- United States

- /

- Professional Services

- /

- NYSE:ALIT

Is Alight a Bargain After 60% Drop and New Employee Benefits Partnerships?

Reviewed by Bailey Pemberton

- Ever wondered if Alight could be a hidden gem or is already priced to perfection? If you’re on the hunt for value, you might be surprised by what the numbers reveal.

- It's been a rollercoaster for Alight’s shareholders. They have seen the stock drop 12.3% in the last week and a staggering 60.0% since the start of the year, signaling a big shift in how the market values the business.

- Recently, Alight made headlines by entering new partnerships that aim to strengthen its position in the employee benefits solutions space. These developments have kept investor interest lively, even as uncertainty continues to weigh on the broader sector.

- When it comes to valuation, Alight scores a 4 out of 6 in our latest value checks, suggesting it is undervalued by several key measures. Let’s break down what underpins that score using traditional approaches, and stay tuned for a fresh perspective on how to truly value the company by the end of this article.

Find out why Alight's -60.0% return over the last year is lagging behind its peers.

Approach 1: Alight Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is really worth today by forecasting all of its expected future cash flows and then discounting those amounts back to their present value. This approach is widely used to gauge whether a stock is undervalued or overvalued based on future earning potential.

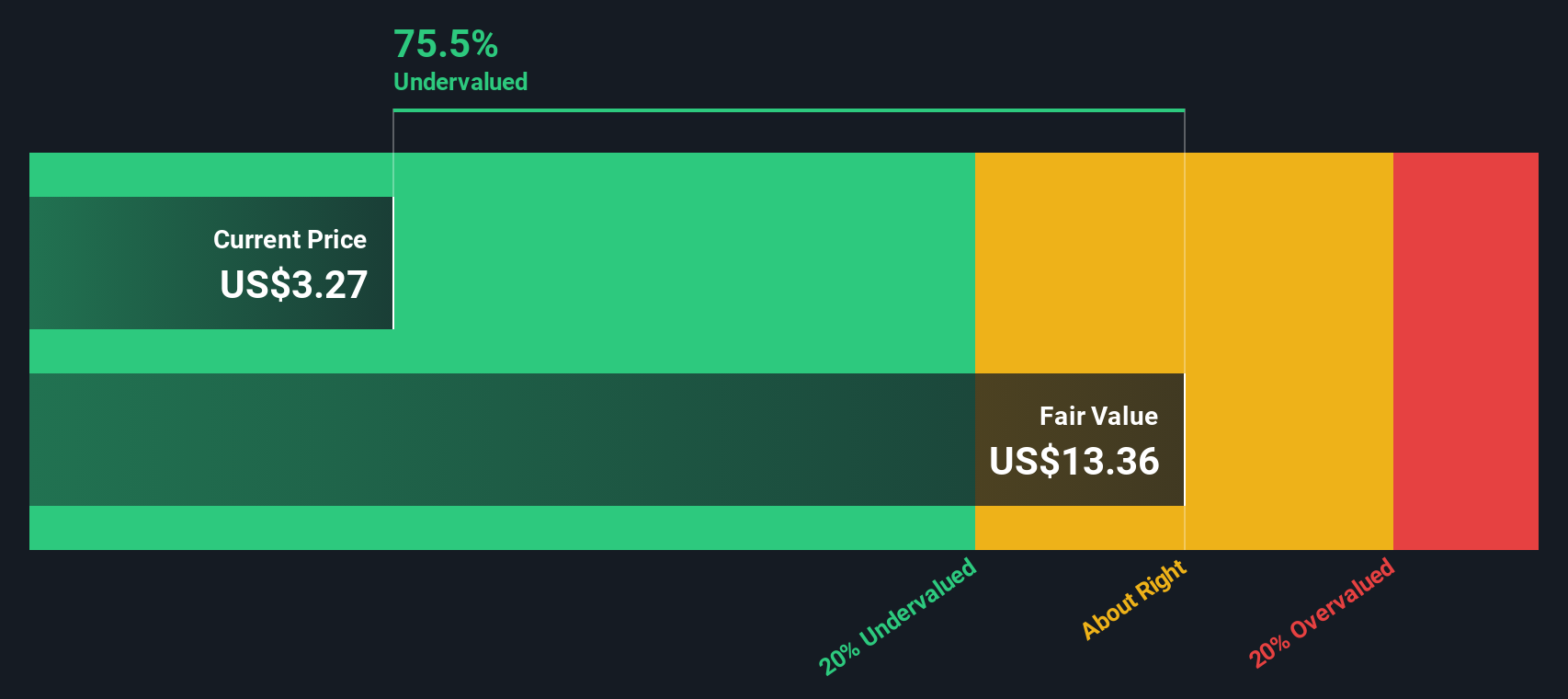

For Alight, the analysis starts with its current Free Cash Flow (FCF), which stands at $133.5 million. Projections show a steady climb in annual FCF, with estimates reaching $536.1 million by 2035. Analysts provide growth forecasts for the next several years, and further projections are generated by extrapolation. As future cash flows are discounted to their present value, the DCF calculation reflects the time value of money and the company’s long-term earning power.

