- United States

- /

- Professional Services

- /

- NYSE:KBR

Does KBR’s (KBR) Revenue Cut Shift the Long-Term Growth Narrative Amid Strategic Tech Moves?

Reviewed by Sasha Jovanovic

- In recent developments, KBR revised its 2025 revenue guidance downward by about US$900 million, primarily due to the exclusion of the HomeSafe JV revenue, while continuing progress on advanced product testing for NASA's Artemis III spacesuit and collaborating with Hazer Group and EnergyPathways on a nationally significant UK hydrogen and graphite project.

- This combination of a material financial guidance change alongside technology milestones and clean energy partnerships highlights the complexity of KBR's business outlook and the multiple levers influencing its future direction.

- We'll explore how KBR's lowered revenue guidance, tied to the HomeSafe JV, may impact its long-term growth outlook and analyst assumptions.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

KBR Investment Narrative Recap

To invest in KBR right now, you have to believe the company can successfully advance its technology-driven business, space, defense, and energy transition contracts, while maintaining steady financial execution despite many moving parts. The recent exclusion of HomeSafe JV revenue and downward adjustment of 2025 guidance is the most important near-term risk, as it resets expectations for short-term growth, while not materially diminishing the company’s key catalyst: conversion of its record contract pipeline as award decisions accelerate into 2026.

KBR’s recent milestone, the successful uncrewed thermal vacuum test of the Artemis III spacesuit with Axiom, shows continued progress in technology leadership and fulfills a critical step for upcoming NASA missions. With government contract wins and technology validation moving forward even after the guidance cut, investors watching short-term volatility will likely weigh both the near-term revenue reset and these high-profile wins as signals of future momentum. Contrast this financial reset, the new baseline may bring unexpected consequences that investors should be aware of, especially if...

Read the full narrative on KBR (it's free!)

KBR's outlook anticipates $9.4 billion in revenue and $664.3 million in earnings by 2028. This is based on a 5.4% annual revenue growth rate and a $264.3 million increase in earnings from the current $400.0 million.

Uncover how KBR's forecasts yield a $57.14 fair value, a 40% upside to its current price.

Exploring Other Perspectives

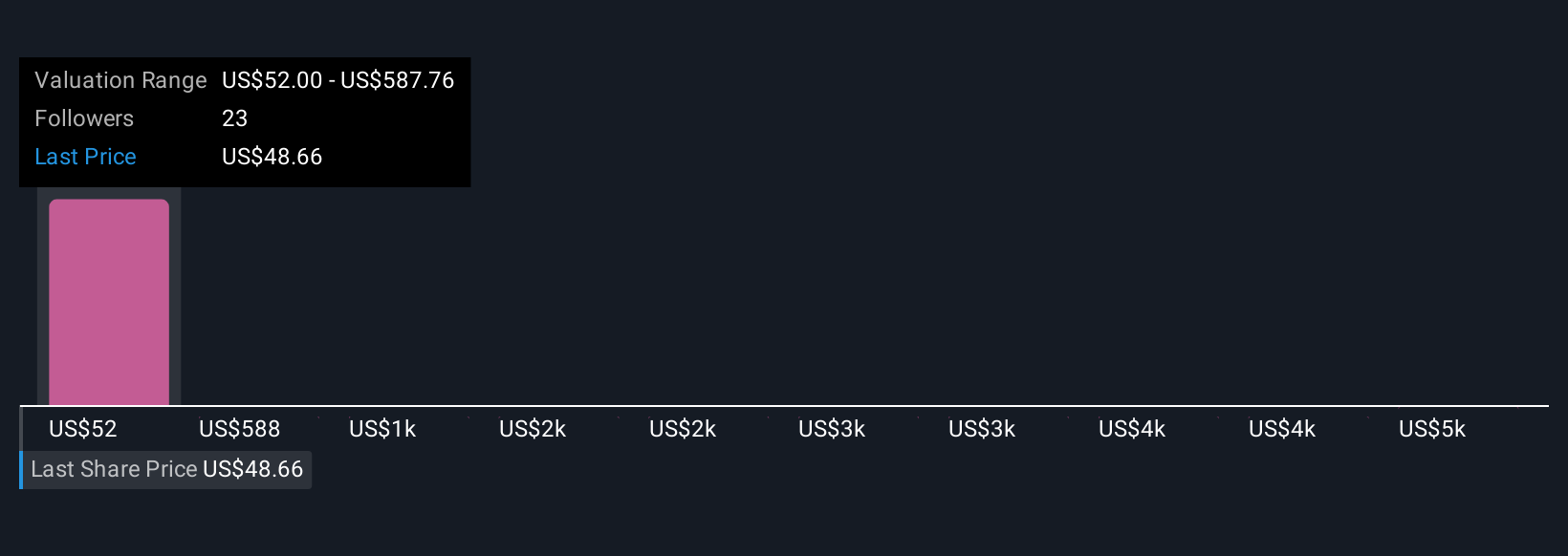

Eight fair value estimates from the Simply Wall St Community range from US$40 to an outlier at US$5,409.58, reflecting sharply varied market expectations. Amid this diversity, the removal of HomeSafe JV revenue now pulls the starting point for KBR’s long-term outlook several steps lower, inviting readers to compare differing assumptions about future recovery and contract conversion.

Explore 8 other fair value estimates on KBR - why the stock might be worth just $40.00!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

No Opportunity In KBR?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBR

KBR

Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success