- United States

- /

- Professional Services

- /

- NYSE:FCN

Assessing FTI Consulting (FCN) Valuation: Is There Hidden Upside After Recent Momentum Shift?

Reviewed by Simply Wall St

FTI Consulting (FCN) shares have been shaping up with interesting moves lately. Over the past month, the stock has gained about 1%, while longer-term returns have been more varied for investors.

See our latest analysis for FTI Consulting.

FTI Consulting’s momentum has faded somewhat since the start of the year, with a year-to-date share price return of -13.92% and a one-year total shareholder return of -19.88%. While the longer-term five-year total return remains positive, recent trading suggests investors are reassessing the company’s growth versus risk profile as market sentiment has cooled.

If you’re interested in seeing what else stands out in today’s market, it could be a good time to broaden your view and explore fast growing stocks with high insider ownership

The key question now is whether FTI Consulting’s weaker momentum has created an undervalued entry point for investors, or if the market has already priced in the company’s future potential for growth and risk.

Most Popular Narrative: 1.6% Undervalued

With FTI Consulting closing at $163.41, the most widely followed narrative values the company just above market price. This sets up intriguing questions about what’s driving the premium and how the forecasted numbers stack up to current momentum.

Continued strategic investment in proprietary digital tools, analytics, and talent, especially experienced academics and senior professionals, positions FTI to capture higher-value, tech-enabled mandates and command premium billing rates. These factors could drive both higher top-line and improved net margins over time.

Want to uncover why experts think this price tag sticks? There’s a key financial lever in play. One future ingredient lifts margins to rarified heights. Can you figure out what financial dynamic underpins this calculation? Tap in to discover the hidden growth engine and what insiders are betting on.

Result: Fair Value of $166 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent integration challenges or rapid automation could limit FTI’s growth and margin improvement, which may undermine the current bullish outlook.

Find out about the key risks to this FTI Consulting narrative.

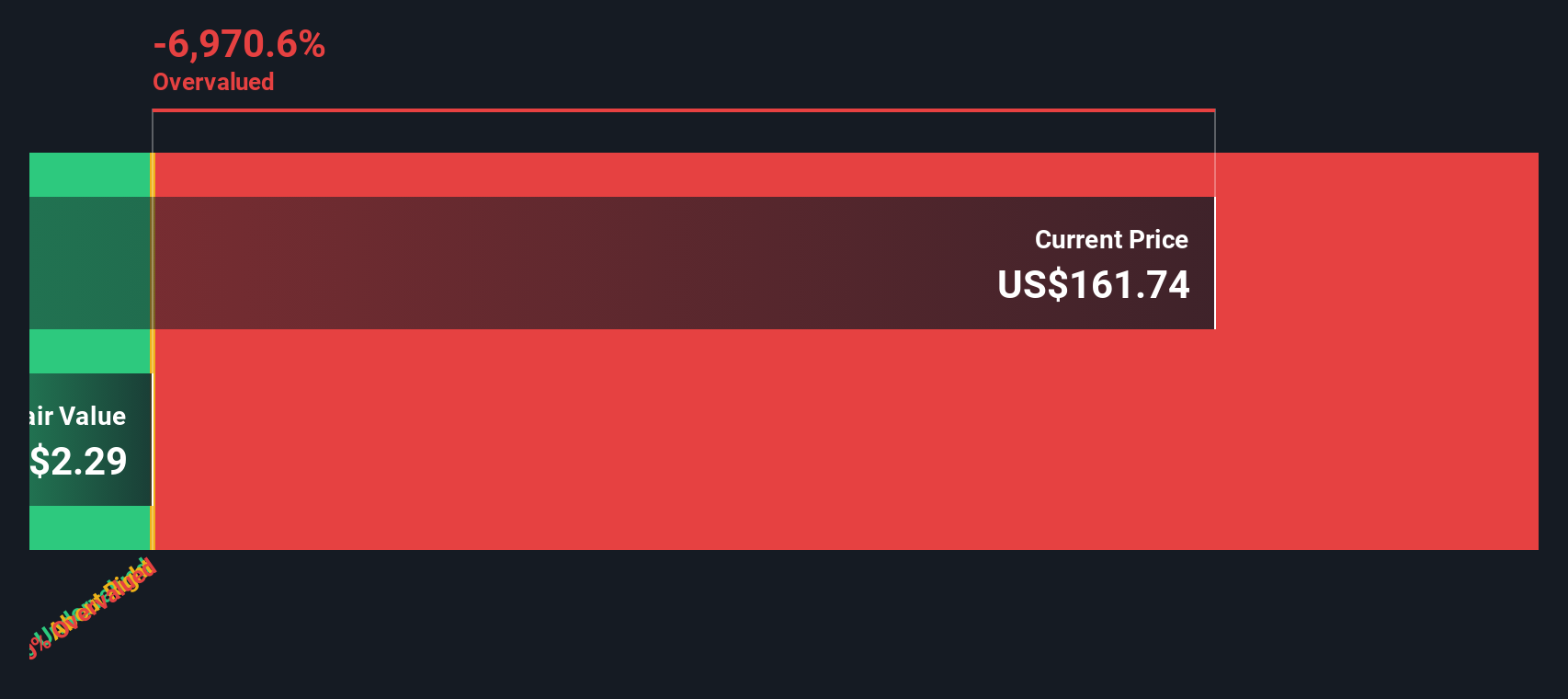

Another View: SWS DCF Model Challenges the Current Narrative

While the consensus sees FTI Consulting as modestly undervalued based on analyst forecasts, our SWS DCF model offers a more cautious perspective. According to our cash flow projections, the fair value is significantly lower than the current share price. This suggests the market may be overestimating future returns. Could the more optimistic outlook be overlooking some underlying risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTI Consulting for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTI Consulting Narrative

If you want to dig deeper and put your own spin on the numbers, you can shape your perspective with our data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for more investment ideas?

Give yourself an edge and avoid missing the biggest stories happening now. A world of promising stocks is just a step away with our expert screeners.

- Unlock new income potential by targeting above-average yield opportunities when you browse these 16 dividend stocks with yields > 3%.

- Get ahead of the curve and chase the next AI breakout by tapping into these 25 AI penny stocks with strong market momentum and innovation potential.

- Seize opportunities on undervalued stocks identified by rigorous cash flow analysis by starting your search with these 884 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives