- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

A Look at Willdan Group’s (WLDN) Valuation Following 2025 Guidance Boost and Recent Acquisitions

Reviewed by Simply Wall St

Willdan Group (WLDN) is drawing attention ahead of its third-quarter earnings release as the company lifts its full-year 2025 guidance to reflect higher expected net revenue, adjusted EBITDA, and adjusted EPS following recent acquisitions.

See our latest analysis for Willdan Group.

Willdan Group’s latest moves, including its APG acquisition and an upbeat outlook for 2025, have fueled significant momentum. The company has seen a dramatic year-to-date share price return of nearly 150%. Long-term investors have also enjoyed a robust 115.5% total shareholder return over the past year, reflecting optimism in the company’s growth trajectory and evolving fundamentals.

If Willdan’s turnaround is catching your interest, this could be the perfect moment to see what else is moving in the market and discover fast growing stocks with high insider ownership

But after such remarkable gains and an improved outlook, is Willdan Group’s current price a fair reflection of its future earnings potential, or could there still be an undervalued buying opportunity for investors?

Most Popular Narrative: 29% Undervalued

Willdan Group's latest fair value estimate, driven by the most popular market narrative, sits substantially above the last traded price of $94.11. This context sets the stage for a deeper look into the growth factors underpinning such a gap in valuation expectations.

Strategic acquisitions that deepen technical capabilities and expand Willdan's geographic and sector footprint are accelerating organic growth through cross-selling and enabling entry into larger, more complex energy and infrastructure projects. This drives both revenue and earnings expansion. Long-term and increasing utility and municipal contracts, typically 3-5 years in duration and funded through stable sources, contribute to recurring revenue and improved earnings visibility. These factors help reduce earnings volatility and support higher net margins.

Curious how Willdan’s price target gets so far ahead of the current share price? This calculation is not just about top-line growth. The methodology includes a set of assumptions regarding recurring revenues, margin expansion, and a surge in demand for their unique services. Want to see the narrative numbers and consensus forecasts that contribute to this premium valuation? Click through and discover how they connect the dots.

Result: Fair Value of $132.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on policy-driven projects and the expiry of valuable tax deductions could put future earnings and margins under pressure if not carefully managed.

Find out about the key risks to this Willdan Group narrative.

Another View: Market Multiples Tell a Different Story

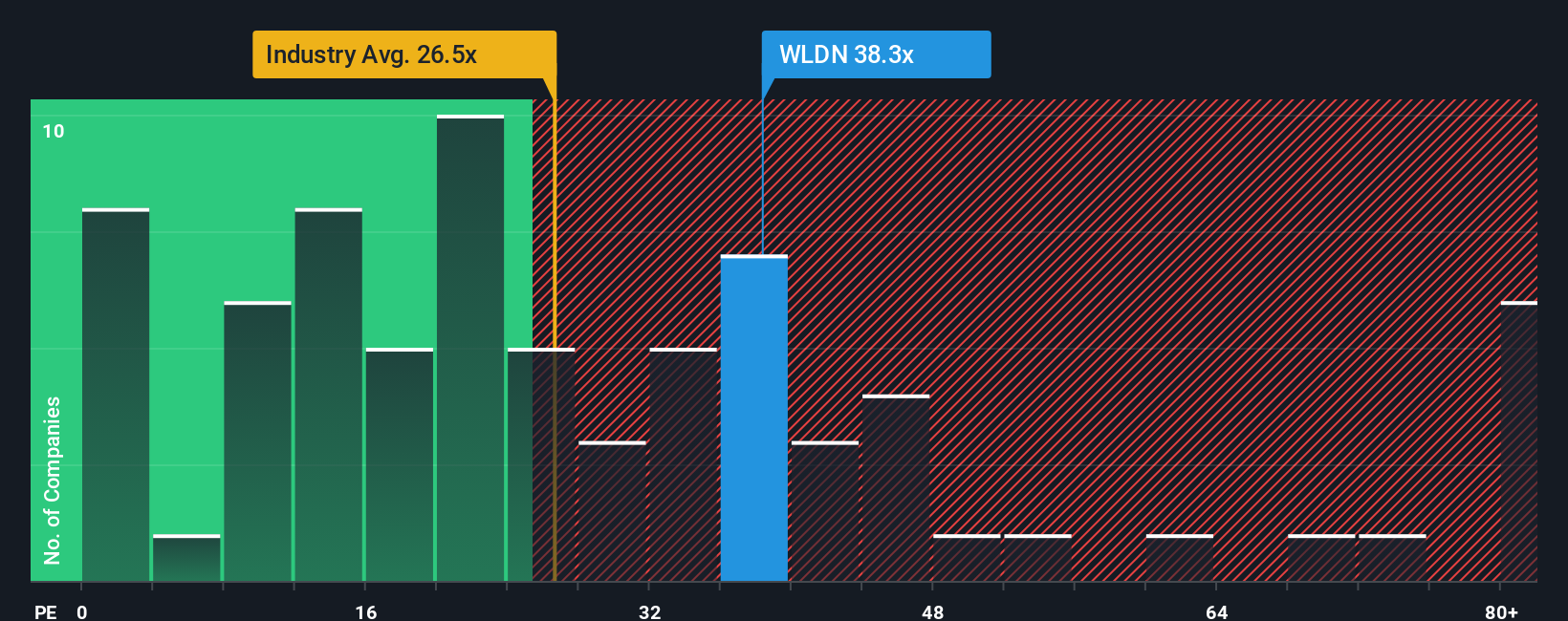

While the fair value narrative sees Willdan as significantly undervalued, the lens of price-to-earnings tells a more cautious tale. Willdan’s P/E ratio of 39.3x stands notably higher than both its industry peers (25.1x) and the fair ratio of 27.9x. This signals the market is already pricing in strong future growth, leaving less obvious margin of safety if targets are missed. Could this premium be justified? Is there a risk the stock is getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willdan Group Narrative

If you’re looking to dig deeper and develop your own perspective, you can run the numbers and shape a narrative that fits your view in minutes. Do it your way

A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves. Take advantage of these tailored stock ideas sourced from the Simply Wall Street Screener and make your next smart investment move before the crowd does.

- Maximize your income potential by checking out these 20 dividend stocks with yields > 3%, where you will find companies rewarding investors with yields above 3%.

- Tap into cutting-edge healthcare opportunities by reviewing these 33 healthcare AI stocks, featuring firms advancing diagnostics, treatment, and biotech performance through artificial intelligence.

- Ride the momentum of groundbreaking technological shifts with these 27 quantum computing stocks, curated for stocks pushing boundaries in quantum computing and future-proof innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives