- United States

- /

- Commercial Services

- /

- NYSE:KAR

A Fresh Look at OPENLANE (KAR) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

OPENLANE (KAR) shares have been quietly moving in recent weeks and have drawn interest from investors tracking trends in the auto services sector. The stock’s performance over the past month deserves a closer look, given evolving market dynamics.

See our latest analysis for OPENLANE.

OPENLANE’s share price momentum has cooled after a solid run earlier this year. A 1-month share price return of -6.8% has offset some of its year-to-date gains; however, the 12-month total shareholder return of 66% highlights enduring investor confidence and robust longer-term performance.

If shifting tides in auto services stocks have your attention, this is a great opportunity to discover what’s next among industry peers by exploring See the full list for free.

With impressive double-digit returns over the past year, yet recent pullbacks in the share price, the central question remains: does OPENLANE present an undervalued entry point, or has the market already factored in its future growth potential?

Most Popular Narrative: 15.7% Undervalued

OPENLANE's narrative consensus fair value sits at $31.36, a solid premium to its latest close of $26.42. The gap reflects confidence in future growth drivers and operational momentum at a pivotal stage for the business.

The accelerating shift from physical to digital platforms in the wholesale vehicle auction industry, evidenced by OPENLANE's double-digit growth in dealer-to-dealer digital volumes and sustained market share gains, points to continued secular tailwinds for revenue growth as digital adoption remains in its early stages within a large total addressable market. Ongoing investment in AI-driven products, process automation, and user experience enhancements (for example, Absolute Sale and advanced inspection technology) is driving higher transaction values and operational efficiencies, which are already resulting in significant margin expansion and are likely to further improve net margins over time.

Want to know the story behind this ambitious price target? Find out which forward-looking projections, growth rates, profit margins, and key assumptions make this valuation possible. Ready to challenge your expectations? Take a closer look at what’s fueling the optimism in OPENLANE’s narrative.

Result: Fair Value of $31.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from rivals with rapid digital expansion and potential regulatory hurdles may impact OPENLANE’s margins and could reshape its future growth outlook.

Find out about the key risks to this OPENLANE narrative.

Another View: Are the Valuation Ratios Too High?

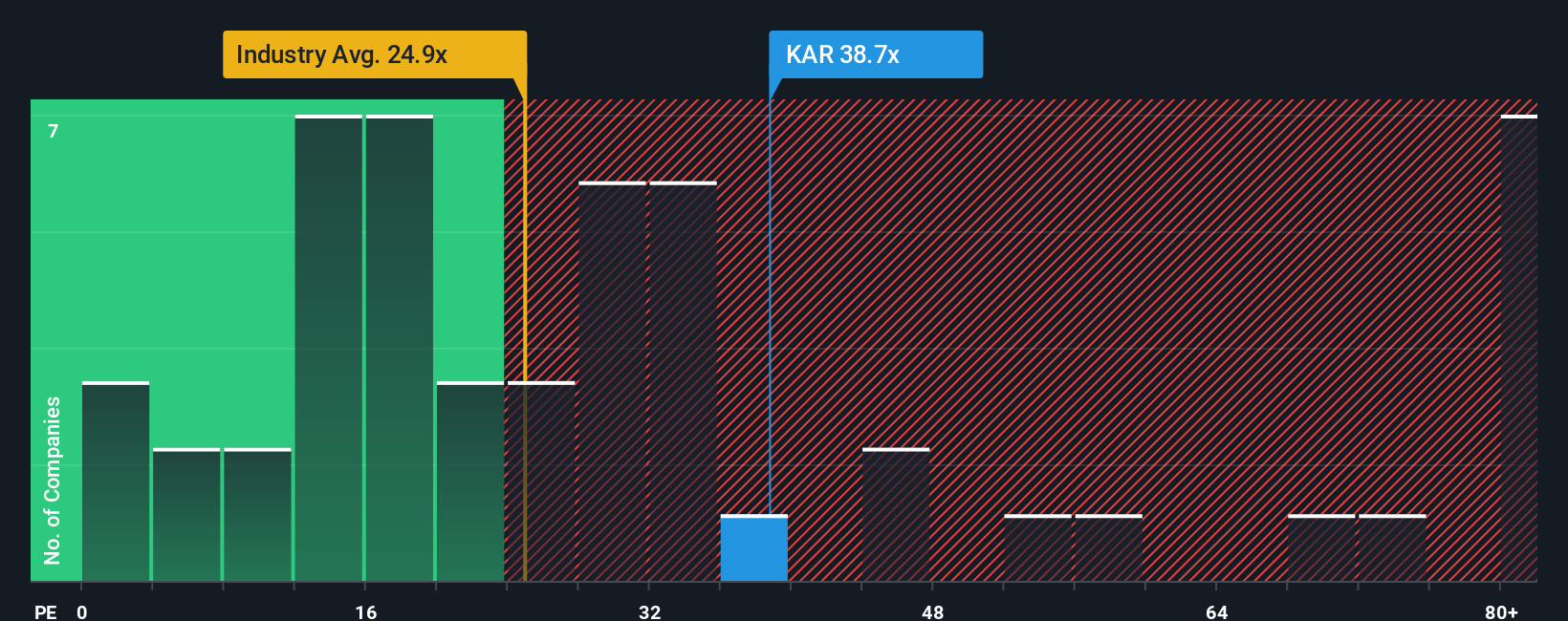

Looking through the lens of price-to-earnings, OPENLANE trades at 35.1x earnings. That is not only above the peer average of 31.9x and the industry benchmark of 22.3x, but also above what our fair ratio suggests is more reasonable at 30.4x. These higher ratios could signal optimism, but also point to potential valuation risk. Will the market reward this premium, or does a pullback loom?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OPENLANE Narrative

If you’re seeking a fresh perspective or want to dive into the numbers for yourself, you can easily build your own case for OPENLANE in just a few minutes. Do it your way

A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Get ahead of the market by handpicking stocks built for growth, value, and tomorrow’s biggest trends. Don’t let the next winner pass you by.

- Capitalize on cutting-edge breakthroughs by spotting tomorrow’s leaders with these 27 AI penny stocks before the crowd catches on.

- Lock in resilient yields with steady earners and see which companies deliver consistent returns through these 22 dividend stocks with yields > 3%.

- Tap into overlooked gems trading below their intrinsic value and uncover opportunities for significant upside via these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAR

OPENLANE

Operates as a digital marketplace for used vehicles, which connects sellers and buyers in the United States, Canada, Continental Europe and the United Kingdom.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives