- United States

- /

- Professional Services

- /

- NYSE:KBR

How Investors Are Reacting To KBR (KBR) Cutting 2025 Guidance on HomeSafe Joint Venture Removal

Reviewed by Sasha Jovanovic

- On November 18, 2025, KBR, Inc. revised its 2025 revenue guidance, lowering the low-end by about US$900 million due mainly to the removal of the HomeSafe joint venture's revenue contribution.

- This adjustment highlights the material impact that excluded joint venture revenues can have on the company's short-term financial outlook and operational planning.

- We'll explore how the reduced revenue outlook from HomeSafe may alter expectations for KBR's future earnings growth and valuation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

KBR Investment Narrative Recap

To be a KBR shareholder today, you need to believe in the company’s ongoing pivot toward higher-margin, technology-driven projects in energy transition and government services. The recent reduction in 2025 revenue guidance, mainly from removing HomeSafe JV contributions, directly impacts this year’s earnings visibility and spotlights the risks from contract delays or terminations, which remain the biggest near-term threat; the long-term catalyst of capturing new government and sustainable infrastructure funding is not materially changed by this update.

Among recent announcements, KBR’s partnership with Hazer Group to develop clean hydrogen and graphite facilities in the UK stands out, reinforcing the strategy to expand in lower-carbon, technology-heavy sectors. These projects align with KBR’s push for new growth avenues as it contends with short-term challenges in its core government contract base.

However, it’s important to note that, despite new opportunities abroad, the unpredictability of contract pipeline conversion is a key risk for investors to be aware of…

Read the full narrative on KBR (it's free!)

KBR's outlook anticipates $9.4 billion in revenue and $664.3 million in earnings by 2028. This is based on 5.4% annual revenue growth and an earnings increase of $264 million from current earnings of $400 million.

Uncover how KBR's forecasts yield a $57.14 fair value, a 40% upside to its current price.

Exploring Other Perspectives

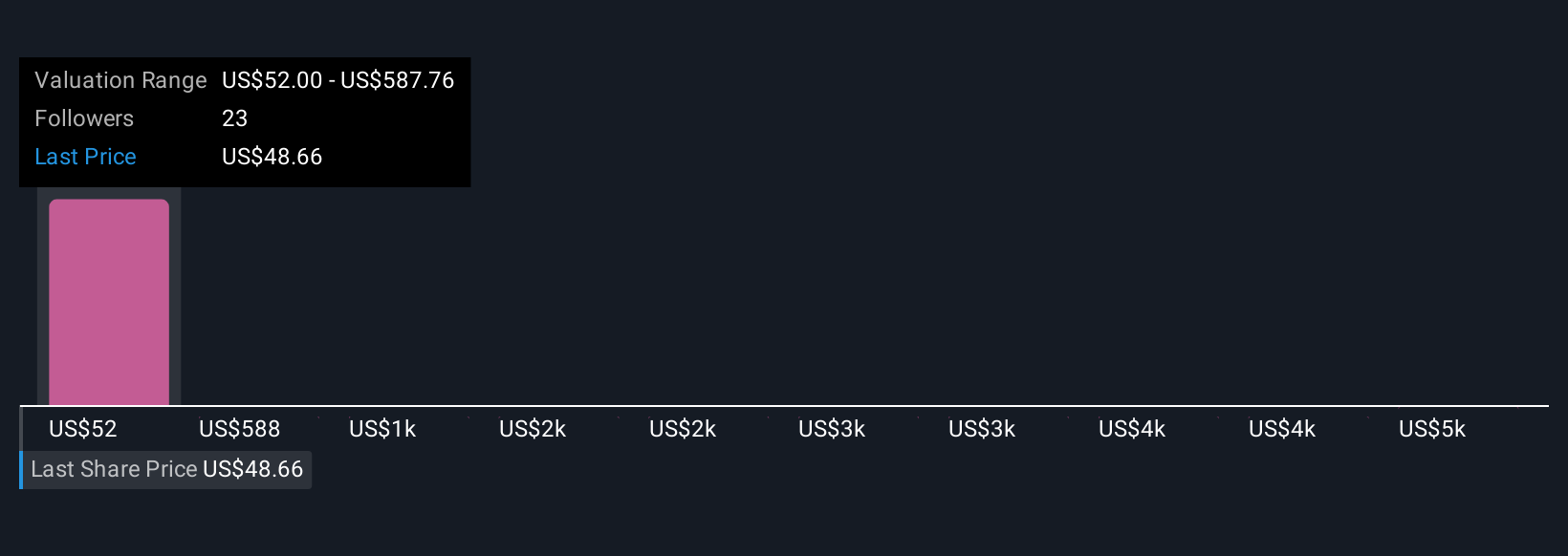

Simply Wall St Community fair value estimates for KBR range from US$40 to an outlier at US$5,409.58, spanning eight member perspectives. While some anticipate upside from government spending and new tech contracts, others caution that execution or award delays could weigh on performance; explore several approaches before making conclusions.

Explore 8 other fair value estimates on KBR - why the stock might be worth just $40.00!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBR

KBR

Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives