- United States

- /

- Professional Services

- /

- NYSE:KBR

KBR’s Expansion in Washington and New Security Projects Might Change the Case for Investing in KBR (KBR)

Reviewed by Sasha Jovanovic

- In late October 2025, KBR announced the opening of a new office in Rosslyn, Virginia, to strengthen its engagement with federal agencies and support critical national security projects such as the Golden Dome missile defense system.

- This move, along with ongoing recruitment and the planned spin-off of the Mission Technology Solutions business, marks a deeper commitment to the nation's capital and signals an expansion of KBR's government-facing operations.

- We'll examine how KBR's expansion in the Washington, D.C. area and strong quarterly earnings may shift its investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

KBR Investment Narrative Recap

For shareholders, the KBR story hinges on the company's ability to deliver consistent earnings growth while winning major government and defense contracts, and adapting quickly to budget or program delays. The recent Rosslyn office opening amplifies KBR's exposure to high-value national security programs, but it does not immediately resolve the core risk: ongoing contract delays and the volatility that comes with reliance on large government spending cycles.

Among recent announcements, the downward revision to KBR’s 2025 revenue guidance stands out. Despite solid earnings and new business wins, this adjustment directly highlights that the expanding D.C. presence and new office do not yet offset the risk posed by uncertain award timing and shifting federal budgets.

Yet, against this strong earnings growth, investors should be aware that contract pipeline risks tied to budget delays may linger...

Read the full narrative on KBR (it's free!)

KBR's outlook anticipates $9.4 billion in revenue and $664.3 million in earnings by 2028. This implies a 5.4% annual revenue growth and an earnings increase of $264.3 million from the current $400.0 million.

Uncover how KBR's forecasts yield a $59.57 fair value, a 39% upside to its current price.

Exploring Other Perspectives

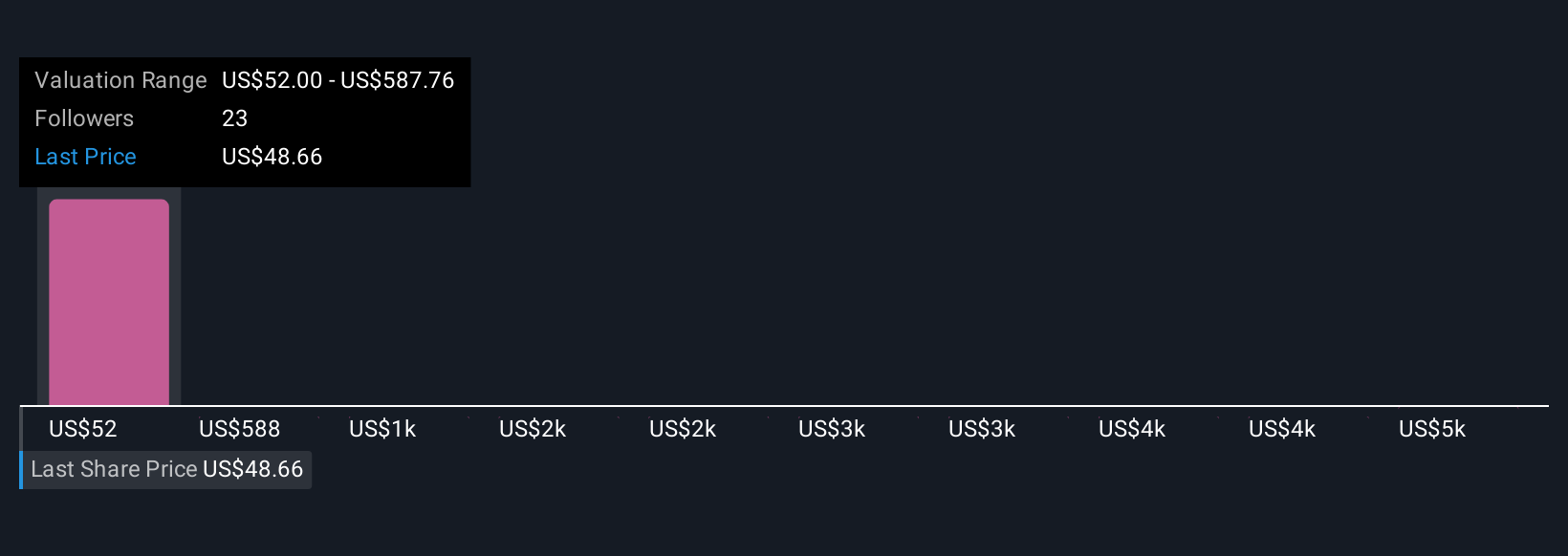

Simply Wall St Community members produced eight unique fair value estimates for KBR, ranging from US$40 to US$5,409.58 per share. While many see potential, contracting delays and government budget uncertainty could drive further debate around true value, so check multiple viewpoints before deciding.

Explore 8 other fair value estimates on KBR - why the stock might be a potential multi-bagger!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBR

KBR

Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives