- United States

- /

- Commercial Services

- /

- NYSE:ACVA

A Fresh Look at ACV Auctions (ACVA) Valuation After Upbeat Q3 Results and 2025 Guidance

Reviewed by Simply Wall St

ACV Auctions (ACVA) just announced its third quarter earnings, reporting revenue growth over last year and providing fresh guidance for both the fourth quarter and full year 2025. These updates give investors a closer look at the company’s recent performance and future outlook.

See our latest analysis for ACV Auctions.

ACV Auctions grabbed attention with a one-day share price jump of 16.03% following its upbeat Q3 results and fresh guidance. However, momentum has not erased its sharp longer-term slide, with a one-year total shareholder return of -68.18%. Volatility like this suggests investors are reassessing growth prospects and risk, making it a name to watch if sentiment keeps shifting.

If you’re curious about other movers with surprising momentum or growth potential, now’s the perfect time to discover fast growing stocks with high insider ownership.

With shares still sitting far below analyst targets even after the recent rally, the key question becomes whether the market is overlooking potential value or if the current price simply reflects ACV Auctions’ realistic growth prospects.

Most Popular Narrative: 65.9% Undervalued

According to the prevailing narrative, ACV Auctions’ fair value stands at $18.65 per share, far above its last close of $6.37. This wide gap between price and narrative valuation puts investor focus squarely on the growth drivers and profitability assumptions supporting that target.

The ongoing integration of advanced AI and machine learning into ACV's vehicle inspection, pricing, and guarantee products positions the platform to further differentiate itself by offering real-time, highly accurate, and transparent transaction solutions. This is expected to continue driving above-industry growth in auction volumes, increase take rates, and support margin expansion.

Want to know what fuels such a high price target? The secret sauce is tech transformation, rapid expansion, and ambitious profit and revenue goals. Which assumptions power this valuation leap? The story gets more revealing when you see the detailed projections.

Result: Fair Value of $18.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, flat dealer volumes and ongoing macroeconomic uncertainty still loom as catalysts that could quickly challenge this upbeat valuation narrative.

Find out about the key risks to this ACV Auctions narrative.

Another View: Value Through Multiples

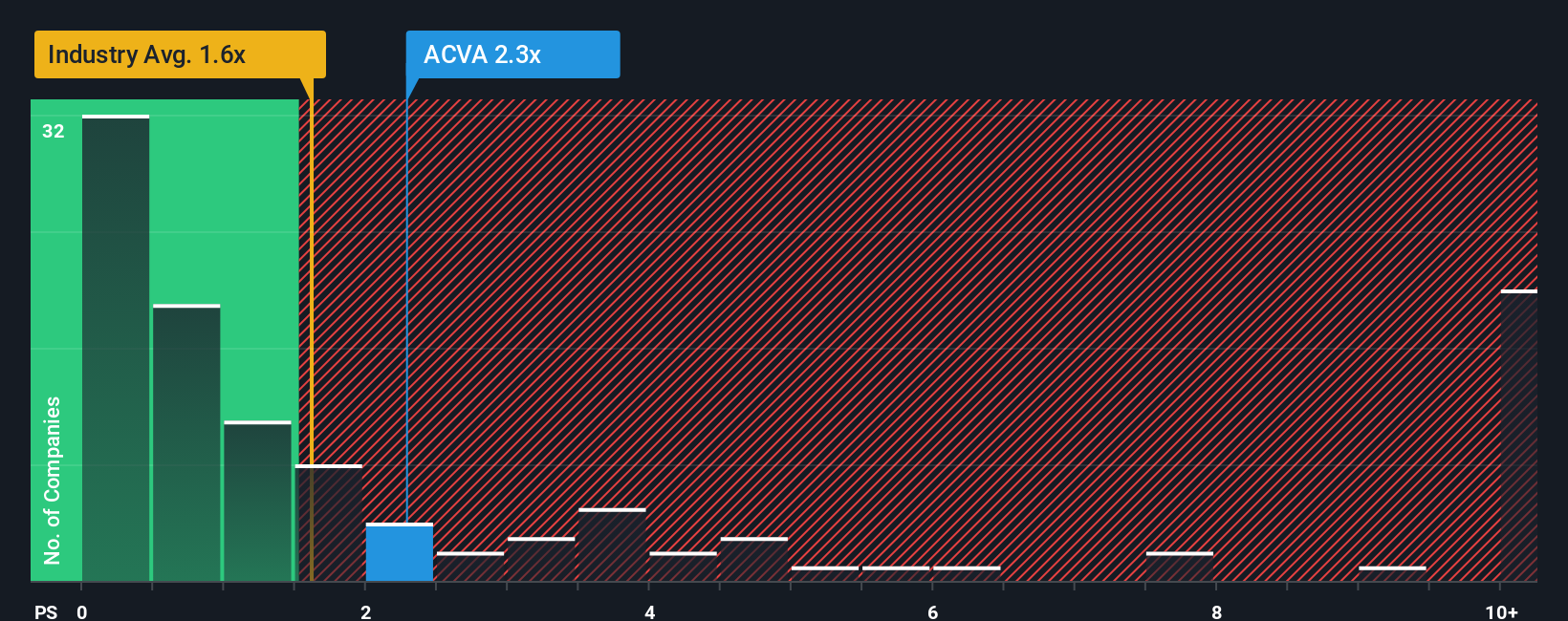

Looking at ACV Auctions through its price-to-sales ratio, the story diverges from pure fair value. The company trades at 1.5 times sales, which looks expensive compared to the industry average of 1.1 times and even pricier than its peer average of just 1 times. The fair ratio to watch is also 1.1 times. This gap signals valuation risk if the market expects results that do not materialize. Could this premium hold up, or will market sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If you see things differently or want to dig into the numbers for yourself, it's quick and simple to craft your personal view (Do it your way).

A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Get ahead of the pack by using the Simply Wall Street Screener to pinpoint new opportunities across multiple themes. Miss this, and you could overlook the next breakout story.

- Capture high yield potential and steady income by focusing on these 15 dividend stocks with yields > 3%, which offers attractive returns above 3%.

- Tap into the future of medicine by checking out these 31 healthcare AI stocks, which is driving remarkable innovation in healthcare technology.

- Upgrade your portfolio with these 868 undervalued stocks based on cash flows to spot hidden gems that may be trading below their true worth based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACVA

ACV Auctions

Provides a wholesale auction marketplace to facilitate business-to-business used vehicle sales between a selling and buying dealership.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives