Will Genpact’s (G) Fresh Debt and Shelf Filing Redefine Its Financial Flexibility?

Reviewed by Sasha Jovanovic

- Genpact Limited recently completed a US$348.58 million fixed-income offering of 4.950% Senior Subordinated Unsecured Notes due November 18, 2030, and filed an omnibus shelf registration covering multiple securities, including debt, common and preference shares, depositary shares, warrants, and units.

- These moves suggest Genpact is actively improving its liquidity position and preparing for potential future capital raising or refinancing initiatives across its international operations.

- Now, we'll explore how this boost to financial flexibility through completed debt issuance may impact Genpact's investment narrative and future outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Genpact Investment Narrative Recap

Genpact shareholders generally focus on the company’s ability to shift from legacy business process outsourcing to higher-growth, AI-powered solutions, as well as its resilience during shifts in client demand. The recent US$348.58 million issuance of senior subordinated unsecured notes and fresh registration for new securities enhance Genpact’s liquidity but do not materially shift the main short-term catalyst, the pace of client adoption in advanced technology, nor mitigate the biggest risk, which remains competitive and execution pressures in an evolving services industry.

Among recent announcements, Genpact’s Q3 2025 earnings stood out, showing year-over-year gains in both sales and profit. These results reinforce the importance of new capital flexibility, especially as the company looks to accelerate growth in its Advanced Technology Solutions and maintain momentum in high-value, AI-driven contracts.

On the other hand, investors should be keenly aware that increased liquidity alone does not address...

Read the full narrative on Genpact (it's free!)

Genpact's outlook anticipates $5.9 billion in revenue and $669.6 million in earnings by 2028. This is based on a 6.2% annual revenue growth rate and a $131.3 million increase in earnings from $538.3 million currently.

Uncover how Genpact's forecasts yield a $50.30 fair value, a 13% upside to its current price.

Exploring Other Perspectives

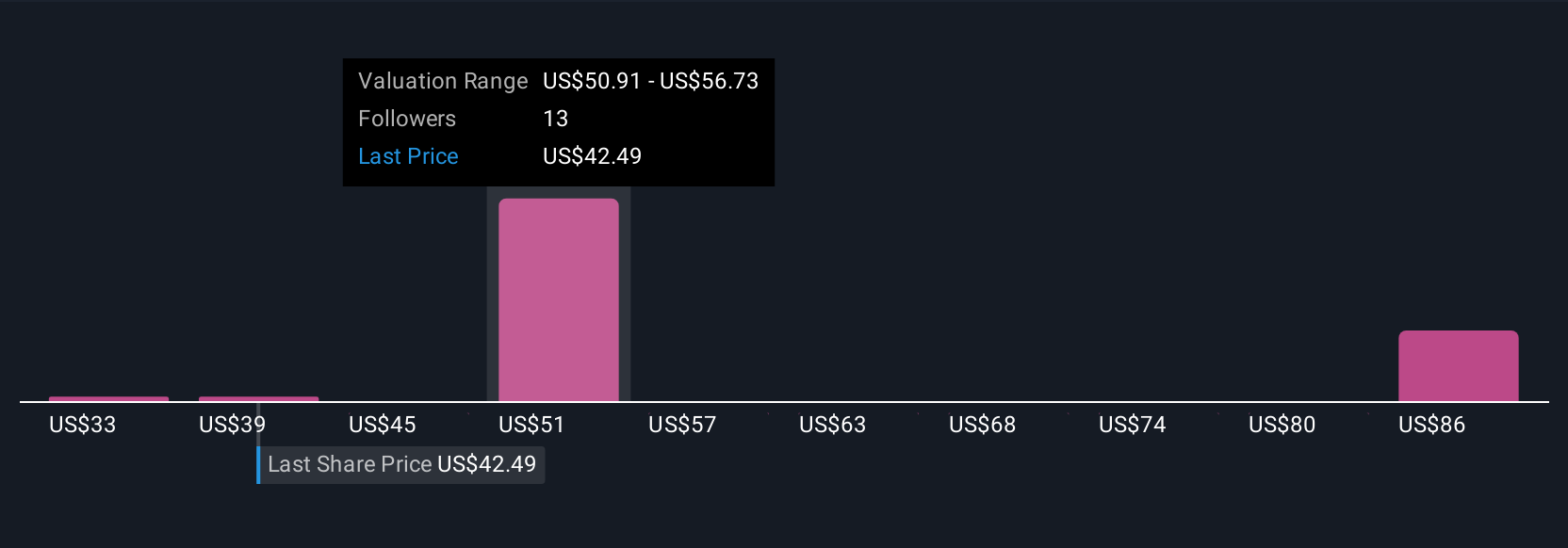

Fair value estimates from the Simply Wall St Community span US$33.84 to US$77.56, with three individual opinions captured. While community perspectives range widely, the company’s dependence on new AI-powered solutions for growth continues to be a major driver for performance and future opportunity.

Explore 3 other fair value estimates on Genpact - why the stock might be worth as much as 75% more than the current price!

Build Your Own Genpact Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genpact research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Genpact research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genpact's overall financial health at a glance.

No Opportunity In Genpact?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:G

Genpact

Provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives