- United States

- /

- Professional Services

- /

- NYSE:AMTM

Assessing Amentum Holdings After New Contract Wins and a 10% Share Price Jump

Reviewed by Bailey Pemberton

- Wondering if Amentum Holdings is a smart buy right now? You are not alone, as many investors are keen to understand whether the stock price truly reflects the company’s value.

- After a jump of 10.0% over the last week and a 6.7% gain this month, shares have posted a solid 12.6% year-to-date return even though the stock is down 1.5% from a year ago.

- Recent headlines spotlight Amentum Holdings’ expanding presence in government services, including new contract wins that highlight strong operational momentum. These developments may help to explain the recent uptick and changing market sentiment around the stock.

- Even so, our valuation score currently sits at 2 out of 6, with only two major valuation checks showing the stock as undervalued. Next, we will explore how various valuation methods compare for Amentum Holdings. Stay tuned for a more insightful perspective on assessing value by the end.

Amentum Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Amentum Holdings Discounted Cash Flow (DCF) Analysis

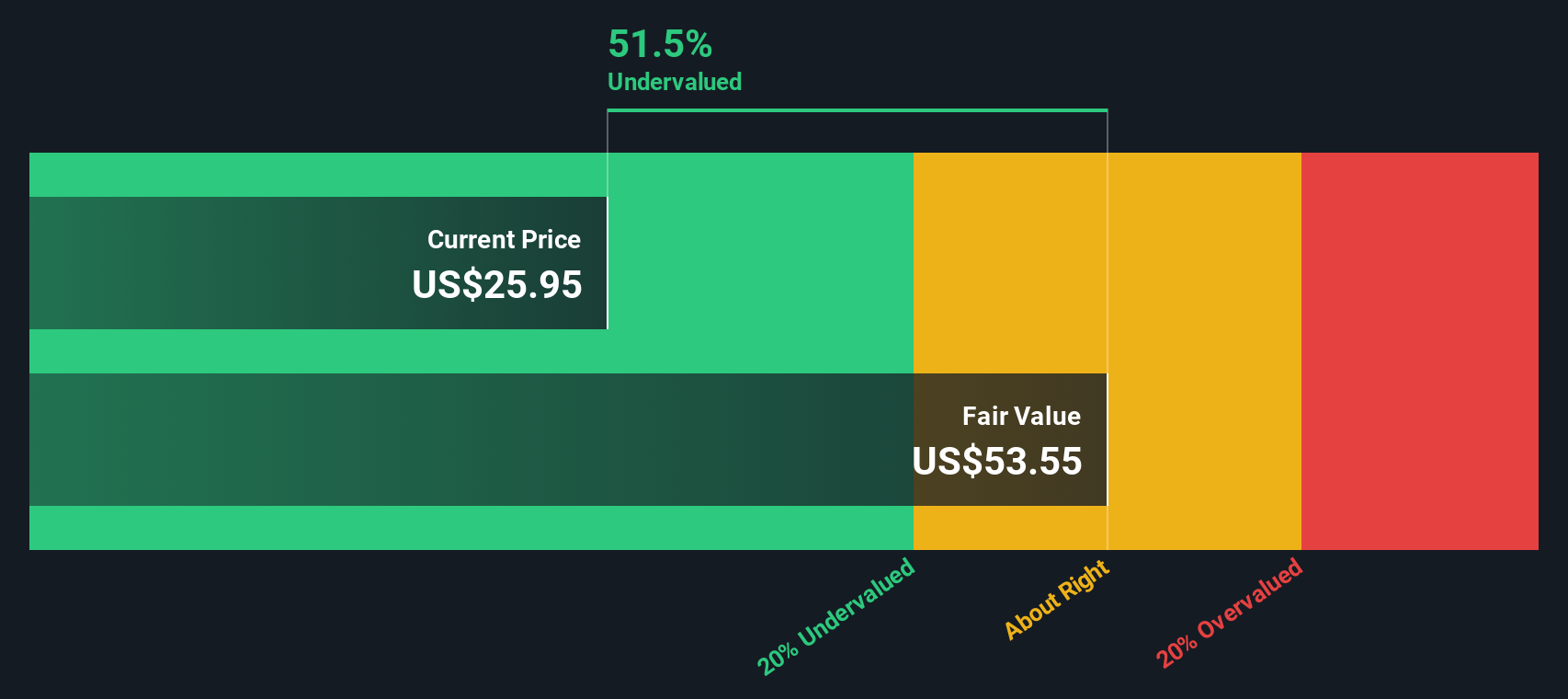

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future free cash flows and discounting them back to today’s value. This approach provides a clearer picture of what a business is truly worth, apart from market sentiment and short-term fluctuations.

For Amentum Holdings, the current Free Cash Flow stands at $139.5 million. Analyst estimates suggest substantial growth over the next several years, projecting Free Cash Flow to reach $654 million by 2027. Looking further, Simply Wall St extrapolates that, by 2035, annual Free Cash Flow could top $921.7 million as the business matures and expands in its sector.

These projections are all expressed in US dollars and use a two-stage Free Cash Flow to Equity model. After applying the DCF technique, the intrinsic value per share is calculated to be $53.41. This figure implies the stock trades at a discount of 54.4 percent to its estimated fair value, suggesting it may be significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amentum Holdings is undervalued by 54.4%. Track this in your watchlist or portfolio, or discover 919 more undervalued stocks based on cash flows.

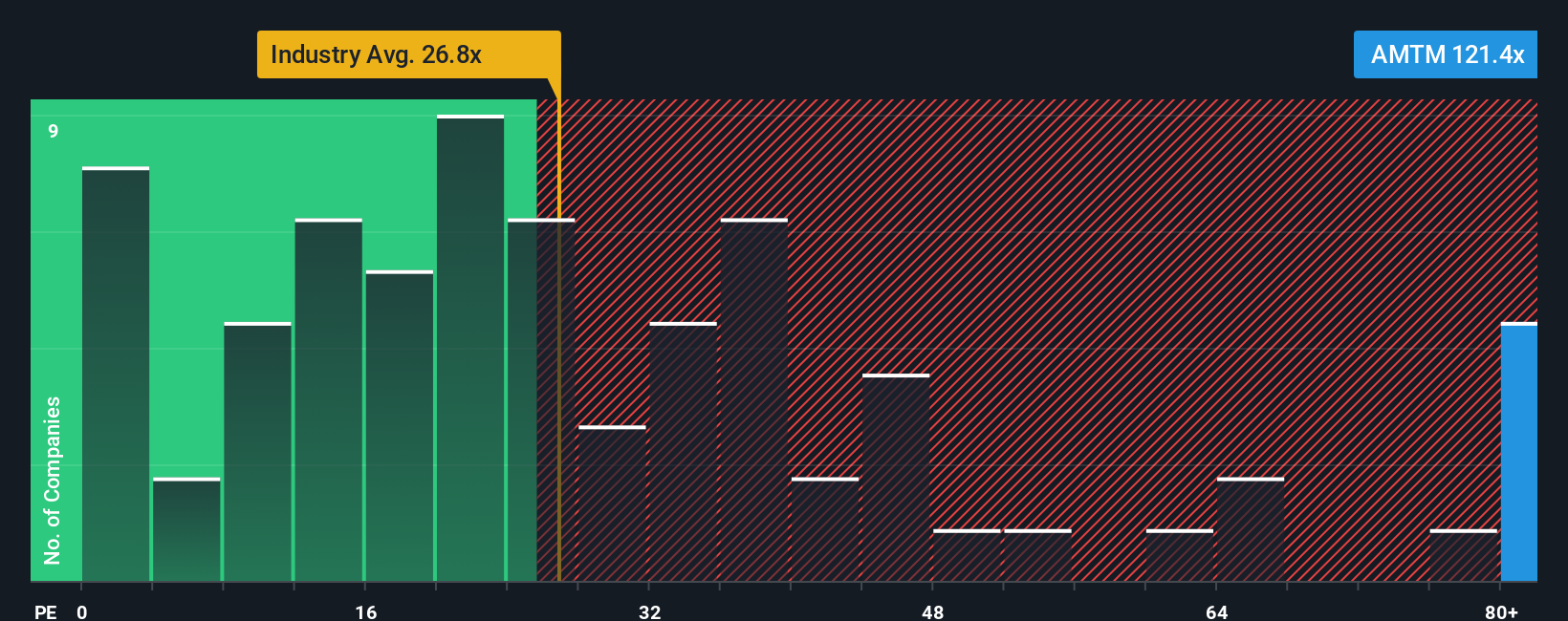

Approach 2: Amentum Holdings Price vs Earnings

The price-to-earnings (PE) ratio is one of the most reliable valuation metrics for profitable companies, as it relates a company’s current share price to its annual net earnings. PE is especially useful in assessing whether investors are paying the right price for a firm’s growth and profitability.

Growth expectations and risk play a critical role in what constitutes a “normal” or “fair” PE ratio. A fast-growing firm often deserves a higher PE, reflecting optimism about future earnings. Conversely, high risks or slower growth typically justify lower multiples.

Amentum Holdings currently trades at a PE ratio of 114.08x. This is significantly higher than both the professional services industry average of 23.69x and the peer average of 23.17x. This wide gap can raise questions about whether the stock’s price already factors in optimistic growth forecasts.

To get a clearer picture, Simply Wall St calculates a proprietary "Fair Ratio" by factoring in key elements like future earnings growth, profit margins, industry nuances, market cap, and risk. This makes the Fair Ratio, here at 41.75x, a more holistic benchmark than simply comparing to peers or industry averages.

With Amentum Holdings’ actual PE of 114.08x sitting well above its Fair Ratio of 41.75x, the shares appear substantially overvalued by this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amentum Holdings Narrative

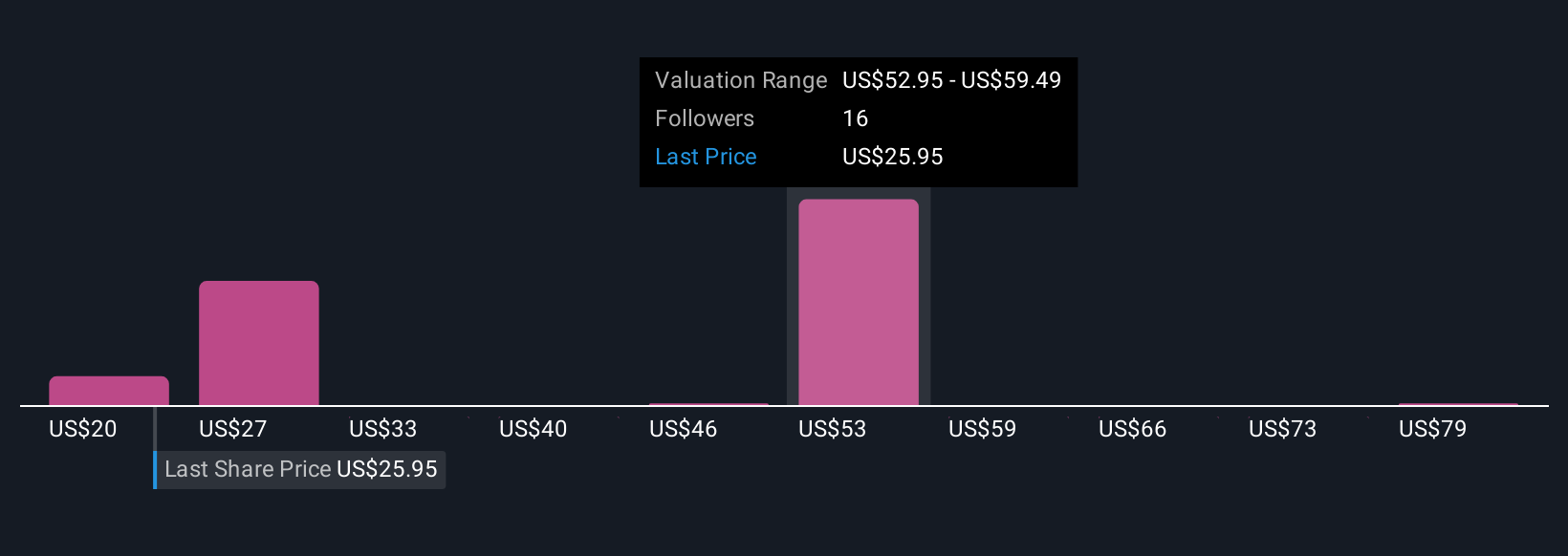

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful idea: it connects your own story and reasoning about a company with concrete numbers, like your estimate for fair value and assumptions about future revenue, earnings, and margins.

Unlike static metrics, Narratives help you translate your vision for a company into an actionable financial forecast, so you can see how its story links directly to a calculated fair value. On Simply Wall St's Community page, millions of investors use Narratives as an accessible tool to map out their investment thesis, whether they expect aggressive growth or see warning signs ahead.

Narratives let you compare your fair value to the current price, helping you decide when to buy or sell, and they automatically update as new information like news or earnings is released. For Amentum Holdings, for example, one investor’s Narrative might see a fair value far above today’s price due to expected contract wins, while another may anticipate challenges and set a much lower fair value. This shows just how perspectives can differ.

Do you think there's more to the story for Amentum Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Provides engineering and technology solutions to the U.S.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives