- United States

- /

- Commercial Services

- /

- NYSE:ACVA

Will Amazon Alliance Unlock New Data-Driven Growth for ACV Auctions (ACVA)?

Reviewed by Sasha Jovanovic

- Amazon Autos recently announced an alliance with ACV Auctions, aimed at leveraging ACV's expanding data services capabilities and strengthening its auto auction marketplace presence.

- This collaboration is expected to open new data-driven revenue opportunities for ACV Auctions as industry consolidation and digital transformation accelerate.

- Given the focus on unlocking additional revenue streams through the Amazon partnership, we'll examine how this development could reinforce ACV Auctions' projected growth and earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ACV Auctions Investment Narrative Recap

To own ACV Auctions stock, you need to believe that digitizing the wholesale auto market, scaling data services, and deepening partnerships will outweigh risks like uneven dealer volumes and heavy upfront investment. The Amazon Autos alliance brings positive attention to ACV's data-driven initiatives but is unlikely to fundamentally change the near-term catalyst, which remains the ability to reignite dealer transaction volume growth; the biggest risk remains margin pressure if investment fails to pay off quickly.

Among recent updates, ACV’s increased revolving credit facility to US$250 million stands out as most relevant, providing additional flexibility to support R&D for new initiatives like the Amazon Autos partnership. This expanded credit access may help fund innovation and cushion margins while ACV ramps up its broader revenue streams and commercial remarketing efforts.

On the other hand, investors should be aware that ACV’s dealer wholesale volumes are projected to remain flat or down in 2025, which means...

Read the full narrative on ACV Auctions (it's free!)

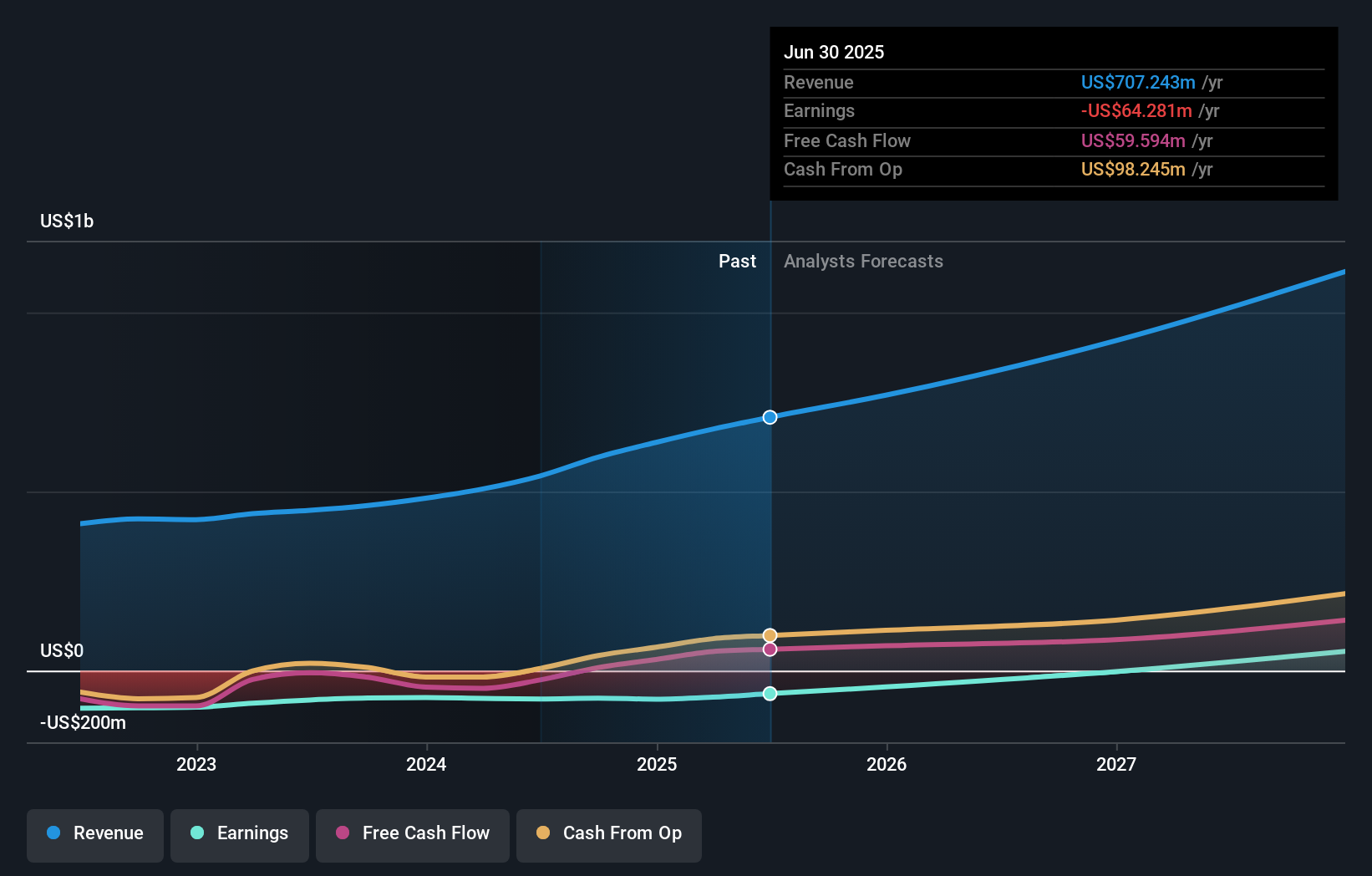

ACV Auctions' outlook anticipates $1.2 billion in revenue and $98.2 million in earnings by 2028. This is based on 20.6% annual revenue growth, with earnings increasing by $162.5 million from the current -$64.3 million.

Uncover how ACV Auctions' forecasts yield a $19.73 fair value, a 95% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate ACV’s fair value between US$19.52 and US$72.12 per share, showing a wide span of views. The split reflects divergent expectations, especially as dealer volumes and margin trends become critical for ACV’s performance outlook.

Explore 3 other fair value estimates on ACV Auctions - why the stock might be worth just $19.52!

Build Your Own ACV Auctions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ACV Auctions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACV Auctions' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACVA

ACV Auctions

Provides a wholesale auction marketplace to facilitate business-to-business used vehicle sales between a selling and buying dealership.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion