- United States

- /

- Professional Services

- /

- NYSE:KBR

Is KBR a Bargain After a 27% Price Drop and Recent Contract Wins?

Reviewed by Bailey Pemberton

- Wondering whether KBR is trading at a bargain or if it is looking pricey right now? Let’s break down the numbers and see what’s going on beneath the surface.

- KBR’s stock has had a rough ride this year, dropping 26.7% year to date and down 36.9% over the past 12 months. Looking back five years, however, it is still up nearly 70%.

- These recent moves follow several high-profile contract wins and industry updates, which have added both excitement and uncertainty. Market sentiment has shifted as investors weigh the longer-term impacts of these strategic announcements.

- On a bright note, KBR earns a standout valuation score of 6 out of 6, meaning it appears undervalued across all our key metrics. Next, we’ll dig into how we arrive at that score, and at the end of the article, explore an alternative way to look at valuation.

Find out why KBR's -36.9% return over the last year is lagging behind its peers.

Approach 1: KBR Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows, then discounting those back to today's value using an appropriate rate. This approach focuses on what KBR might realistically earn in the future, rather than short-term market swings.

KBR's most recent reported Free Cash Flow is $437.7 million. Analyst forecasts estimate this will grow steadily, reaching around $600 million by 2027. Beyond analyst projections, Simply Wall St extrapolates these trends further. In ten years, KBR's cash flow is expected to climb to approximately $827.9 million.

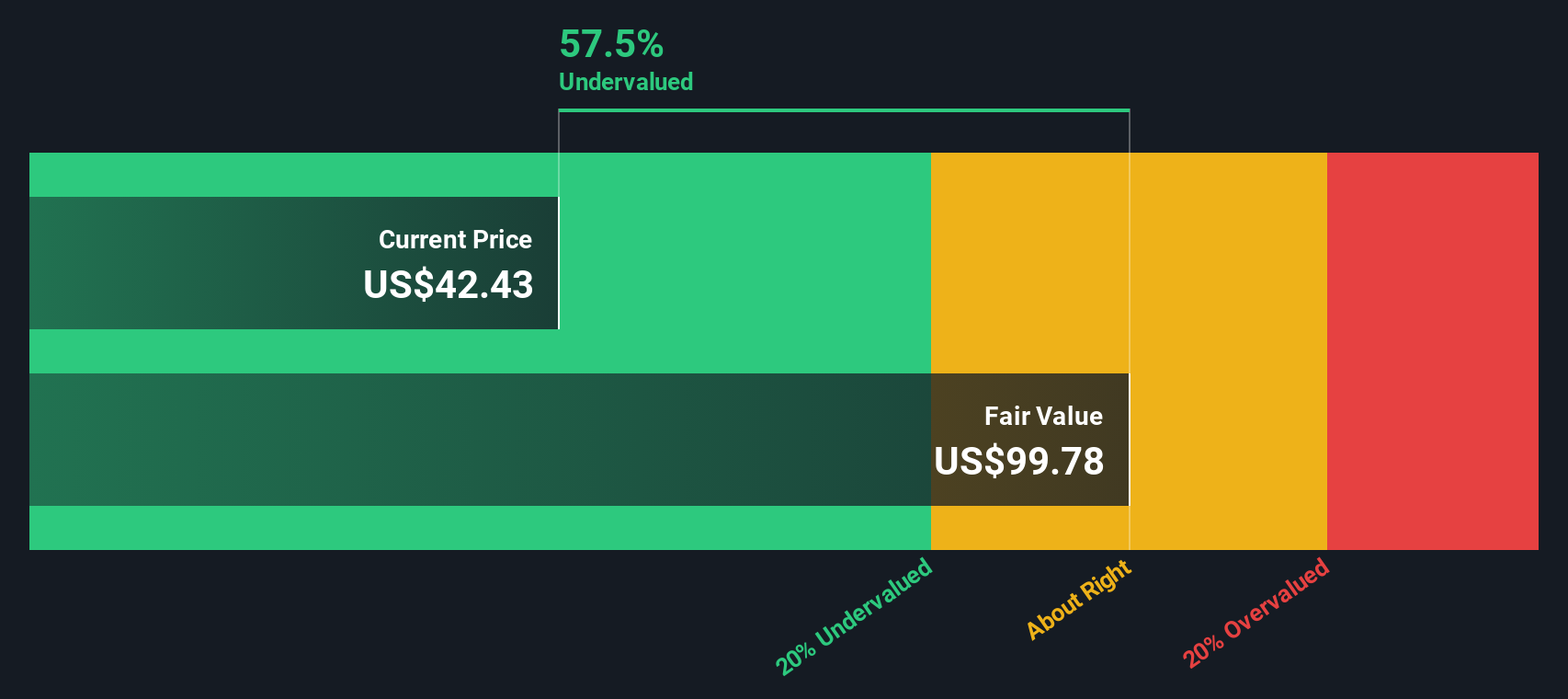

Using the 2 Stage Free Cash Flow to Equity model, the current intrinsic value for KBR shares is calculated at $100.47. This valuation suggests the stock is trading at a significant discount, specifically, it is 57.8% below its calculated fair value.

