- United States

- /

- Commercial Services

- /

- NYSE:MSA

What MSA Safety (MSA)'s New SCBA Launch and European Debut Mean for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, MSA Safety announced the launch of the MSA G1 XR 2025 Edition SCBA with key safety certifications, and the European debut of its ALTAIR io 6 Multigas Detector at the A+A International Trade Fair.

- These product developments highlight MSA's focus on innovative, compliant safety solutions aligned with evolving industrial and regulatory standards.

- We'll consider how these new product launches, particularly the SCBA upgrade for first responders, affect MSA's long-term growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MSA Safety Investment Narrative Recap

To be a shareholder in MSA Safety, you need to believe in the company’s ability to drive growth and margin improvement through innovation in industrial and first responder safety solutions, while managing input cost pressures and government-driven demand cycles. The recent launch of the G1 XR 2025 Edition SCBA and the ALTAIR io 6 Multigas Detector strengthens MSA’s competitive position, but does not materially reduce short-term risks, such as uncertainties around the timing of government funding and evolving standards.

Among the new product launches, the G1 XR 2025 Edition SCBA is particularly relevant since it aligns directly with the updated NFPA 1970 standard and is now available to order for fire departments. This upgrade leverages a decade of platform innovation, potentially supporting MSA’s core Fire Service business segment and positioning the company for upcoming replacement cycles, a key near-term sales catalyst.

However, investors should also consider that the timing of government funding and the approval process for industry standards can remain unpredictable, which means...

Read the full narrative on MSA Safety (it's free!)

MSA Safety's narrative projects $2.1 billion in revenue and $377.8 million in earnings by 2028. This requires 5.2% yearly revenue growth and a $100.9 million earnings increase from the current $276.9 million.

Uncover how MSA Safety's forecasts yield a $187.40 fair value, a 20% upside to its current price.

Exploring Other Perspectives

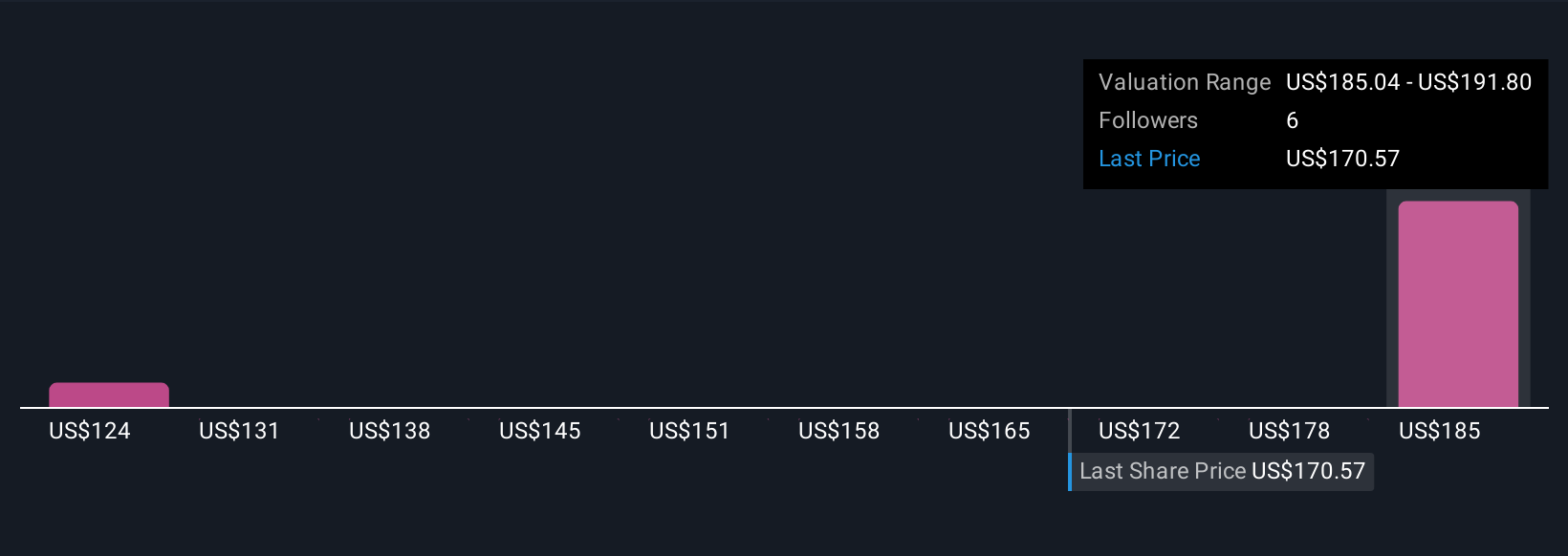

Simply Wall St Community members contributed three fair value estimates for MSA Safety, ranging from US$124.23 to US$207.51 per share. As product cycles speed up and innovation expands, government funding delays and evolving standards remain important factors affecting performance and future outlook; you can compare your view with other investors here.

Explore 3 other fair value estimates on MSA Safety - why the stock might be worth 21% less than the current price!

Build Your Own MSA Safety Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSA Safety research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MSA Safety research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSA Safety's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSA

MSA Safety

Develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives