- United States

- /

- Commercial Services

- /

- NasdaqGS:VSEC

Why VSE (VSEC) Is Up 13.0% After Becoming a Pure-Play Aviation Aftermarket Company

Reviewed by Simply Wall St

- VSE Corporation recently completed the sale of its Fleet segment, expanded through the acquisition of Turbine Weld Industries, reported record quarterly earnings, and reaffirmed its 2025 revenue growth guidance, reflecting its new focus as a pure-play aviation aftermarket company.

- These moves, combined with new service agreements and improved free cash flow, point to strong integration momentum from recent acquisitions and increased confidence in VSE's transformed business model.

- We'll explore how VSE's sharpened focus on aviation aftermarket services and record earnings may reshape its investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

VSE Investment Narrative Recap

To own VSE, investors need confidence in the company’s pivot to a pure-play aviation aftermarket model, and belief that recent record earnings, improved cash flow, and integration of acquisitions will deliver sustainable growth. The latest news, including strong Q2 earnings, confirmed revenue guidance, and a new dividend, appear to reinforce market optimism on short-term growth catalysts while addressing near-term integration risks; the impact on VSE’s reduced business diversification risk does not appear material just yet. VSE’s reaffirmed 2025 revenue growth guidance of 35% to 40% stands out alongside its recent quarterly results, signaling management’s confidence that the company can capitalize on synergies and higher-margin aviation services, both crucial to driving ongoing momentum in the stock and supporting future earnings targets. However, it’s important to remember that while execution has been strong, the recent shift away from diversification leaves VSE more exposed in the event of...

Read the full narrative on VSE (it's free!)

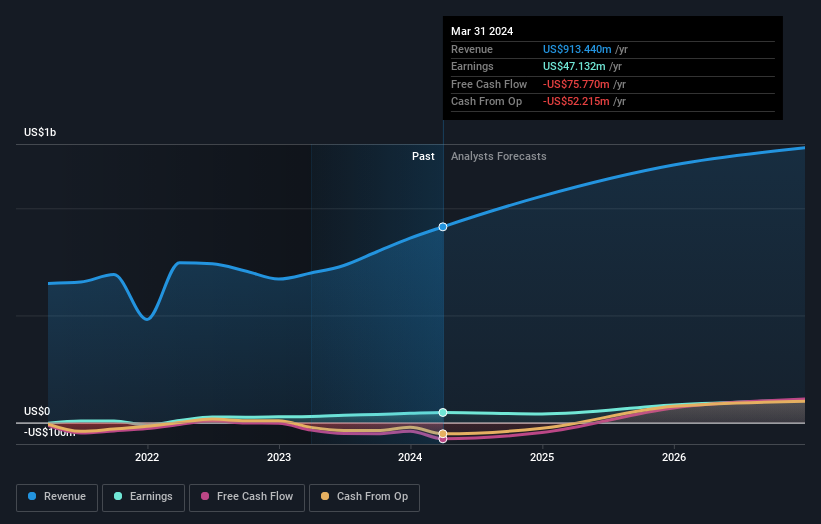

VSE's outlook anticipates $1.5 billion in revenue and $137.1 million in earnings by 2028. This forecast relies on an 8.0% annual revenue growth and a $92.2 million increase in earnings from the current $44.9 million level.

Uncover how VSE's forecasts yield a $169.58 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for VSE ranging from US$114.31 to US$169.58 per share. While the company guides for strong revenue growth, views diverge over how recent business model shifts might shape earnings and risk, reminding you to consider a wide range of opinions.

Explore 2 other fair value estimates on VSE - why the stock might be worth 27% less than the current price!

Build Your Own VSE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VSE research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free VSE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VSE's overall financial health at a glance.

No Opportunity In VSE?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives