- United States

- /

- Professional Services

- /

- NYSE:CACI

CACI International (CACI): Assessing Valuation After Recent Double-Digit Share Price Gains

Reviewed by Simply Wall St

CACI International (CACI) has been on the radar recently, drawing attention from investors curious about its trajectory. Over the past month, shares have gained around 15%, prompting a closer look at what might be driving this momentum.

See our latest analysis for CACI International.

Zooming out beyond the month’s gains, CACI International has maintained a strong wave of momentum throughout 2024, with a stellar 43% year-to-date share price return and a robust 103.8% total shareholder return over three years. That kind of sustained growth hints at increasing confidence in the company’s outlook, whether that is thanks to recent contract wins, ongoing support for federal clients, or positive sentiment around its long-term strategy.

If sharp moves like these have you thinking beyond your current watchlist, now’s an ideal moment to discover fast growing stocks with high insider ownership.

But with shares now trading close to analyst price targets and a remarkable run already behind it, the central question remains: is CACI International still undervalued, or has the market already accounted for its future growth?

Most Popular Narrative: 8.9% Undervalued

The most widely followed narrative suggests CACI International's fair value sits well above its latest closing price of $589.25, pointing to upside potential against current market expectations. This sets the stage for a closer look at what is driving the positive long-term outlook.

Accelerated adoption of advanced technologies, such as software-defined platforms, cyber solutions, and enterprise software modernization, is driving a shift in federal procurement toward higher-value, tech-enabled contracts. In this environment, CACI's existing leadership, strong track record, and investments in anticipation of customer needs support higher win rates, contract stickiness, and margin expansion.

Curious about what’s fueling this bullish fair value? The numbers behind this narrative hinge on a powerful combination of future revenue acceleration, a boost in profit margins, and a premium on long-term earnings. There is more just beneath the surface. See for yourself what drives this target valuation.

Result: Fair Value of $646.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent government budget uncertainties and intensifying industry competition could challenge CACI International’s projected growth and put pressure on future earnings.

Find out about the key risks to this CACI International narrative.

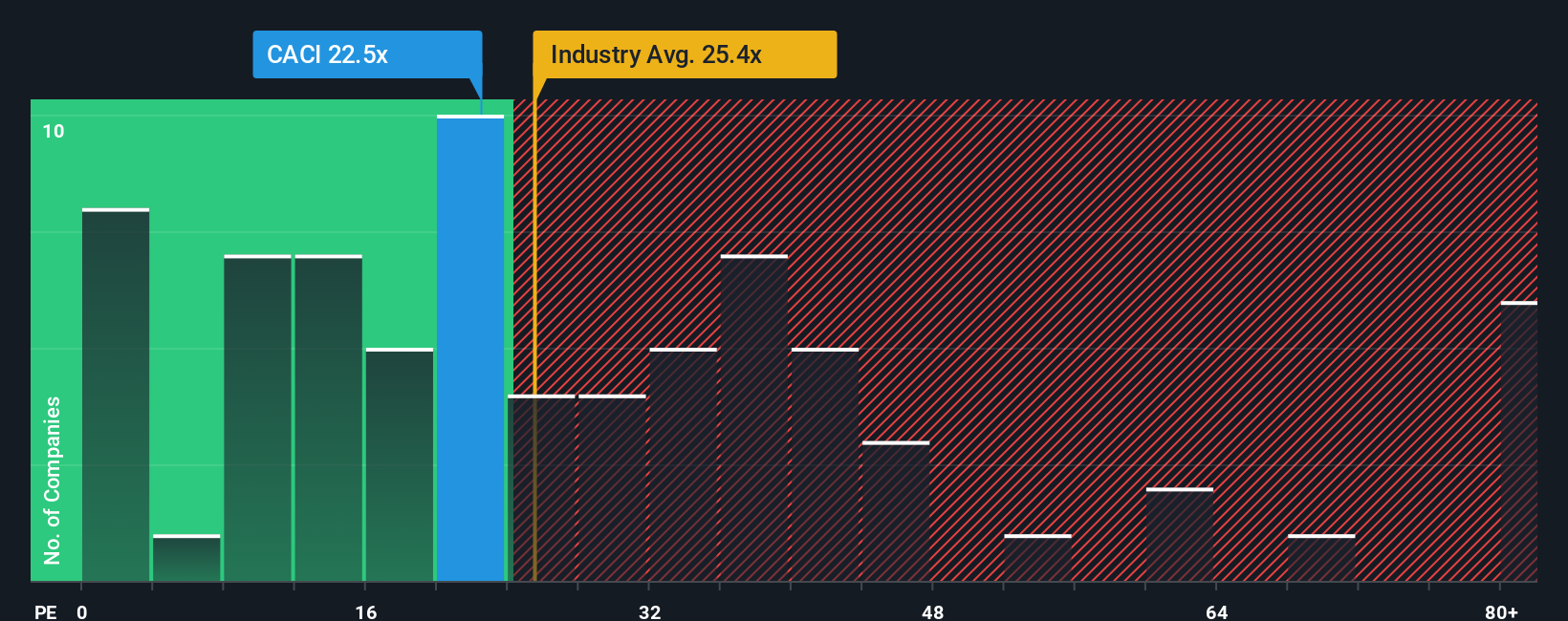

Another View: Market Multiples Tell a Different Story

Looking at market valuation multiples, CACI trades at 25.8 times earnings, which is slightly above the industry average of 24.5 times and closely matches the fair ratio of 25.5. This suggests that, based on this angle, the stock’s value may already be largely priced in. But is this market pricing too cautious or just right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CACI International Narrative

If you see things differently or want to investigate CACI International from your own perspective, dive into the data and shape your own view in just a few minutes. Do it your way.

A great starting point for your CACI International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Smart Investment?

Expand your horizons beyond CACI International and seize the opportunity to spot tomorrow’s winners early. Don’t let these unique investment angles slip past you.

- Jump on game-changing technology by checking out these 24 AI penny stocks, which are shaping major shifts in artificial intelligence.

- Secure steady income potential when you browse these 16 dividend stocks with yields > 3%, featuring attractive yields above 3%.

- Capitalize on growth stories trading below value by reviewing these 875 undervalued stocks based on cash flows, powered by strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CACI

CACI International

Through its subsidiaries, provides expertise and technology solutions in the United States, the United Kingdom, rest of Europe, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives