- United States

- /

- Professional Services

- /

- NYSE:KBR

KBR (KBR) Earnings Surge 93% Reinforces Bull Case On Discounted Valuation

Reviewed by Simply Wall St

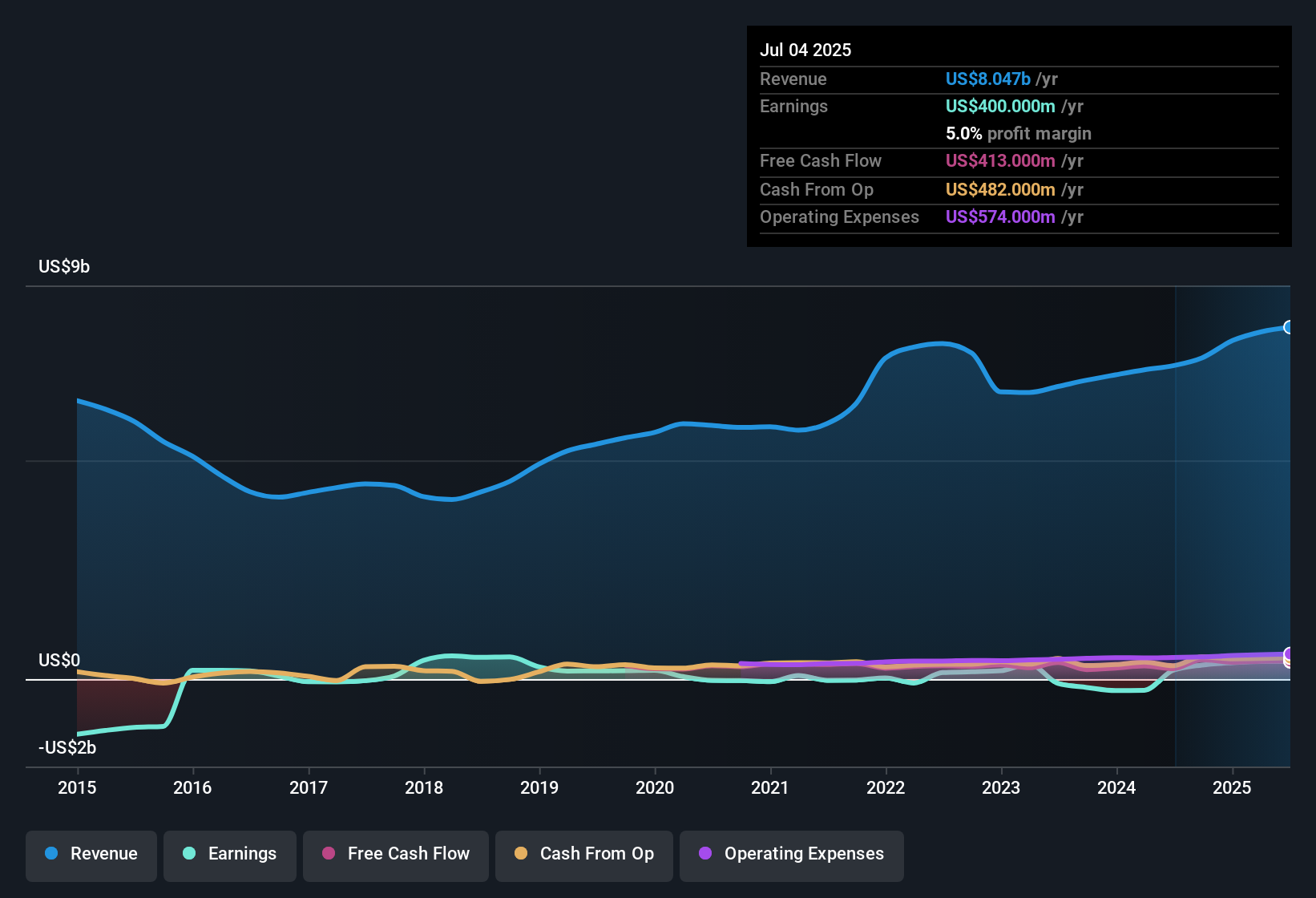

KBR (KBR) delivered standout earnings growth this year, with EPS surging 93.3% and net profit margins reaching 5%, up from 2.9% a year ago. The company's earnings are forecast to climb another 16.3% per year, though revenue growth is expected to trail the market at 6% annually. A forward Price-to-Earnings ratio of 13.4x and a share price of $41.51, far below the estimated fair value of $92, have some investors taking a closer look at the stock’s value story. Given the track record of profit growth and improving margins, the latest release has fueled positive sentiment, provided the company’s financial position remains on the radar.

See our full analysis for KBR.Next, we will compare these numbers with current investor narratives to see where KBR’s story confirms the hype and where it challenges it.

See what the community is saying about KBR

Margins Expand as Profit Quality Rises

- Net profit margins rose to 5% from 2.9% year-over-year and are projected to reach 7% within three years, with margins steadily catching up to best-in-class peers.

- Analysts' consensus view highlights that KBR’s strategic move into higher-margin, tech-oriented, and sustainable infrastructure contracts strengthens long-term earnings quality.

- Recent pipeline growth, especially in global defense and engineered solutions, supports the potential for above-industry margins if current delays in award decisions subside.

- Consensus sees lasting benefits from the company’s pivot toward digital, ESG-compliant projects and notes this could keep KBR ahead of less agile competitors as demand shifts to sophisticated solutions.

- With margins forecast to further improve, analysts expect KBR’s disciplined project selection and tech-driven approach to support more resilient earnings, even as project timing remains unpredictable. 📊 Read the full KBR Consensus Narrative.

Contract Delays and Government Reliance Heighten Unpredictability

- Recent award and project starts have fallen behind schedule, weighing on near-term revenue visibility, while KBR’s heavy exposure to government spending and contract volatility poses ongoing risk.

- Consensus narrative cautions that pivotal events, such as the abrupt end to the HomeSafe Alliance joint venture, underscore KBR’s dependence on complex government awards.

- Delayed contract awards due to U.S. budget fragmentation or global instability have the potential to disrupt revenue conversion and backlogs beyond 2025.

- Bears argue that regional turmoil in growth markets like the Middle East or U.S. defense funding uncertainties could sharply impact both top-line growth and margin execution if these pressures persist.

Discounted Valuation Stands Out Against Peers

- KBR’s current Price-to-Earnings ratio sits at 13.4x, which is far below the peer average of 41.2x and industry average of 25.3x. Its share price of $41.51 trades at a 54.9% discount to the DCF fair value of $92.00 and a 33.1% discount to the analyst consensus target of $60.29.

- Consensus narrative points out that investors may be underpricing KBR’s earnings momentum and margin improvement.

- With strong historical profit growth and robust project pipelines, consensus anticipates the current gap between price and fair value could narrow once the market re-rates KBR’s earnings durability or if near-term risks ease.

- KBR’s ability to deliver on margin expansion and reduced share count are seen as key catalysts for a potential upward re-rating versus the sector and peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for KBR on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot new patterns in the data? In just a few minutes, you can capture your unique insights and shape your own take on the story. Do it your way

A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

KBR’s reliance on unpredictable government contracts and project delays creates uncertainty for investors seeking dependable, stable performance.

If consistency matters to you, use our stable growth stocks screener (2112 results) to focus on companies with proven track records of reliable earnings and revenue growth, regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBR

KBR

Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives