- United States

- /

- Commercial Services

- /

- NYSE:BCO

Should Brink's Q3 Brink's Business System Progress Require Action From Brink's (BCO) Investors?

- Brink's recently reported a mixed Q3, with revenue guidance coming in slightly ahead of analysts' expectations and earnings per share broadly matching estimates.

- The company highlighted accelerated growth in its AMS and DRS segments, as customer conversions and new portfolio additions supported its Brink's Business System transformation, which is improving margins and cash generation.

- We will now examine how Brink's focus on the Brink's Business System transformation shapes the company’s broader investment narrative for investors.

Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Brink's Investment Narrative?

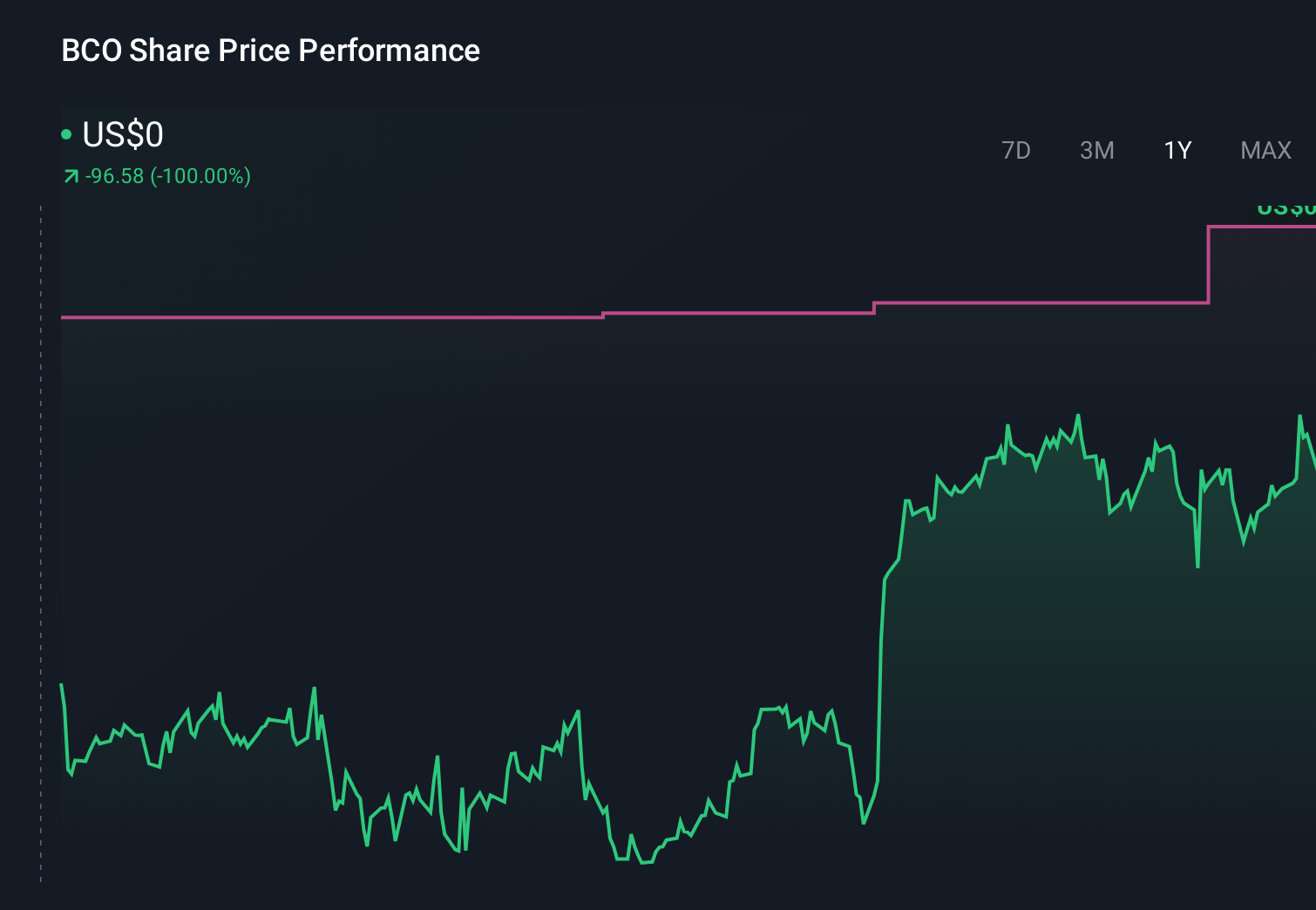

To own Brink’s, you have to believe its Brink’s Business System can keep turning a traditional cash‑handling operation into a higher‑margin, more cash‑generative services platform. The latest mixed Q3 update broadly supports that thesis: revenue guidance came in slightly ahead of expectations, AMS and DRS growth looked healthy, and management again leaned on the transformation story. Given the share price has already moved sharply over the past year, this news probably tweaks, rather than rewrites, the near term catalysts, which still center on execution in AMS/DRS, converting more customers and sustaining margin improvement. The bigger risks remain intact: a rich earnings multiple versus peers, heavy reliance on debt, and the need to keep servicing costs under control if growth slows or cash generation disappoints.

However, investors should be aware of how Brink’s debt load could limit future flexibility. Brink's shares have been on the rise but are still potentially undervalued by 44%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on Brink's - why the stock might be worth less than half the current price!

Build Your Own Brink's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brink's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brink's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

- The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Find 53 companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brink's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCO

Brink's

Provides cash and valuables management, digital retail solutions, and automated teller machines (ATM) managed services in North America, Latin America, Europe, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.