Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Enviri Corporation (NYSE:NVRI) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Enviri

How Much Debt Does Enviri Carry?

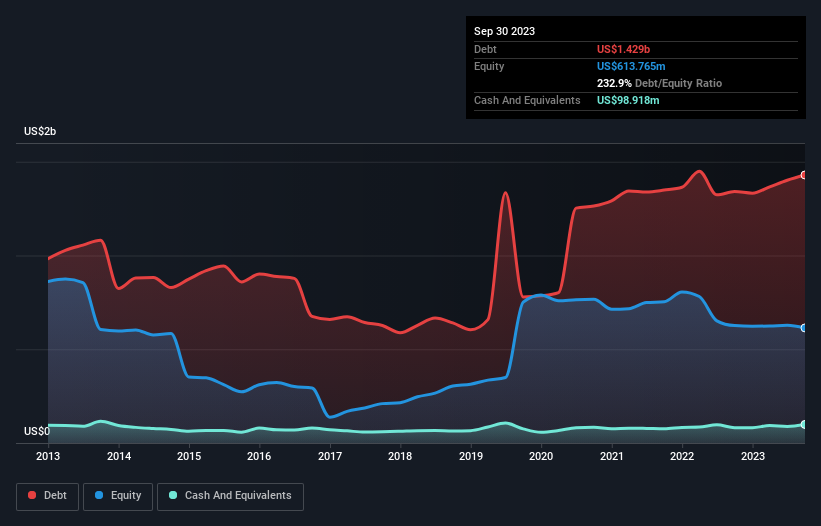

The image below, which you can click on for greater detail, shows that at September 2023 Enviri had debt of US$1.43b, up from US$1.34b in one year. On the flip side, it has US$98.9m in cash leading to net debt of about US$1.33b.

How Healthy Is Enviri's Balance Sheet?

We can see from the most recent balance sheet that Enviri had liabilities of US$592.9m falling due within a year, and liabilities of US$1.63b due beyond that. On the other hand, it had cash of US$98.9m and US$317.6m worth of receivables due within a year. So it has liabilities totalling US$1.81b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$506.1m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Enviri would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Enviri shareholders face the double whammy of a high net debt to EBITDA ratio (5.1), and fairly weak interest coverage, since EBIT is just 1.0 times the interest expense. The debt burden here is substantial. On the other hand, Enviri grew its EBIT by 26% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Enviri's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Enviri saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Enviri's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. Taking into account all the aforementioned factors, it looks like Enviri has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. While Enviri didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Enviri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NVRI

Enviri

Provides environmental solutions for industrial and specialty waste streams in the United States and internationally.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives