- United States

- /

- Professional Services

- /

- NYSE:MG

Mistras Group (MG) One-Off $8.6M Loss Puts Earnings Quality Narrative to the Test

Reviewed by Simply Wall St

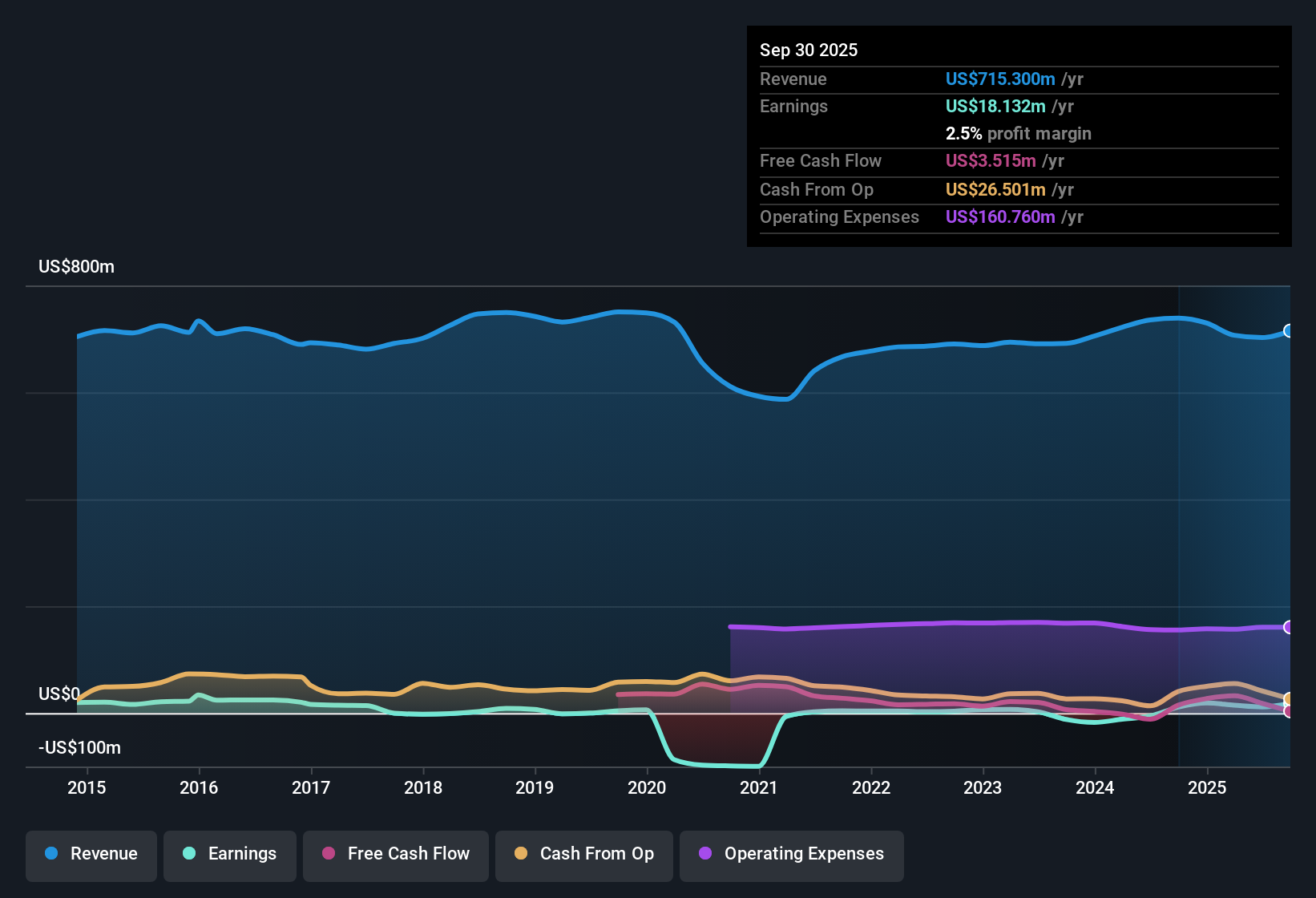

Mistras Group (MG) has made a notable leap to profitability, growing earnings at an impressive 71.1% per year over the past five years and only turning profitable in the most recent period. While the company’s reported earnings for the latest 12 months were affected by a one-off $8.6 million loss, the longer-term growth rate remains robust even as short-term results appear volatile.

See our full analysis for Mistras Group.Now, let’s see how the fresh earnings numbers measure up to the dominant narratives. Some expectations could be validated, while others might be put to the test.

See what the community is saying about Mistras Group

Margin Targets Outpace Recent Gains

- Analysts forecast profit margins rising from 1.6% today to 7.2% in three years, alongside 3.3% annual revenue growth. These projections reflect ambitions well above the current margin baseline.

- Analysts' consensus view is that Mistras Group’s improved recurring revenue mix and cost-cutting will help deliver these ambitious targets, but there are tensions:

- Structural changes, such as consolidating underperforming locations and boosting operational efficiency, are expected to contribute to margin gains. However, persistent labor and operating cost pressures could prevent margins from reaching the high end of projections.

- The emphasis on cost-cutting has driven margin improvements so far, but the lack of significant topline expansion limits how far these efficiencies can benefit net results.

- To see how optimistic projections play out against shifting fundamentals, bulls and skeptics are both watching margin progress closely.

📊 Read the full Mistras Group Consensus Narrative.

One-Off Loss Weighs on Quality

- The latest reported period includes a one-off $8.6 million loss, which significantly distorts reported profitability and makes short-term comparisons to prior years less reliable for investors reviewing the bottom line.

- Analysts' consensus view calls attention to how this one-off masks the underlying improvement in operations, but it also increases debate:

- Recurring revenue strength and new tech-enabled services are increasing, supporting higher-quality earnings over time. However, these non-recurring charges can undermine confidence in the durability of current profit levels.

- Consensus sees long-term catalysts in SaaS and data solutions adoption, but recurring restructuring and exceptional items need to decline for results to be truly trusted.

Valuation Discount Despite Premium P/E

- Shares currently trade at $11.79, about 32.4% below the analyst price target of $14.00 and meaningfully beneath the DCF fair value estimate of $22.02, while holding a P/E ratio of 32.5x, well above the peer group average of 25.1x.

- Analysts' consensus narrative frames this setup as a discount opportunity, with a caveat:

- Despite its high P/E, the potential for operating leverage and a transition toward more stable, recurring revenue are key factors for closing the valuation gap identified by DCF and analysts’ targets.

- The premium P/E signals market skepticism about delivering on margin growth amid volatile earnings quality, raising the stakes for follow-through on longer-term expansion strategies.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mistras Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Put your insights to work and craft your unique view in just a few minutes with Do it your way.

A great starting point for your Mistras Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Mistras Group’s progress is tempered by margin volatility, inconsistent earnings quality, and lingering doubts about achieving sustainable, stable growth.

If you want companies delivering reliable results across cycles, use stable growth stocks screener (2074 results) to identify those that consistently achieve steady earnings and revenue growth without the turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MG

Mistras Group

Provides technology-enabled asset protection solutions in the United States, other Americas, Europe, and the Asia-Pacific.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives