- United States

- /

- Commercial Services

- /

- NYSE:MSA

A Fresh Look at MSA Safety (MSA) Valuation as Recent Stock Movements Draw Investor Attention

Reviewed by Simply Wall St

MSA Safety (MSA) has recently seen some movement in its stock price, prompting investors to take a closer look at its performance in recent months. A quick check of the numbers helps frame its recent trajectory.

See our latest analysis for MSA Safety.

After a volatile year, MSA Safety’s share price is down from recent highs and its one-year total shareholder return sits at -6.5%. Despite some shorter-term pressure, the bigger picture looks steadier with an 18% total return for shareholders over three years. Changes in risk appetite may be playing a role, but the company’s long-term momentum suggests investors are watching for renewed growth signals.

If you’re curious what other resilient companies are catching investor interest lately, now’s the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With shares trading nearly 18% below analyst targets and the company posting steady revenue and earnings growth, the question remains: Is this an overlooked buying opportunity, or has the market already factored in MSA Safety’s future prospects?

Most Popular Narrative: 14.1% Undervalued

With analysts assigning a fair value of $187.40, MSA Safety’s stock price of $160.96 stands at a notable discount. Forecasts and operational factors shape the rationale behind this gap.

Recent results exceeded expectations. This was driven by robust backlog conversion and contributions from recent acquisitions. Analysts recognize improving operational execution, which has led to upward adjustments in price targets.

Are you curious what is fueling MSA Safety’s premium outlook? The fair value calculation includes bold assumptions about future gains, margin expansion, and shifts in industry leadership. Find out which trend flips the narrative and what key forecast really moves the target price.

Result: Fair Value of $187.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, short-cycle demand weakness and persistent margin pressures could challenge the outlook and prompt a rethink if these headwinds prove harder to overcome.

Find out about the key risks to this MSA Safety narrative.

Another View: Looking at Valuation from a Different Angle

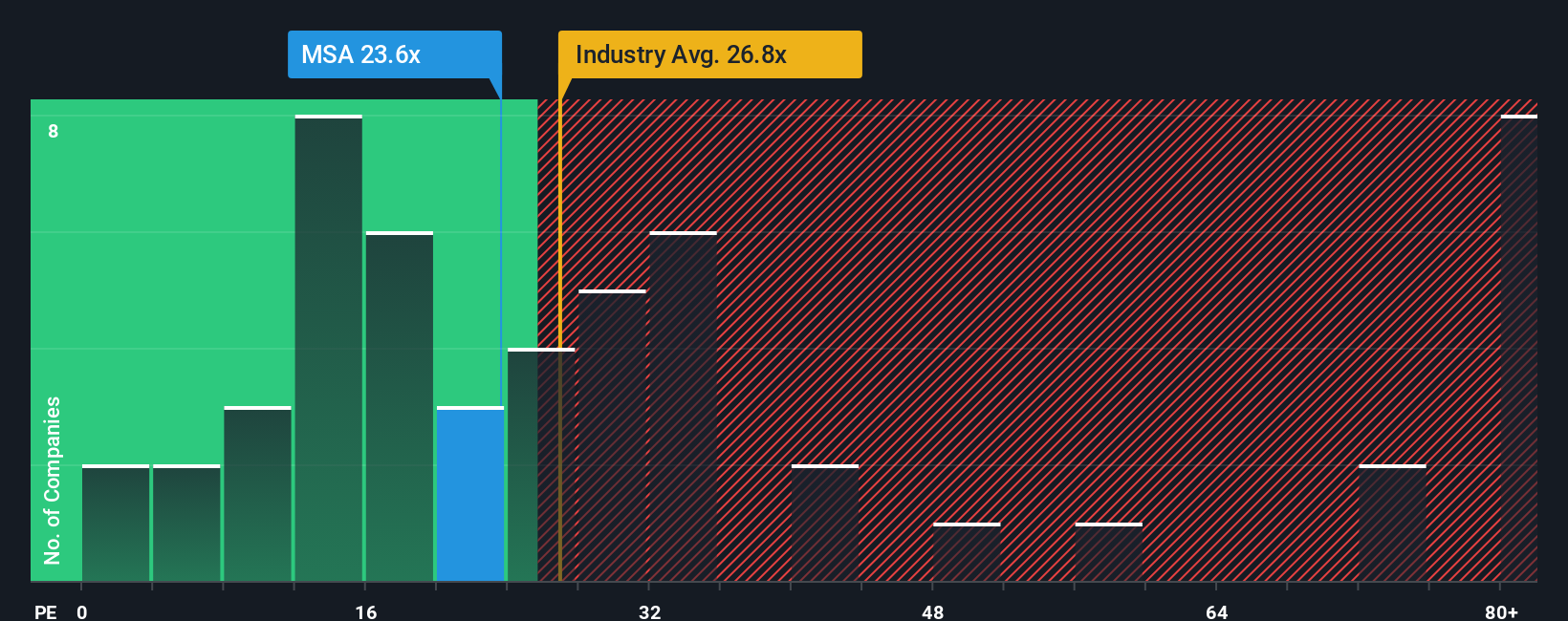

While analysts see upside based on future growth and price targets, a different picture emerges when you compare current price-to-earnings ratios. MSA’s ratio of 22.5x is higher than its sector peers at 17.2x, yet it remains below its own fair ratio of 23.8x. This situation puts the company in a tricky spot—full of potential but not obviously presenting a clear value. Does this higher-than-peer valuation indicate higher quality or suggest added risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSA Safety Narrative

If you want to dig into the details or believe there’s more to the story, you can shape your own view in just a few minutes. Do it your way

A great starting point for your MSA Safety research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity when you can strengthen your portfolio with stocks focused on growth and innovation? Let Simply Wall Street Screener help guide your next move. Consider these investment ideas you might not want to miss:

- Boost your income by exploring these 15 dividend stocks with yields > 3%, which features yields over 3% and consistent payout histories in established sectors.

- Take advantage of smart tech by searching these 25 AI penny stocks for companies at the forefront of artificial intelligence advancements and driving innovation in today’s market.

- Enhance your portfolio by reviewing these 926 undervalued stocks based on cash flows, which highlights stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSA

MSA Safety

Develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures worldwide.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success