The result of this modeling estimates Alight’s intrinsic value at $11.12 per share. Compared with the current price, this suggests the stock may be trading at a notable 75.7 percent discount, which could indicate it is significantly undervalued based on these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alight is undervalued by 75.7%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Alight Price vs Sales

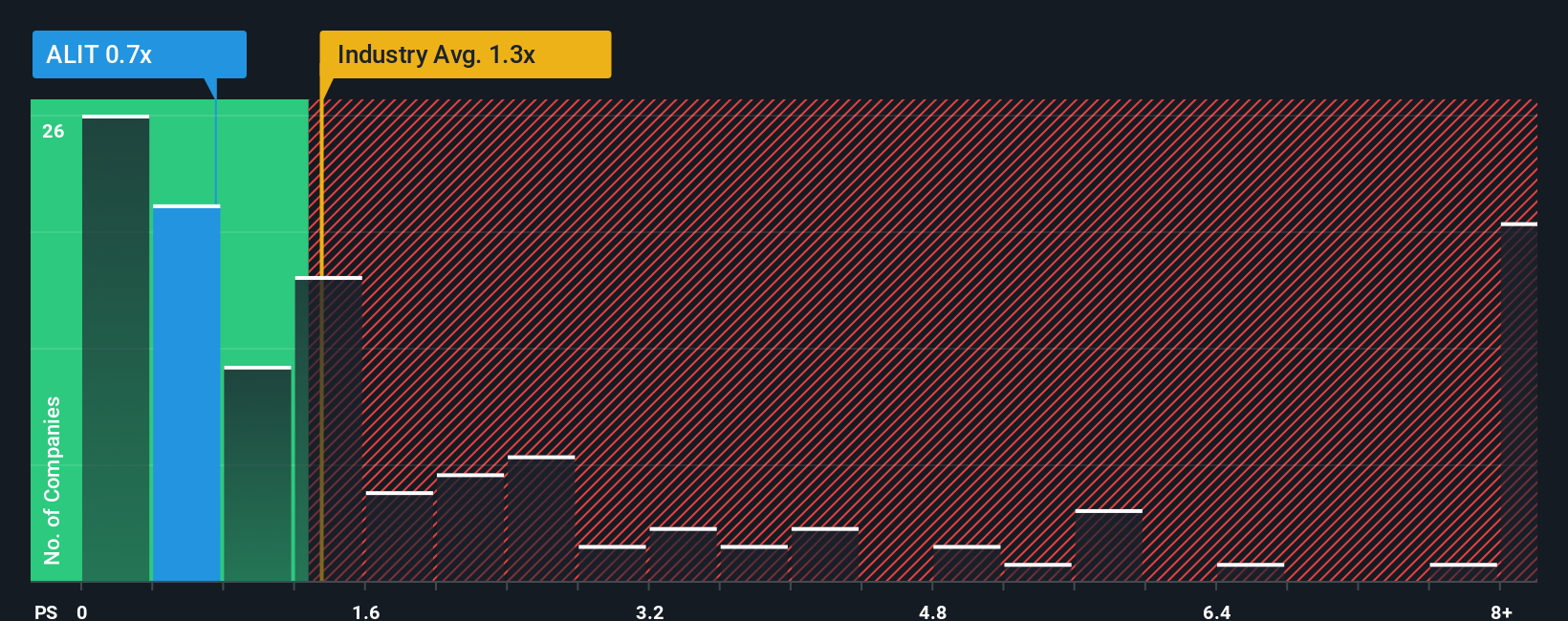

The Price-to-Sales (P/S) ratio is a preferred yardstick for companies like Alight, especially when profitability is limited or earnings are volatile. By comparing a company’s market value to its sales, the P/S ratio allows investors to gauge how much they are paying for each dollar of revenue. This makes it useful for valuing businesses focused on growth or in transition periods.

Growth expectations and risk both shape what counts as a “normal” or appropriate P/S multiple. Companies with higher sales growth and more stable outlooks often deserve a premium multiple. Firms facing greater risk or industry headwinds may trade at a discount.

Alight’s current Price-to-Sales ratio stands at 0.62x. When compared to the Professional Services industry average of 1.31x and its peer average of 0.44x, Alight is priced lower than most of its industry but slightly above its peer group. Beyond these basic comparisons, Simply Wall St’s proprietary “Fair Ratio” offers a more comprehensive benchmark. The Fair Ratio, set at 1.02x for Alight, is built on factors like projected revenue growth, profit margins, sector trends, and company-specific risks. This provides a more tailored view than relying solely on peer or industry multiples.

With the Fair Ratio at 1.02x and Alight’s actual P/S at 0.62x, the stock appears attractively valued on this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alight Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Rather than solely relying on numbers and traditional valuation models, Narratives help you connect the unique story you believe about a company with your perspective on its future potential and risks, along with your financial forecasts and a resulting fair value for the stock.

A Narrative starts with your view: What do you think will drive Alight's growth, or what challenges do you believe it might face? You then link this story directly to your estimates of future revenue, profit margins, and fair value, giving context to the numbers that matter. Narratives are an easy and accessible tool available on Simply Wall St's Community page, used by investors worldwide to share, refine, and compare their convictions.

This approach empowers you to make buy or sell decisions by directly comparing your own fair value calculation to the stock's current market price. In addition, Narratives stay up to date automatically. If new news or earnings data is released, your analysis will evolve with it, always reflecting the latest information.

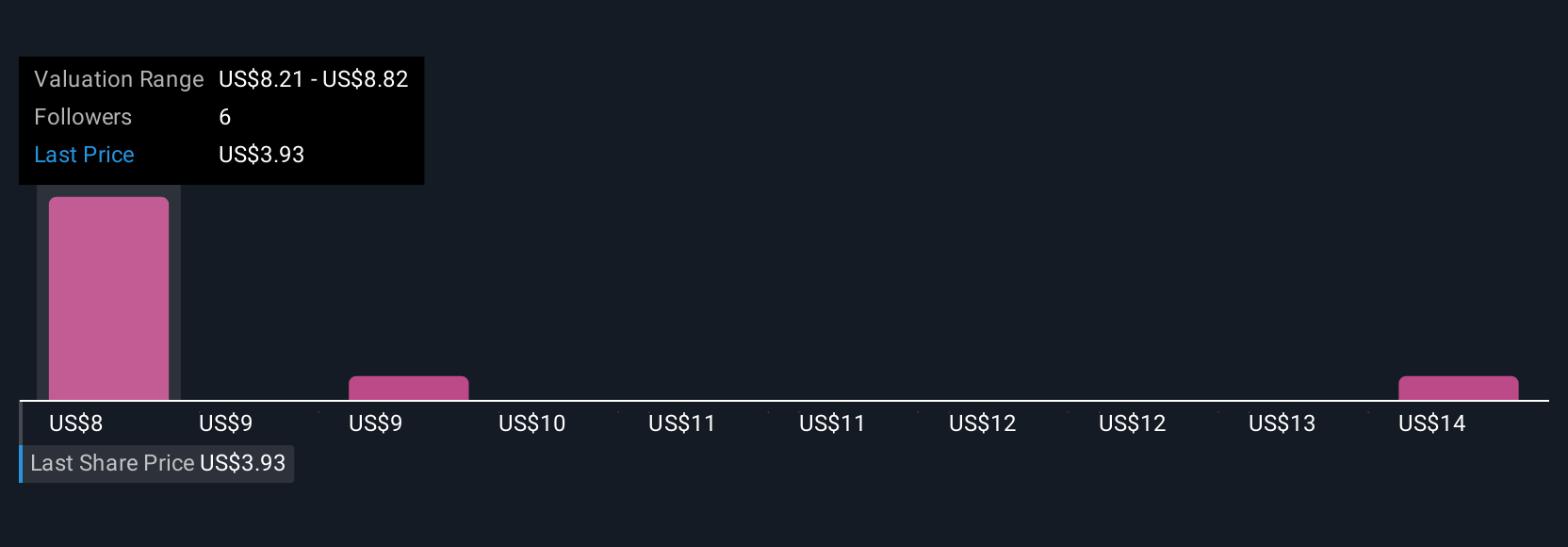

For example, one Alight Narrative on the platform projects a bullish fair value of $11.0 per share based on strong recurring revenue growth and new partnerships. Another Narrative takes a more cautious view, setting fair value at just $6.0 per share due to concerns over client retention and margin pressures. With Narratives, you can see the full range of investor perspectives, helping you form a well-rounded investment thesis.

Do you think there's more to the story for Alight? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALIT

Good value with adequate balance sheet.

Market Insights

Community Narratives