- United States

- /

- Professional Services

- /

- NYSE:LDOS

What Leidos Holdings (LDOS)'s Lead Role in Starlab Station Assembly Means For Shareholders

Reviewed by Sasha Jovanovic

- Starlab Space LLC recently announced that Leidos will lead U.S.-based assembly, integration, and testing activities for the Starlab commercial space station, overseeing critical work such as system integration, environmental and performance testing, and mission assurance in Alabama.

- This partnership positions Leidos as a significant player in the emerging commercial space infrastructure sector, extending its reach beyond traditional government and defense projects.

- We'll explore how Leidos' new leadership role in assembling Starlab's space station could reshape expectations for its future business mix.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Leidos Holdings Investment Narrative Recap

For shareholders in Leidos Holdings, the core thesis often centers on consistent growth from long-term, high-value government contracts in defense, national security, and increasingly, commercial innovation. The recent Starlab partnership highlights Leidos’ expansion into commercial space infrastructure but is unlikely to materially alter the most critical short-term catalyst, securing large federal contracts, or offset the ongoing risk of heavy dependence on U.S. government budgets.

Of the latest announcements, the enhanced partnership with VAST Data Federal stands out as highly relevant since it further extends Leidos’ reach into next-generation AI-driven security and data operations, aligning closely with the company’s push toward higher-margin, technology-enabled contracts. While Starlab broadens Leidos’ business scope, bolstering AI and cyber capabilities could prove just as pivotal for near-term opportunities and competitive positioning.

By contrast, any shift in U.S. government funding priorities remains an ever-present risk that investors should watch for...

Read the full narrative on Leidos Holdings (it's free!)

Leidos Holdings' narrative projects $18.6 billion revenue and $1.5 billion earnings by 2028. This requires 3.0% yearly revenue growth and a $0.1 billion earnings increase from $1.4 billion.

Uncover how Leidos Holdings' forecasts yield a $201.83 fair value, a 4% upside to its current price.

Exploring Other Perspectives

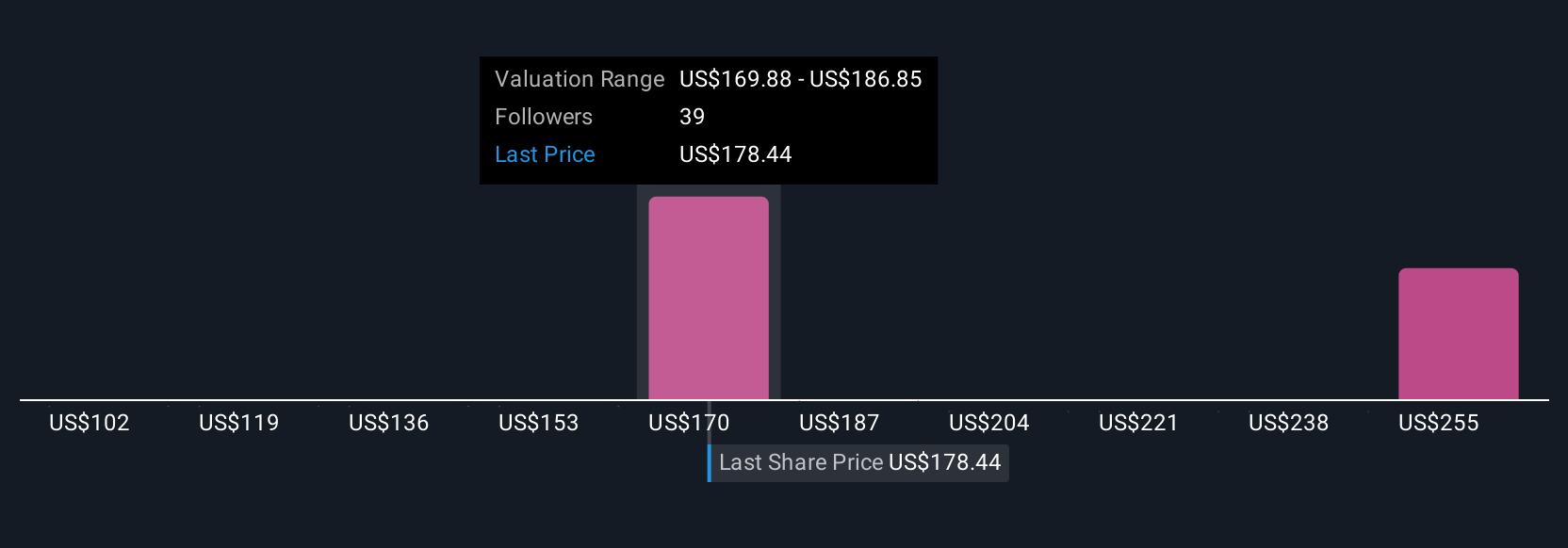

Six fair value estimates from the Simply Wall St Community span from US$152.74 to US$298.93 per share, reflecting significant differences in outlook. With opinions this varied and ongoing exposure to shifts in government spending, you may want to compare several perspectives before forming your own view.

Explore 6 other fair value estimates on Leidos Holdings - why the stock might be worth as much as 53% more than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leidos Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Leidos Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leidos Holdings' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives