- United States

- /

- Professional Services

- /

- NasdaqCM:YOUL

Evaluating Youlife Group (NasdaqCM:YOUL) Valuation After Strong Earnings and Strategic Partnership Announcements

Reviewed by Simply Wall St

If you have been keeping an eye on Youlife Group (NasdaqCM:YOUL) lately, it is hard to miss the excitement building around its stock. After announcing standout earnings for the first half of 2025, including a sizeable jump in both revenue and profit, Youlife also sealed the deal on a joint venture with Beijing Galbot Co., Ltd. This move, together with plans to expand its reach across HR, AI, and vocational training, has investors buzzing about what could come next for the company.

The impact of these updates has been clear in the price action. Investor sentiment has propelled shares upward, with recent gains topping 69% on the back of both results and news about partnerships. While Youlife has experienced periods of volatility this year, the overall momentum appears renewed as the company outlines its ambitions to build a broader business ecosystem and carve out a leadership spot in intelligent vocational education.

With the dust settling after such a dramatic run, investors now face a key question: is Youlife Group still undervalued considering its innovation and growth plans, or has the market already priced in the next stage for the stock?

Price-to-Sales Ratio of 0.6x: Is it justified?

Based on the available data, Youlife Group is currently considered undervalued using the price-to-sales ratio, which sits at 0.6x compared to a US Professional Services industry average of 1.2x.

The price-to-sales ratio measures how much investors are paying for each dollar of the company's revenue. This multiple is useful for companies like Youlife, which are not currently profitable, as it focuses on top-line sales rather than earnings. It is a common benchmark when analyzing service-based businesses, because it provides insight even when net income is negative.

A significantly lower price-to-sales ratio suggests that the market may not be pricing in the company's expected growth or future profitability. This could represent an attractive entry point for investors who believe in the company's turnaround or expansion plans.

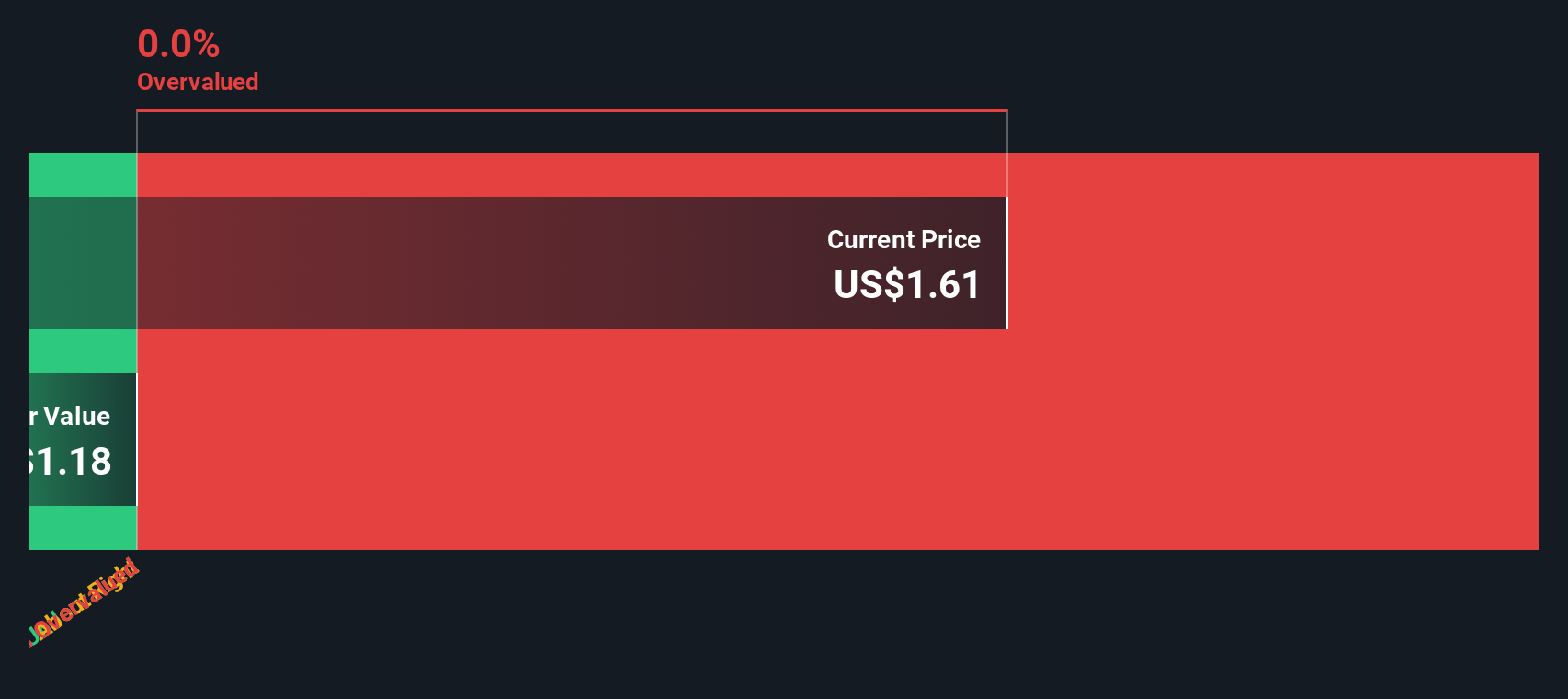

Result: Fair Value of $1.81 (UNDERVALUED)

See our latest analysis for Youlife Group.However, sustained losses and a lack of clear annual revenue growth could make it difficult to argue that Youlife remains undervalued.

Find out about the key risks to this Youlife Group narrative.Another View: Are the Numbers Telling the Full Story?

While the previous analysis relied on the company’s sales in comparison to the industry, our DCF model offers a different lens. This method emphasizes long-term cash flow forecasts to evaluate value, which can sometimes deliver a very different outcome. Could the future look less certain than recent momentum suggests?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Youlife Group Narrative

If our analysis does not align with your perspective, or if you prefer to investigate the numbers yourself, you can shape your own insights in just a few minutes. Do it your way.

A great starting point for your Youlife Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to keep your edge, do not miss out on other unique opportunities beyond Youlife Group. The right screeners can help you spot hidden gems and market leaders before the crowd catches on.

- Uncover fast-growing companies shaking up artificial intelligence by jumping into AI penny stocks as they push the boundaries of what is possible with smart technology.

- Pinpoint undervalued stocks poised for a turnaround with undervalued stocks based on cash flows, putting attractive opportunities in your path before they gain wider attention.

- Pursue dividend champions delivering reliable income and stable returns with dividend stocks with yields > 3%, which is ideal if consistency is your investment game plan.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:YOUL

Youlife Group

Operates as a blue-collar lifetime service provider in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives