- United States

- /

- Commercial Services

- /

- NYSE:CLH

Clean Harbors (CLH): How New Analyst Ratings and Strong Results Shape the Company's Current Valuation

Reviewed by Simply Wall St

Clean Harbors (CLH) has caught the attention of investors following new coverage and ratings updates from several major investment firms, as well as the company’s latest report showing that both revenue and net profit climbed last quarter.

See our latest analysis for Clean Harbors.

Following a wave of ratings updates and robust quarterly results, Clean Harbors’ momentum has been mixed. After a sharp short-term drop, the latest 1-day share price return of 3.74% hints that investor confidence could be stabilizing. While the stock’s year-to-date share price return sits at -8.81% and the total shareholder return over the past year is -15.2%, those who have held shares for the long haul still enjoy an impressive 177% five-year total return, underscoring the company’s durable long-term growth story.

If positive financial updates have you rethinking your watchlist, now’s a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading more than 20% below consensus analyst price targets and an even steeper discount to some intrinsic value estimates, investors may wonder if Clean Harbors is an undervalued play for patient investors or if the market is already including future growth in the current price.

Most Popular Narrative: 18.1% Undervalued

With Clean Harbors’ most widely followed narrative assigning a fair value of $255.60 against a last close of $209.28, there is a notable gap suggesting the stock may not reflect its full earnings power. The fair value is based on analysts projecting robust multi-year growth, efficiency gains, and margin expansion. These are elements the market could be underestimating.

The growing urgency and evolving regulatory landscape around PFAS and hazardous waste management is expected to create a multibillion-dollar opportunity. Clean Harbors' unique position as the only company with end-to-end PFAS destruction capabilities positions it to capture significant long-term revenue and margin growth as new government and corporate standards take effect.

Want to know why the market is missing the mark? The narrative’s foundation lies in sizable future sales, rising profitability, and a bold profit multiple rarely seen in the sector. Curious what combination of forecasts and margin leaders underpin this high valuation? Dive deeper to unlock the full financial playbook powering this bullish view.

Result: Fair Value of $255.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a faster shift to alternative waste solutions or tougher industrial regulations could dampen Clean Harbors’ long-term growth and put pressure on future profitability.

Find out about the key risks to this Clean Harbors narrative.

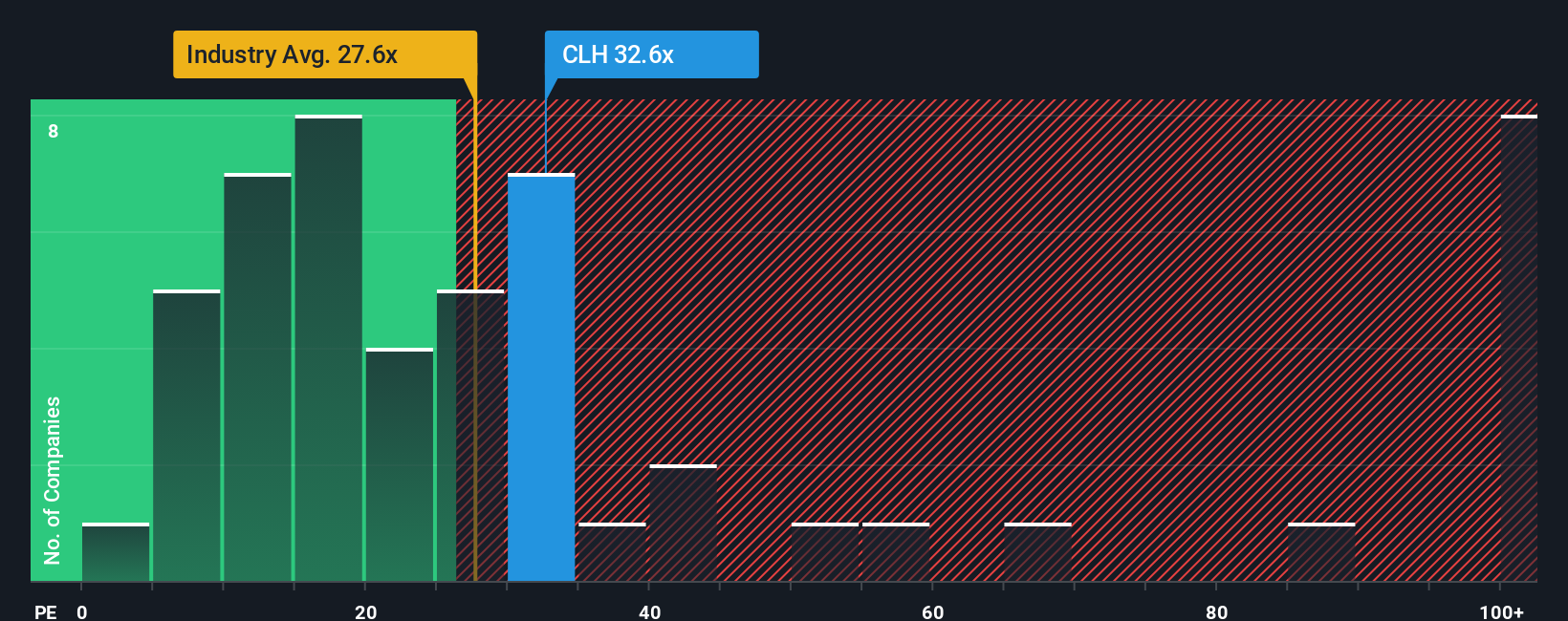

Another View: Multiples Tell a Different Story

Looking at Clean Harbors using the price-to-earnings ratio, the stock currently trades at 28.8x earnings. This is much higher than the industry average of 21.8x and above its fair ratio of 24.8x. In comparison, peers are even more expensive at 48.8x. Such a premium suggests investors may be exposed to valuation risk if market expectations shift. Does this premium signal unique opportunity or extra risk that needs caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clean Harbors Narrative

If these perspectives don't quite fit your take, or you prefer charting your own course with Clean Harbors' numbers, you can shape your own narrative in just minutes. Do it your way

A great starting point for your Clean Harbors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Fresh Investment Opportunities?

Smart investors never limit their horizons. Don’t miss out on other standout opportunities. Simply Wall St’s Screener puts more unique, future-focused stocks within your reach right now.

- Kickstart your search for companies shaking up the AI space by checking out these 27 AI penny stocks powering tomorrow’s breakthroughs in automation and intelligent systems.

- Capture the potential for consistent income by reviewing these 18 dividend stocks with yields > 3% featuring market leaders with strong, reliable yields above 3%.

- Spot early movers in the rapidly evolving digital assets landscape and see these 81 cryptocurrency and blockchain stocks positioned to shape the blockchain and crypto ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives