- United States

- /

- Commercial Services

- /

- NYSE:HNI

Will HNI’s (HNI) Land Donation Shape Its Stakeholder Engagement and Community Impact Strategy?

Reviewed by Sasha Jovanovic

- HNI Corporation recently donated nearly 30 acres of land off University Drive to the city of Muscatine to support residential development aimed at meeting local housing needs.

- This initiative not only addresses a documented housing shortage but also reflects HNI's focus on community partnership and sustainable growth.

- We'll explore how HNI's commitment to community development could influence its investment narrative and stakeholder engagement outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

HNI Investment Narrative Recap

To be a shareholder in HNI, you need to believe in the company's ability to grow in both workplace furnishings and residential building products, even as the broader demand for traditional office furniture remains uncertain. The recent land donation to Muscatine signals a commitment to long-term community value but does not materially affect the primary short-term catalyst, which is operational efficiency and synergy realization, or the ongoing risk from evolving workplace trends.

Of the recent company updates, the Q2 earnings report is most relevant, showing profit and revenue growth. This performance underscores HNI’s ability to generate earnings despite challenging housing market dynamics, linking back to the demand-driven risks and operational catalysts investors are watching most closely. Contrast with ongoing questions about the sustainability of HNI’s core market size as remote work continues to reshape demand...

Read the full narrative on HNI (it's free!)

HNI's narrative projects $2.9 billion revenue and $234.7 million earnings by 2028. This requires 4.2% yearly revenue growth and an $86.7 million earnings increase from $148.0 million today.

Uncover how HNI's forecasts yield a $66.75 fair value, a 48% upside to its current price.

Exploring Other Perspectives

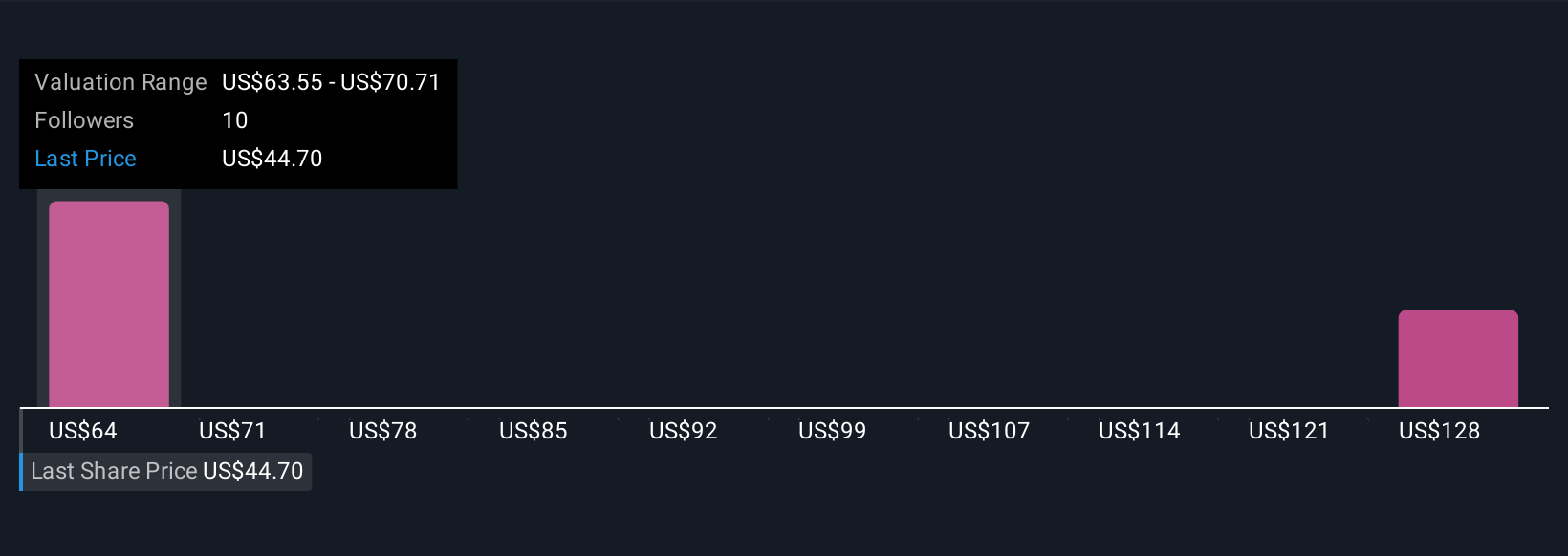

Three distinct fair value estimates from the Simply Wall St Community span from US$63.55 to US$176.68 per share, reflecting wide-ranging views on HNI’s potential. While many focus on the risk posed by long-term changes in office furniture demand, it’s clear opinions differ sharply on how these shifts could affect future performance.

Explore 3 other fair value estimates on HNI - why the stock might be worth just $63.55!

Build Your Own HNI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HNI research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free HNI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HNI's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HNI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNI

HNI

Engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives