- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (BR): Assessing Valuation Following Strong Q1 Growth and New Tech Partnerships

Reviewed by Simply Wall St

Broadridge Financial Solutions (BR) delivered strong first quarter results, with revenue and earnings both climbing year over year. In addition to its financial momentum, the company announced a new partnership aimed at automating global tax operations.

See our latest analysis for Broadridge Financial Solutions.

Broadridge’s latest financial win comes on the heels of some big strategic moves, including expanding its tax automation capabilities and showcasing its tokenization tech in a major digital bond issuance. While short-term share price performance has wobbled, discipline and innovation have helped shareholders see a solid three-year total return of nearly 62%, signaling that long-term momentum remains in play.

If these kinds of tech-driven breakthroughs interest you, it’s worth exploring other companies building the future. Check out the full list via See the full list for free..

With Broadridge posting strong results and launching new tech partnerships, investors are left to consider whether further upside remains or if the stock’s promising future is already reflected in its current valuation.

Most Popular Narrative: 17% Undervalued

Broadridge’s most widely followed valuation narrative puts its fair value at $276.13 per share, compared to a recent closing price of $228.39. The wide gap hints at a market that may be undervaluing Broadridge’s long-term growth initiatives and digital transformation story.

*The continued shift toward digitization of financial services, evidenced by Broadridge's growing double-digit digital revenue and rapid increases in digitization rates for regulatory communications (now over 90% for equity proxies), positions the company to benefit from rising demand for digital investor communications and lower-cost delivery. This supports long-term recurring revenue growth and future margin expansion.*

Want to uncover the math behind this optimism? The narrative is built on bold profit growth projections and margin expansion, along with some surprising revenue assumptions. What is driving their fair value? Get the inside story in the full narrative.

Result: Fair Value of $276.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued declines in event-driven revenues or longer sales cycles could slow Broadridge’s momentum and challenge the positive growth outlook.

Find out about the key risks to this Broadridge Financial Solutions narrative.

Another View: By the Numbers

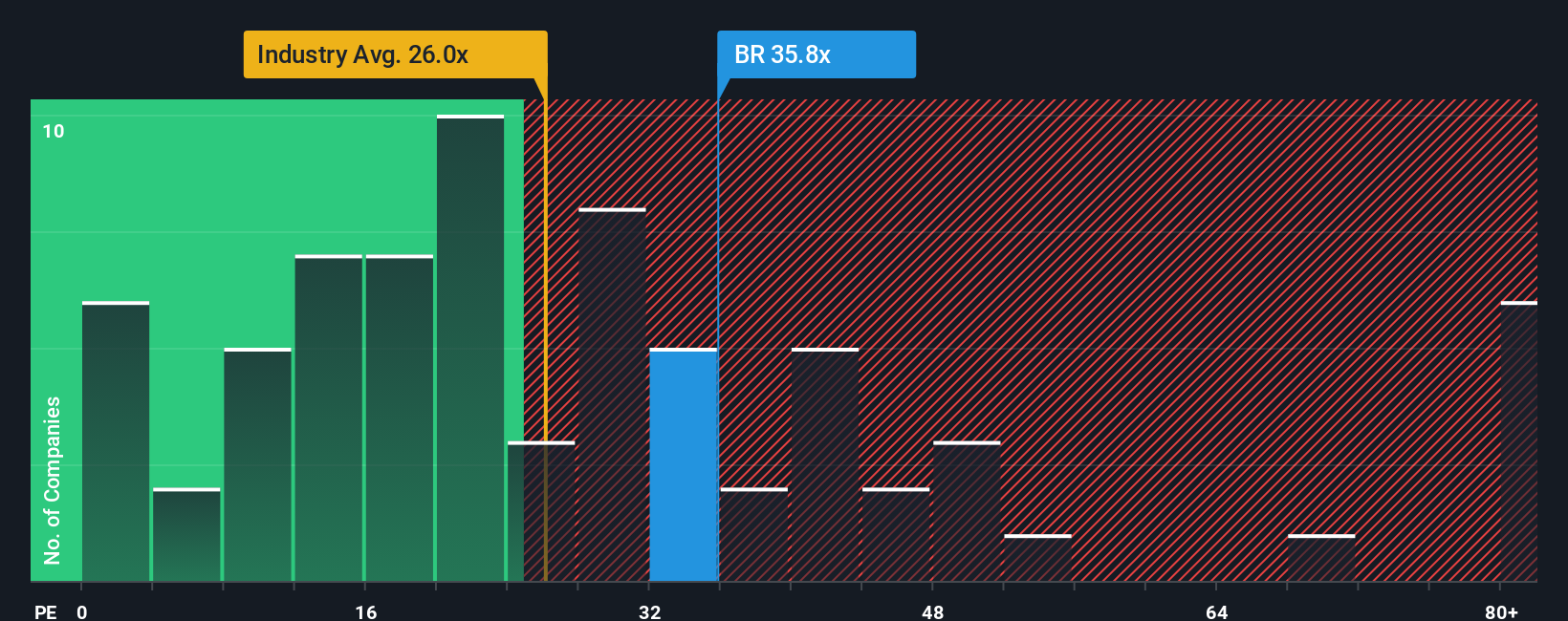

Looking at Broadridge through the lens of the price-to-earnings ratio tells a different story. At 28.8x earnings, the stock is significantly more expensive than both its industry peers (24x) and the fair ratio of 26.4x. This higher valuation might signal investor confidence, or it might suggest less margin for error if growth falters. Will the market keep rewarding this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadridge Financial Solutions Narrative

Whether you want to dig deeper or trust your own analysis, you can easily build your personal investment narrative in just a few minutes. Do it your way.

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your portfolio and spot the next big opportunity before it hits the headlines. If you’re aiming for smarter investing, don’t miss these handpicked shortcuts to stocks with serious potential:

- Boost your income with reliable yield and check out these 16 dividend stocks with yields > 3% that consistently deliver attractive dividends above 3%.

- Ride the wave of innovation in healthcare and see which companies are transforming patient care with advanced technology by tapping into these 30 healthcare AI stocks.

- Get ahead of the curve and secure growth potential with these 928 undervalued stocks based on cash flows, spotlighting stocks currently priced below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives