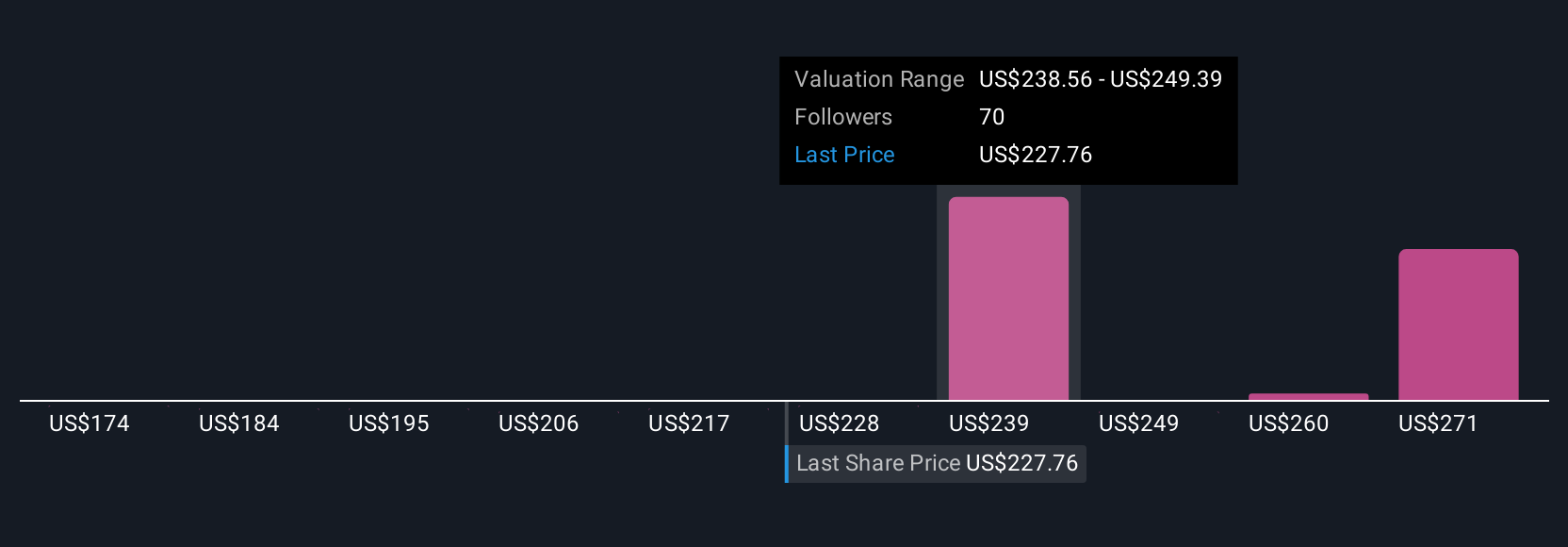

Uncover how Paycom Software's forecasts yield a $248.73 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set their fair value estimates for Paycom Software between US$173.58 and US$281.72, based on 10 unique analyses. With AI automation potentially affecting industry margin trends, different viewpoints highlight how future earnings quality and risk may be interpreted.

Explore 10 other fair value estimates on Paycom Software - why the stock might be worth as much as 20% more than the current price!

Build Your Own Paycom Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paycom Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Paycom Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paycom Software's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAYC

Paycom Software

Provides cloud-based human capital management (HCM) solution delivered as software-as-a-service for small to mid-sized companies in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives