- United States

- /

- Professional Services

- /

- NYSE:AMTM

Assessing Amentum Holdings’s (AMTM) Valuation After Securing Major Air Force MQ-9 Reaper Support Contract

Reviewed by Simply Wall St

Amentum Holdings (AMTM) just secured a major contract from the Air Force Air Combat Command worth up to $995 million for MQ-9 Reaper maintenance support. This deal enhances the company's profile within the defense technology sector.

See our latest analysis for Amentum Holdings.

The MQ-9 Reaper contract comes as Amentum Holdings enjoys renewed investor enthusiasm, with a 1-day share price return of 17.12%. This caps off an impressive year-to-date gain of 17.82%. Momentum seems to be building, and recent appearances at major security conferences underscore the company's expanding footprint in the defense industry. For long-term shareholders, the 1-year total shareholder return now sits at 13.88%, reflecting both tactical wins and enduring demand for defense services.

If the surge in Amentum’s share price has you looking for more in this space, now is an ideal time to explore further with our curated See the full list for free..

Given the surge in Amentum’s shares and fresh contract wins, the key question is whether the current price leaves room for upside or if the market has already factored in future growth prospects. Is there still a buying opportunity?

Price-to-Earnings of 119.4x: Is it justified?

Amentum Holdings trades at a price-to-earnings (P/E) ratio of 119.4, which is well above both the US Professional Services industry average of 23.3 and the peer average of 23.5. At the last close of $25.52, investors are paying a premium for every dollar of reported earnings.

The P/E ratio is a standard measure comparing a company’s current share price to its per-share earnings. For firms that have just reached profitability or operate in growing markets, a high P/E may signal that the market expects strong future earnings growth or exceptional company prospects.

This multiple is extremely high. The market may be pricing in aggressive profit growth or unique strengths that set Amentum apart from its peers. Compared to the estimated fair P/E ratio of 41.1, the current multiple is almost triple what fair value models suggest. If sentiment changes or growth expectations stall, this premium could be at risk.

Explore the SWS fair ratio for Amentum Holdings

Result: Price-to-Earnings of 119.4x (OVERVALUED)

However, slower revenue growth or any disappointment in earnings could quickly dampen the enthusiasm that is currently boosting Amentum's valuation.

Find out about the key risks to this Amentum Holdings narrative.

Another View: Does the SWS DCF Model Tell a Different Story?

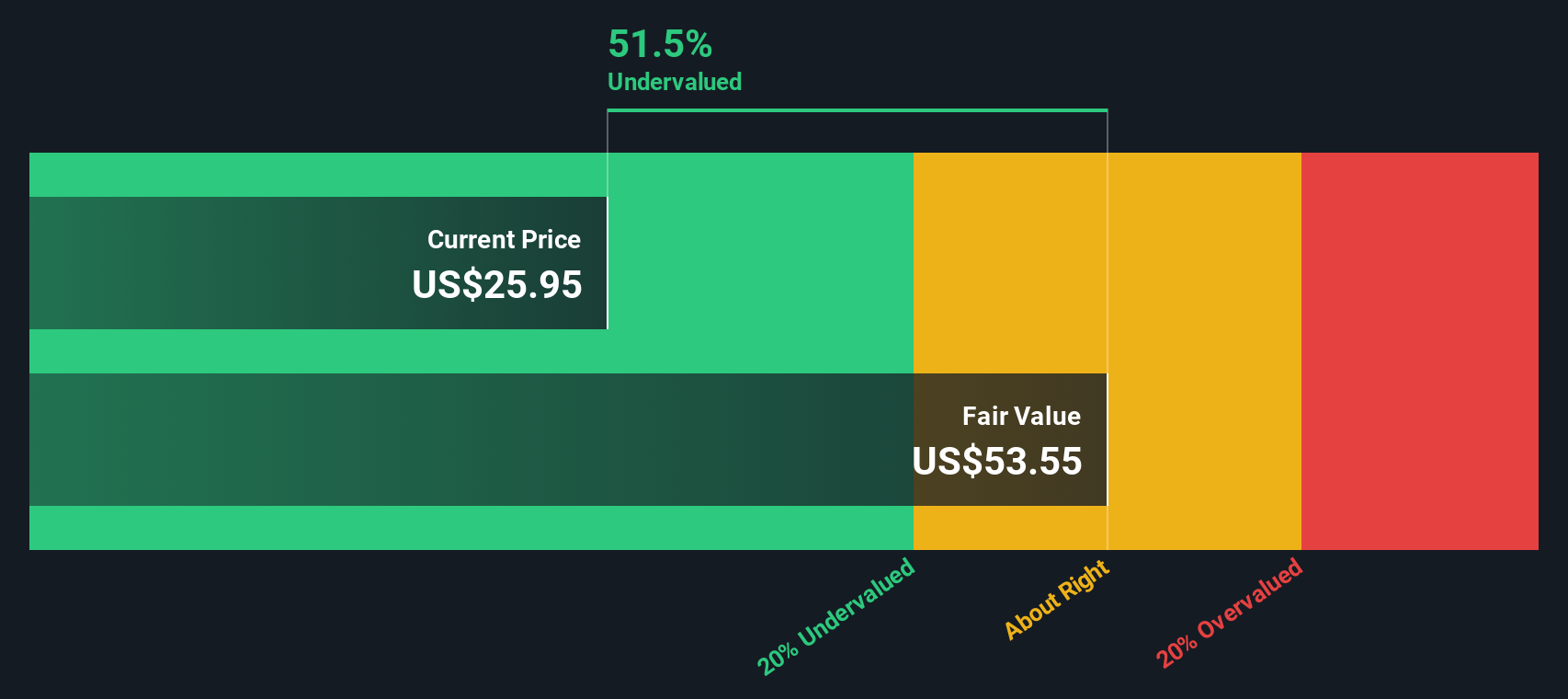

While the high price-to-earnings ratio points toward overvaluation, our DCF model comes to a much different conclusion. According to this approach, Amentum is trading at a hefty 50.2% discount to its estimated fair value, suggesting hidden upside. Could this disconnect signal an opportunity, or does it simply reflect market skepticism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amentum Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amentum Holdings Narrative

Readers who want to dig deeper or approach the story from their own angle can easily build a custom analysis in just a few minutes. Do it your way.

A great starting point for your Amentum Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your full investing potential by checking out new opportunities before they hit the headlines. Smart choices today can make a huge difference tomorrow.

- Spot overlooked opportunities by sorting through these 3580 penny stocks with strong financials, which combine potential and strong fundamentals in today's dynamic markets.

- Capitalize on the rise of machine intelligence and innovation by tapping into these 27 AI penny stocks. These are poised to reshape industries.

- Secure value in your portfolio with these 898 undervalued stocks based on cash flows, showing strong cash flow potential and favorable price points for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Provides engineering and technology solutions to the U.S.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives