- United States

- /

- Commercial Services

- /

- NYSE:NVRI

Should Enviri's (NVRI) Lowered Guidance and Widening Losses Prompt a Reassessment by Investors?

Reviewed by Sasha Jovanovic

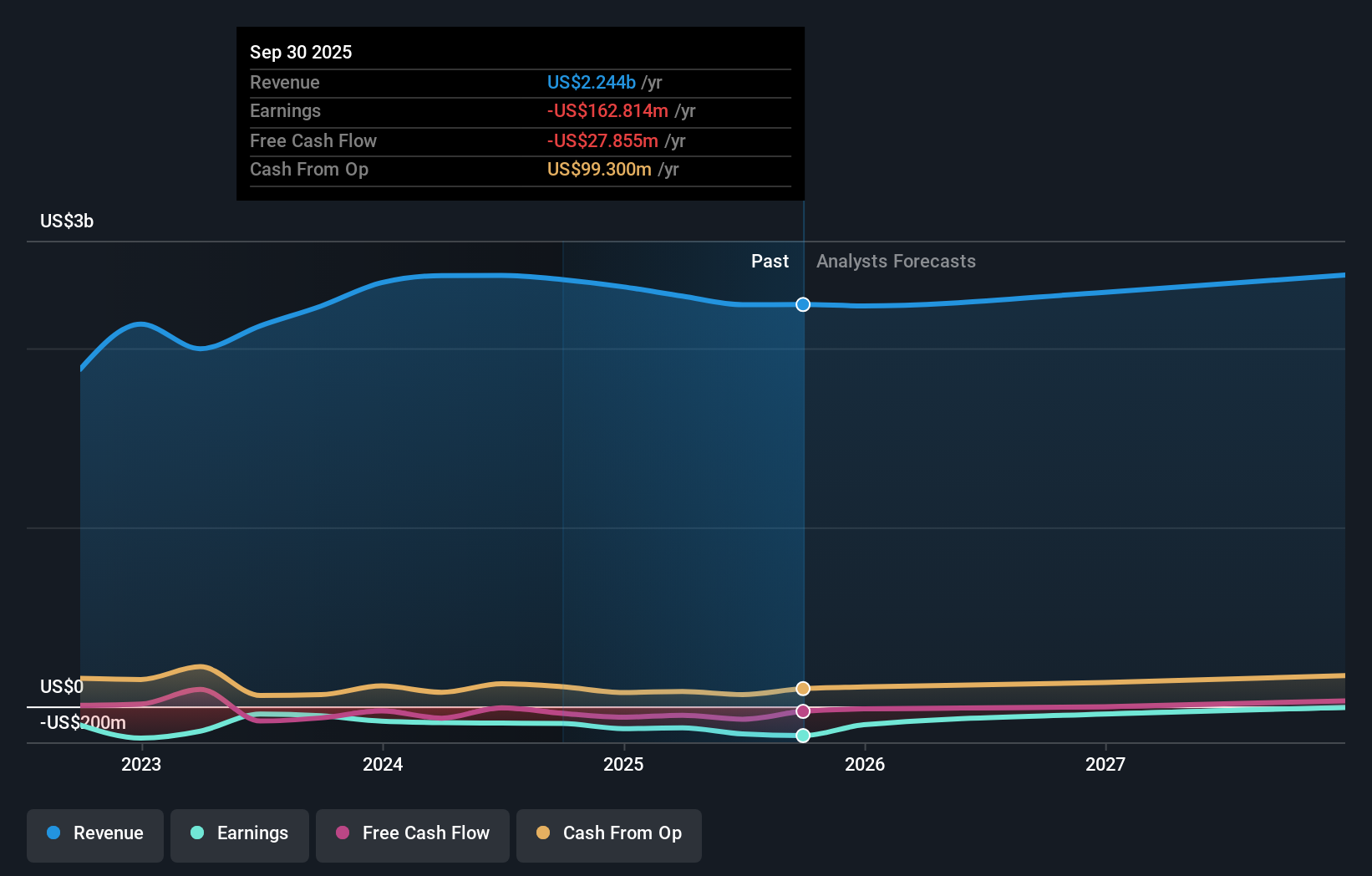

- Enviri Corporation recently reported its third-quarter 2025 results, revealing revenue of US$574.82 million while net loss widened to US$22.31 million from US$13.17 million a year ago, and it lowered its full-year earnings guidance.

- This update highlights that operational or market challenges are weighing more heavily on performance than previously expected, prompting a wider projected loss for the year.

- We'll explore how Enviri's revised guidance and higher quarterly net loss may impact the company's future investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Enviri Investment Narrative Recap

To be a shareholder in Enviri today, one needs to believe in its ability to harness secular growth in environmental and recycling services, despite ongoing cyclical and operational headwinds. The recent wider-than-expected loss and reduced full-year guidance increase scrutiny on whether operational improvements and end-market demand can materialize quickly enough; these results may delay, but do not fundamentally alter, the short-term catalyst of potential strategic actions such as the Clean Earth business divestiture, though they amplify execution risks linked to prolonged losses and capital constraints.

The company’s recent update explicitly lowering its full-year earnings outlook is the most directly relevant announcement to the earnings news, as it signals near-term challenges are greater than anticipated. This downshift draws attention to risks around funding flexibility and adds pressure on management to accelerate turnaround steps, especially as ongoing losses narrow room for reinvestment and may impact any potential Clean Earth transaction.

Yet, with persistent net losses and higher loss projections, investors should not overlook the possibility that continued cash outflows could...

Read the full narrative on Enviri (it's free!)

Enviri's narrative projects $2.5 billion revenue and $178.8 million earnings by 2028. This requires 3.2% yearly revenue growth and a $332.5 million increase in earnings from -$153.7 million today.

Uncover how Enviri's forecasts yield a $15.67 fair value, a 24% upside to its current price.

Exploring Other Perspectives

All one fair value estimate from the Simply Wall St Community sits at US$15.67 per share. Community viewpoints can vary widely, especially given concerns about financial flexibility and the need for turnaround moves.

Explore another fair value estimate on Enviri - why the stock might be worth as much as 24% more than the current price!

Build Your Own Enviri Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enviri research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enviri research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enviri's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enviri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVRI

Enviri

Provides environmental solutions for industrial and specialty waste streams in the United States and internationally.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives