ADT Inc. (NYSE:ADT) has announced that it will pay a dividend of US$0.035 per share on the 4th of January. This makes the dividend yield 1.6%, which will augment investor returns quite nicely.

Check out our latest analysis for ADT

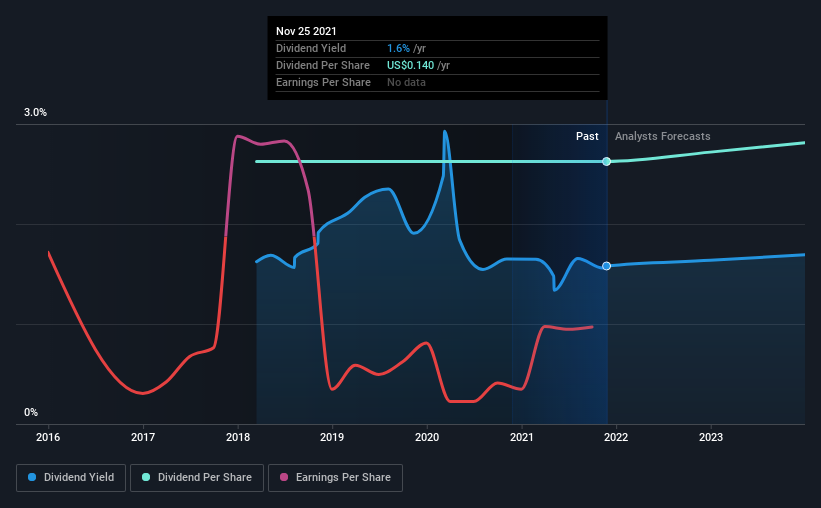

ADT's Distributions May Be Difficult To Sustain

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. The company is paying out a large amount of its cash flows, even though it isn't generating any profit. This makes us feel that the dividend will be hard to maintain.

Over the next year, EPS is forecast to expand by 32.0%. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. Unfortunately, for the dividend to continue at current levels the company definitely needs to get there sooner rather than later.

ADT Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The last annual payment of US$0.14 was flat on the first annual payment 4 years ago. ADT hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. ADT's EPS has fallen by approximately 14% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

ADT's Dividend Doesn't Look Great

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. We don't think that this is a great candidate to be an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for ADT that investors should know about before committing capital to this stock. We have also put together a list of global stocks with a solid dividend.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:ADT

ADT

Provides security, interactive, and smart home solutions to residential and small business customers in the United States.

Undervalued slight.