- United States

- /

- Professional Services

- /

- NYSE:AMTM

How Investors Are Reacting To Amentum Holdings (AMTM) Securing Sellafield Nuclear Decommissioning Contract

Reviewed by Sasha Jovanovic

- In October 2025, Sellafield Ltd. announced that Amentum secured positions on the multi-billion-pound Decommissioning and Nuclear Waste Partnership framework for remediation and waste retrieval at the Sellafield nuclear site in England.

- This 15-year contract will see Amentum deploy advanced digital and robotic technologies to help safely remediate one of the UK's highest-profile nuclear sites, with potential work valued up to £1.4 billion (US$1.9 billion).

- We'll explore how winning this large, multi-year Sellafield contract highlights Amentum's expansion in advanced nuclear decommissioning solutions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Amentum Holdings' Investment Narrative?

For anyone considering Amentum Holdings, the big picture is evolving fast. The recent Sellafield win adds clear momentum to Amentum’s advanced nuclear decommissioning profile, addressing a core risk: lumpy revenue cycles tied to large contract awards. Securing a potential £1.4 billion (US$1.9 billion), multi-year contract bolsters short-term visibility and could help smooth earnings, a key catalyst given Amentum’s historic reliance on periodic, high-value government and defense deals. Before this major contract, the business was seen as expensive on earnings metrics and carried risks around a new, still-settling management team, high board turnover, and sensitivity to project-based cash flows. While Amentum’s pipeline just became more resilient, the recent pullback in share price suggests investors are still weighing execution risks on these new, complex projects and whether such wins will finally translate to consistent profit growth. Yet, that new contract brings fresh operational demands and potential margin pressure that investors should not overlook.

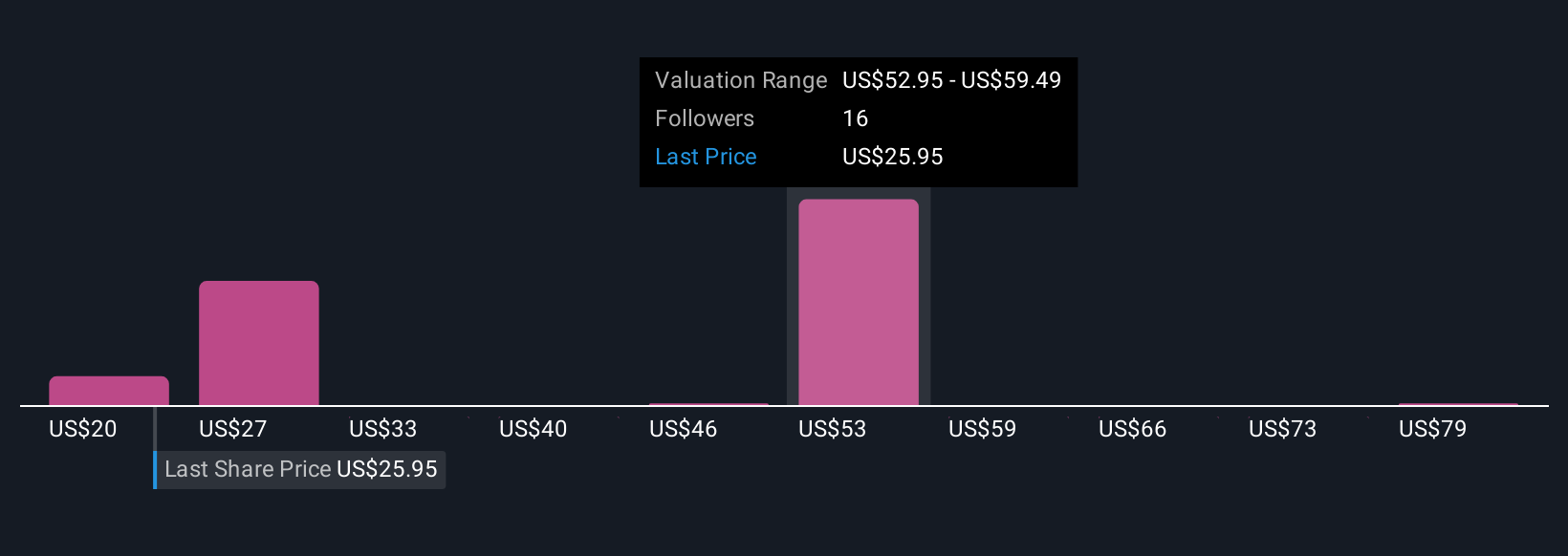

Despite retreating, Amentum Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 7 other fair value estimates on Amentum Holdings - why the stock might be worth 10% less than the current price!

Build Your Own Amentum Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amentum Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amentum Holdings' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Provides engineering and technology solutions to the U.S.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives