- United States

- /

- Professional Services

- /

- NYSE:DAY

Assessing Dayforce (DAY) Valuation as Shares Remain Steady and Revenue Growth Nears Double Digits

Reviewed by Simply Wall St

See our latest analysis for Dayforce.

Dayforce has seen its share price move in a tight range lately, reflecting a broader trend for the stock over the past year. While recent events have not sparked dramatic swings, the 1-year total shareholder return sits at -7.74%. Modest positive momentum this quarter suggests that some investors may be starting to revisit its longer-term growth potential.

If you’re curious where other fast movers might be hiding, it may be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares hovering just below analyst targets and annual revenue growth nearing double digits, investors are left to wonder if Dayforce presents a buying opportunity or if the market has already priced in its future prospects.

Most Popular Narrative: 1.7% Undervalued

The narrative suggests Dayforce’s fair value estimate is just above its recent close, pointing to a market that may be missing some upside. With the discount rate at 7.19%, investors are challenged to look closer at what supports this nearly even call versus the price target.

Advances in AI integration and analytics (including 30+ AI agents in development) are differentiating Dayforce as an indispensable workforce platform for organizations seeking smarter decision support, employee engagement, and productivity gains. This not only drives additional revenue streams but also supports future operating leverage and net margin expansion.

What is fueling this razor-thin undervaluation? The key to the narrative’s math is explosive profit expectations, sticky customer wins, and a leap in recurring contract value. Want to know what market-defying projections are built into that target? Dive in to see the forecasted leap that justifies this sharp call.

Result: Fair Value of $70.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition from industry giants and execution challenges around large-scale deployments could quickly erode Dayforce’s edge if conditions change.

Find out about the key risks to this Dayforce narrative.

Another View: What About Multiples?

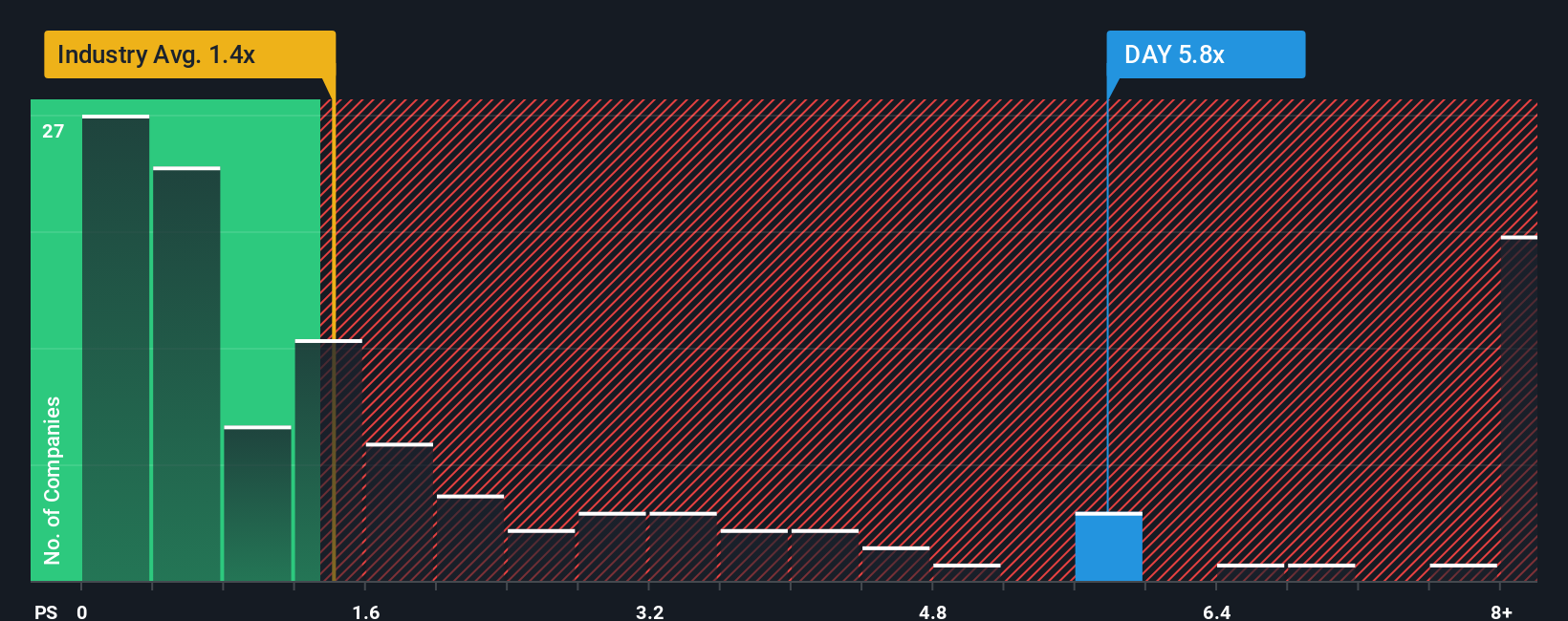

Looking beyond fair value estimates, Dayforce's price-to-sales ratio is 5.8x. This is above both the U.S. Professional Services industry average of 1.3x and its own fair ratio of 3.1x. This suggests the market might be assigning a premium or overlooking some valuation risks. Is this confidence justified, or is there room for a correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dayforce Narrative

Prefer to dive into the data and shape your own conclusions? You can dig in and build a fresh narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Dayforce.

Looking for more investment ideas?

Don't settle for a narrow view when smarter, faster market moves are waiting to be found. Take your investing to another level by targeting proven opportunities you might be missing right now.

- Unlock the next big trend in tech by tapping into these 27 AI penny stocks with transformative AI potential before they make headlines.

- Grow your passive income stream with steady cash flows by acting on these 18 dividend stocks with yields > 3% yielding above 3%.

- Capture outstanding value by snapping up these 905 undervalued stocks based on cash flows that are primed to deliver strong returns based on their real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAY

Dayforce

Operates as a human capital management (HCM) software company in the United States, Canada, Australia, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives