- United States

- /

- Commercial Services

- /

- NYSE:ACVA

Assessing ACV Auctions (ACVA) Valuation After Analyst Downgrades and Challenging Market Dynamics

Reviewed by Simply Wall St

ACV Auctions (ACVA) is in the spotlight after recent analyst notes flagged persistent softness in its results. Ongoing challenges around gross margins and marketing efficiency continue to raise questions about the company’s long-term profitability.

See our latest analysis for ACV Auctions.

ACV Auctions’ share price has taken a considerable hit this year, falling more than 56% year-to-date as weak quarterly results and cautious industry outlooks have weighed on sentiment. Despite a modest positive three-year total shareholder return, recent momentum has clearly faded as the market reassesses growth potential and risk.

If this shift in sentiment has you curious about what else could be worth a look, now is a perfect time to broaden your universe and discover fast growing stocks with high insider ownership

Given these headwinds and recent analyst downgrades, the question remains: Is ACV Auctions undervalued after its steep drop, or have investors already priced in all the risks and future growth prospects?

Most Popular Narrative: 50.9% Undervalued

With the current share price at $9.16 and the narrative’s fair value at $18.65, the market appears to be heavily discounting ACV Auctions’ future earnings potential. This contrast opens the door to big questions about assumptions and future company growth.

The ongoing integration of advanced AI and machine learning into ACV's vehicle inspection, pricing, and guarantee products positions the platform to further differentiate itself by offering real-time, highly accurate, and transparent transaction solutions. This is expected to continue driving above-industry growth in auction volumes, increase take rates, and support margin expansion.

Curious what ambitious financial targets are fueling this high valuation gap? Find out which profit margin leaps and growth rate forecasts are hiding under the hood of this bullish narrative. One key assumption could surprise you. Uncover the formula driving that eye-catching fair value.

Result: Fair Value of $18.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer dealer volumes and macroeconomic uncertainty could easily disrupt these optimistic growth projections and delay any turnaround story for ACV Auctions.

Find out about the key risks to this ACV Auctions narrative.

Another View: Sizing Up Valuation with Sales Multiples

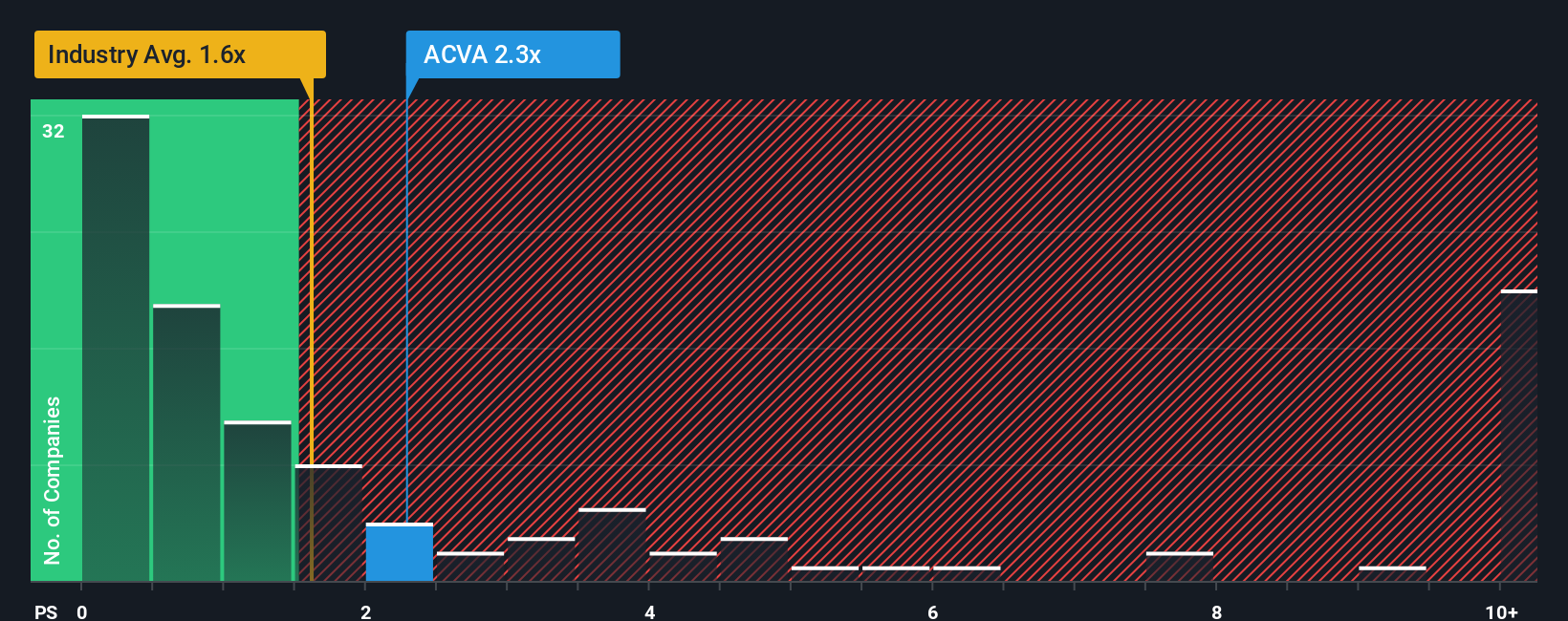

Looking beyond the fair value estimate, ACV Auctions’ price-to-sales ratio stands at 2.2x. This is notably higher than both the US Commercial Services industry average of 1.5x and the peer average of 1.3x. Even compared to its own fair ratio of 1.5x, the gap suggests the stock could be priced for expectations that may not materialize. Is this a signal of hidden opportunity or a warning that investors should tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If these viewpoints do not align with your own or you prefer taking a hands-on approach, you can dive into the data and craft your own unique assessment in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ACV Auctions.

Looking for more investment ideas?

Stop waiting on the sidelines and arm yourself with the freshest opportunities that other smart investors are already tracking. Give your watchlist a major upgrade today.

- Take action on untapped value by checking out these 864 undervalued stocks based on cash flows and pinpoint companies whose prices may not yet reflect their true potential.

- Capitalize on health innovation trends by visiting these 34 healthcare AI stocks for stocks revolutionizing medical technology and AI-driven solutions in healthcare.

- Put your portfolio at the forefront of disruption with these 81 cryptocurrency and blockchain stocks, featuring businesses shaping the future of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACVA

ACV Auctions

Provides a wholesale auction marketplace to facilitate business-to-business used vehicle sales between a selling and buying dealership.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives