- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

Verra Mobility (VRRM) Valuation in Focus After Ontario Exit and AutoKinex Expansion

Reviewed by Simply Wall St

Verra Mobility (VRRM) shares are in focus following Ontario’s move to ban automated enforcement cameras. This decision requires the company to exit the province and close related business. The anticipated revenue loss is already factored into its outlook.

See our latest analysis for Verra Mobility.

Verra Mobility’s stock has faced steady pressure in 2024, with a 1-year total shareholder return of -8.6% and a year-to-date share price return of -10.3%. The recent Ontario exit, though widely anticipated, seems to have accelerated this momentum, even as the company unveiled new growth avenues like its partnership with Stellantis to launch AutoKinex. Over the long term, Verra Mobility’s performance remains strong, with a total shareholder return of 39% for three years and a remarkable 72% over five years.

If you’re curious what other companies are gaining traction for their growth and resilience, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading at a sizable discount to analyst targets, investors are left to consider whether recent setbacks and new innovations signal an overlooked buying opportunity or if the market has already priced in Verra Mobility’s future growth.

Most Popular Narrative: 27.7% Undervalued

With Verra Mobility priced at $21.58 at last close and the most followed narrative putting fair value at $29.83, the gap between market sentiment and analyst confidence is striking. The valuation case points to future profitability gains and momentum in core segments.

Recent legislation in Colorado and Nevada authorizing new photo enforcement programs, along with enabling legislation across the U.S. (including California), is expanding the total addressable market for automated traffic enforcement. This creates multi-year visibility and potential double-digit revenue growth in Government Solutions as new contracts convert to recurring ARR and begin contributing to top-line results.

Want to uncover the bold forecast powering this fair value? The narrative is fueled by aggressive growth assumptions, ambitious profit targets, and a profit multiple more commonly seen in market leaders. The next move could surprise you. Dive into the details to see what could drive the stock higher.

Result: Fair Value of $29.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic headwinds and contract concentration risks in key segments could present challenges for Verra Mobility’s path to realizing its projected growth.

Find out about the key risks to this Verra Mobility narrative.

Another View: Market Multiples Tell a Different Story

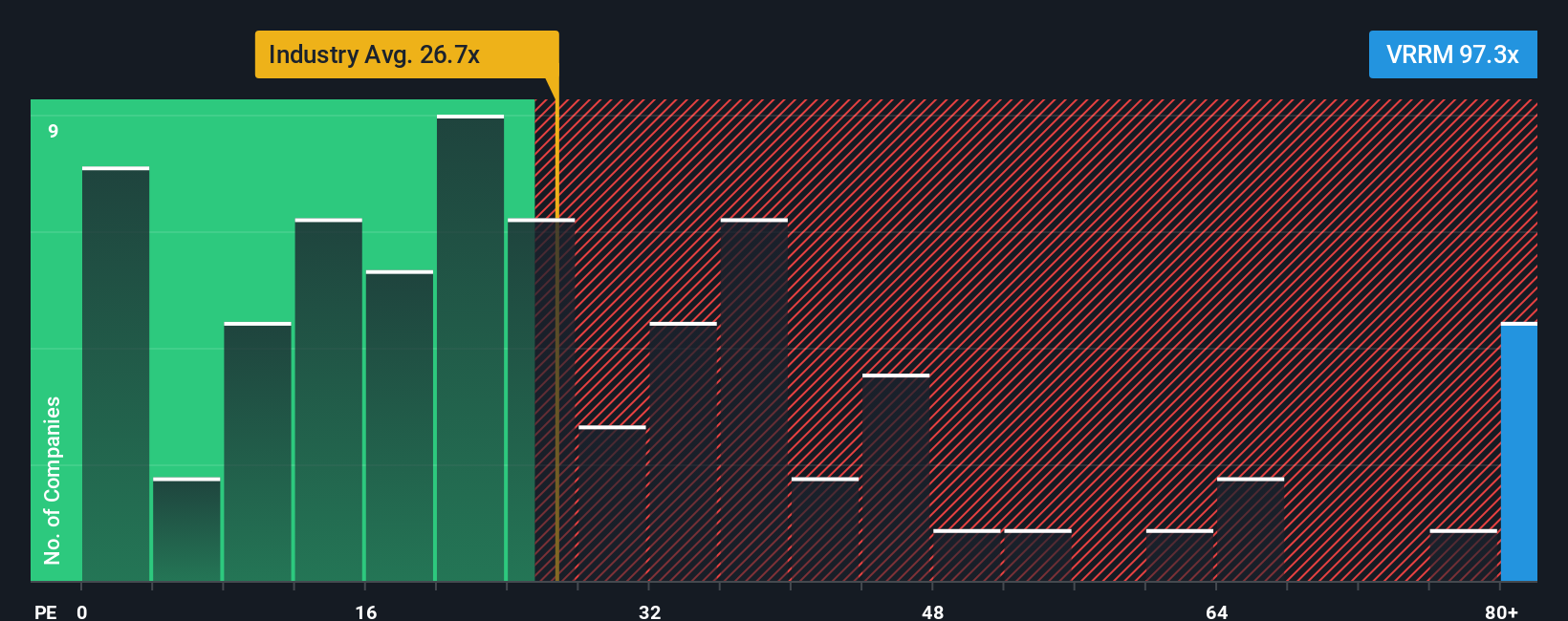

While the consensus narrative relies on discounted cash flow to present Verra Mobility as undervalued, the market’s most-used measure provides a more complex picture. With a price-to-earnings ratio of 67.4x, the stock is significantly higher than both the industry average of 23.8x and a fair ratio of 32.1x. This large difference suggests investors may be paying well above what comparable companies are priced at, even if earnings improve as forecasted.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verra Mobility Narrative

If you want to dig into the numbers yourself or think there’s a different story to tell, you can piece together your own perspective in just a few minutes. Do it your way

A great starting point for your Verra Mobility research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock new opportunities by targeting stocks set for the next big leap. Don’t miss out—these smart screens could reveal tomorrow’s top performers today.

- Seize growth potential and harness AI breakthroughs by tapping into these 26 AI penny stocks poised to benefit from advancements in automation and smart technology.

- Boost your income strategy and stability with these 14 dividend stocks with yields > 3% featuring generous yields and a track record of rewarding shareholders.

- Catch early momentum by analyzing these 3583 penny stocks with strong financials where strong financials set ambitious up-and-comers apart from the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions in the United States, Australia, Europe, and Canada.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success