Jacobs Solutions (J): Evaluating Valuation Following Strong Earnings, Record Backlog, and Bullish Analyst Upgrades

Reviewed by Simply Wall St

Jacobs Solutions (NYSE:J) shares climbed this week after the company reported stronger-than-expected fiscal fourth-quarter and full-year results. Record backlog and expanding margins drew attention from investors. Market optimism also picked up after management issued adjusted EPS and revenue guidance for fiscal 2026 that is projected to top analyst expectations.

See our latest analysis for Jacobs Solutions.

After a rough patch of selling pressure in recent weeks, momentum for Jacobs Solutions seems to be turning. Even with a 16.3% share price drop over the past month, upbeat earnings and a steady stream of new project wins have helped spark renewed optimism. This puts the spotlight on the company’s long-term record, with a 54% total shareholder return over five years attesting to its growth despite short-term volatility.

If you want to see what other companies are attracting attention in fast-evolving sectors, now is a great moment to discover fast growing stocks with high insider ownership

With shares rebounding amid strong results and upbeat guidance, the key question emerges: Is Jacobs Solutions still undervalued, or has the market already priced in the company’s next phase of growth?

Most Popular Narrative: 16% Undervalued

Jacobs Solutions' most followed narrative values shares at $159.69, well above the recent closing price of $133.54. This signals a notable gap between current market sentiment and projected fair value, setting the scene for a closer look at the catalysts driving analyst confidence.

Record-high backlog growth (up 14% year-over-year) in Water, Advanced Facilities, and Critical Infrastructure, driven by global infrastructure modernization, water scarcity, and data center expansion, provides strong visibility into multi-year revenue growth and supports confidence in accelerating top-line results into FY '26 and beyond.

Want to know what’s powering this bullish target? The story hinges on a bold upgrade in profit margins and ambitious future earnings assumptions. Curious about the exact numbers that make analysts confident the share price has room to run? Unlock the details behind the headline projections in the full narrative.

Result: Fair Value of $159.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including shifts in government spending priorities and costly project delays. These factors could challenge profitability and valuation upside.

Find out about the key risks to this Jacobs Solutions narrative.

Another View: What Do Valuation Ratios Say?

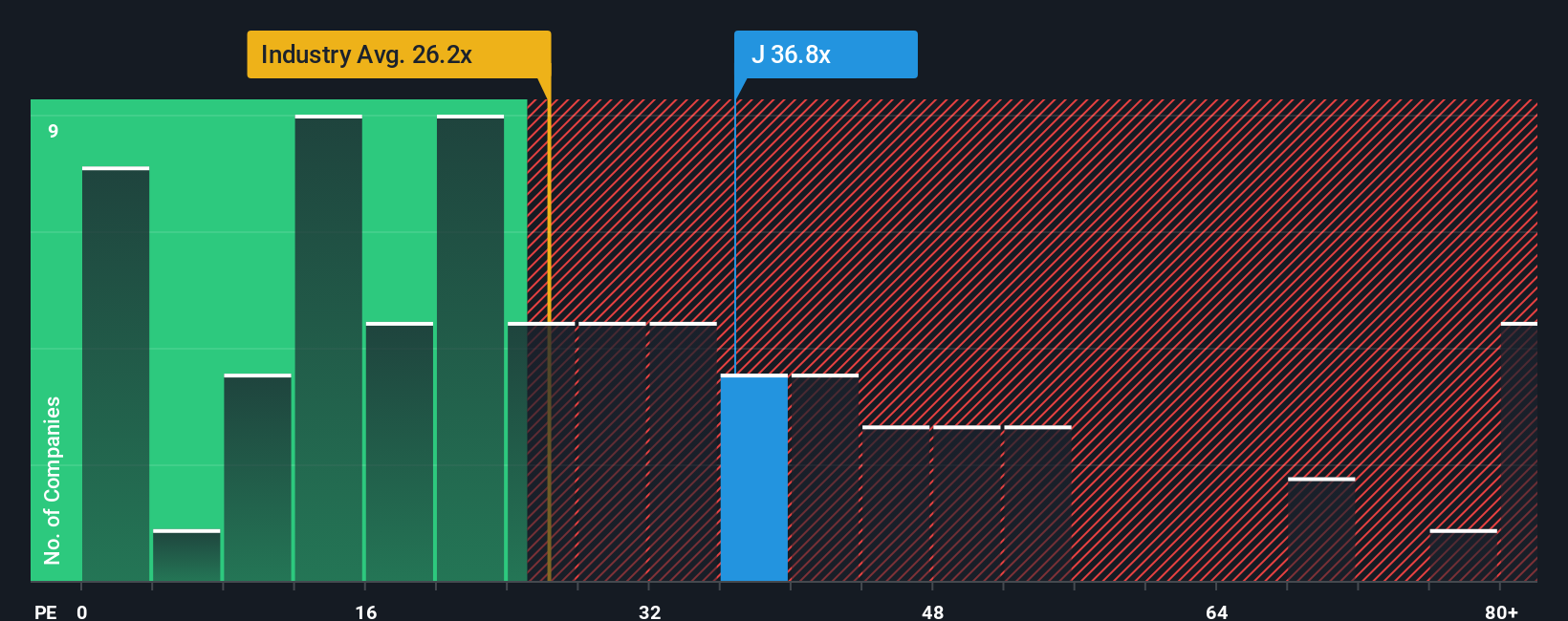

While one approach sees Jacobs Solutions as undervalued, valuation ratios suggest a different picture. The company trades at a price-to-earnings ratio of 50.5x, which is much higher than both the industry average of 23.8x and its peers’ 33.9x. This sizable gap could mean higher valuation risk if growth expectations do not materialize as hoped. Would the market adjust the premium, or does Jacobs have something unique that justifies it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jacobs Solutions Narrative

If you have your own perspective or want to dive deeper into the numbers, shaping your own narrative is quick and easy. Do it your way

A great starting point for your Jacobs Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself an edge in today's fast-changing market by tapping into curated lists of stocks you may have missed. Make your next move count and don't let smarter opportunities pass by.

- Start building wealth through consistent income. Uncover companies offering solid yields with these 14 dividend stocks with yields > 3% before the market catches on.

- Ride the momentum of rapid technological progress and tap into the potential of the sector’s most promising disruptors by checking out these 26 AI penny stocks.

- Take control of your search for real bargains. Spot tomorrow’s winners using these 933 undervalued stocks based on cash flows while value is on your side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success