This model points to a compelling opportunity for investors. Based on the cash flow projections and discounting method, KBR looks substantially undervalued compared to where it trades today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests KBR is undervalued by 57.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: KBR Price vs Earnings

The price-to-earnings (PE) ratio is often the preferred valuation metric for profitable companies like KBR because it gives investors a direct look at what they are paying for each dollar of earnings. This metric works particularly well when a company delivers stable profits and those earnings are expected to continue or grow.

What constitutes a “normal” or “fair” PE ratio is not fixed. It is shaped by expectations for future growth, industry trends, and the degree of risk investors are willing to take. Fast-growing or less risky companies typically command a higher PE, while those with more uncertainty or slower growth tend to trade on the lower end.

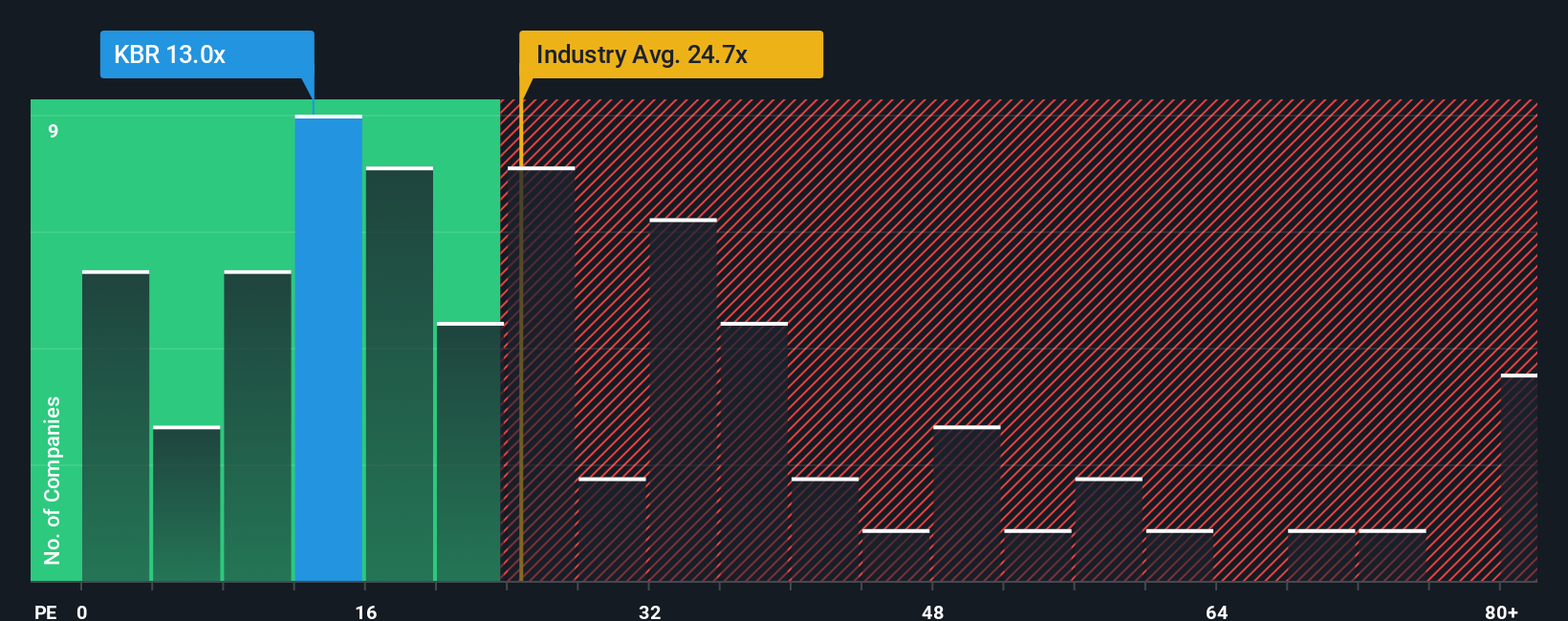

KBR’s current PE ratio stands at 12.9x. For perspective, the average PE across the Professional Services industry is 25.0x, while KBR’s direct peers average a much higher 41.7x. Even with these favorable comparisons, it is important to consider more nuanced company specifics.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio is a proprietary benchmark that estimates the “just right” multiple for a company by analyzing elements like historical and expected earnings growth, profitability, risk, industry, and company size. Unlike simple peer or industry comparisons, the Fair Ratio customizes the benchmark to KBR’s unique circumstances.

For KBR, the Fair Ratio is calculated at 25.1x, which is substantially above its current PE ratio of 12.9x. This difference implies the market is valuing KBR more conservatively than the factors would indicate, suggesting there could be an opportunity for re-rating as sentiment or performance improves.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your KBR Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives.

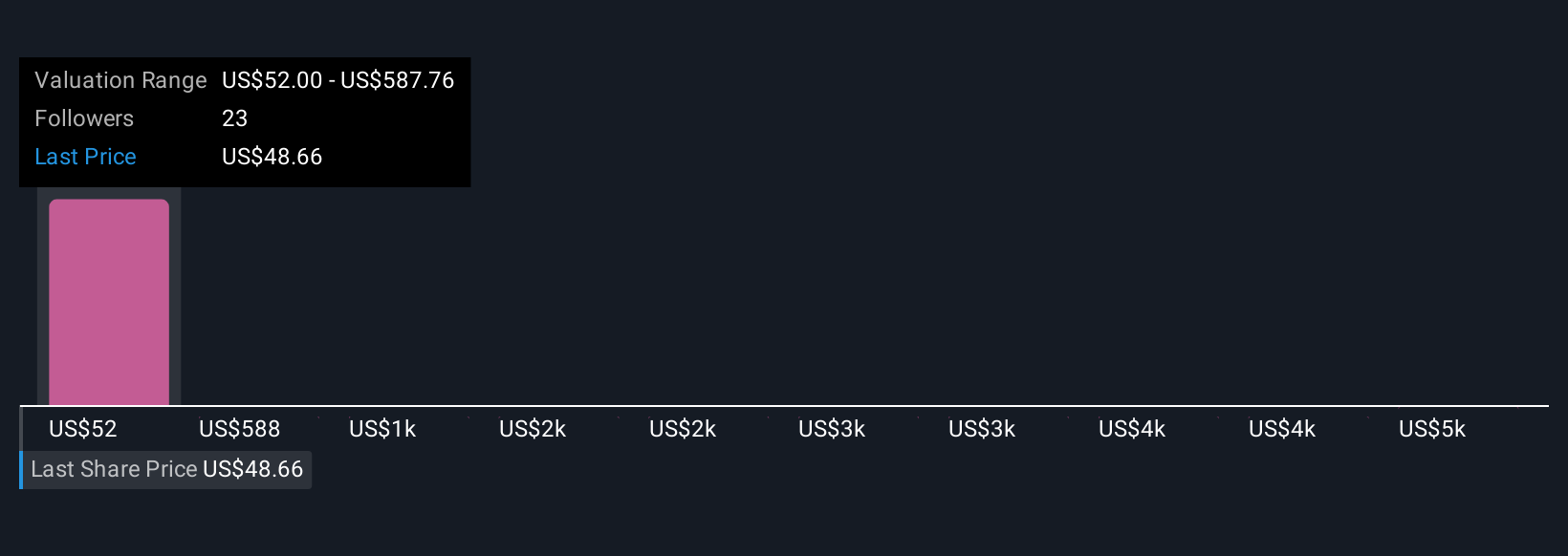

A Narrative is simply your own story about a company’s future, connecting what you believe will happen to its business with a clear set of financial forecasts, and ultimately, your estimate of fair value. It is about moving beyond the headline numbers by personalizing the assumptions behind future revenues, earnings, and margins, so the numbers make sense in the context of your outlook, not someone else’s.

Narratives tie a company’s story, such as KBR’s shift to tech-driven projects or its exposure to government contracts, directly to your expectations for its performance. On Simply Wall St’s Community page, investors of all experience levels use Narratives as an easy, interactive tool to create and update their own views, supported by millions of users referencing real business trends and data.

By comparing your Narrative’s Fair Value to KBR’s current price, you gain a data-backed signal for when shares might be a buy or a sell, especially since Narratives update quickly as new news, earnings, or industry info emerges.

For example, some investors see KBR poised for sustained growth due to defense and sustainable tech momentum, supporting a fair value above $67, while more cautious investors focus on government contract volatility and project delays, seeing a fair value closer to $53.

Do you think there's more to the story for KBR? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBR

KBR

Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives